Investment Adviser means any person, who for consideration, is engaged in the business of providing investment advice to clients or other persons or group of persons and includes a part-time investment adviser or any person who holds out himself as an investment adviser, by whatever name called.

Investment Advice means advice relating to investing in, purchasing, selling or otherwise dealing in securities and advice on investment portfolio containing securities whether written, oral or through any other means of communication for the benefit of the client and shall include financial planning:

Provided that investment advice given through newspaper, magazines, any electronic or broadcasting or telecommunications medium, which is widely available to the public shall not be considered as investment advice for the purpose of SEBI RIA Regulations.

Provided further that trading calls shall not be considered as investment advice for purpose of SEBI RIA Regulations.

Also Read: SEBI specifies what would be considered as material event or information

In India, a Registered Investment Adviser (RIA) is an individual or firm registered with the Securities and Exchange Board of India (SEBI) to provide investment advice to clients in a regulated and transparent manner. SEBI introduced the Securities and Exchange Board of India (Investment Advisers) Regulations, 2013 (“SEBI RIA Regulations”) to promote professional, unbiased advice and ensure investor protection.

An RIA is an individual or firm that provides personalized investment advice and may also manage portfolios for clients. They must register with SEBI and adhere to strict fiduciary responsibilities, ensuring advice is in the best interest of the client.

Key Features of RIA:

|

Feature |

Description |

|

Regulator |

SEBI (Securities and Exchange Board of India) |

|

Governing Law |

SEBI (Investment Advisers) Regulations, 2013 |

|

Client Type |

Retail, HNIs, Corporates, Family Offices |

|

Fiduciary Duty |

RIAs must act in the best interest of their clients. |

|

Fee-only Model |

RIAs can only charge fees to clients. They cannot receive commissions from product manufacturers (like mutual fund companies). |

|

Segregation |

Advisory and distribution services must be separately operated, either through different entities or arms with clear segregation. |

|

Registration |

Mandatory for anyone giving personalized financial/investment advice. |

|

Audit & Compliance |

Must undergo annual compliance audits and submit reports to SEBI. |

Qualification Requirements for RIA Registration:

|

Individual |

Partnership Firm/LLP |

Company |

|

Individual shall at all times have a professional qualification or graduate degree or post-graduate degree or post graduate diploma (minimum two years in duration) in finance, accountancy, business management, commerce, economics, capital market, banking, insurance or actuarial science or other financial services as may be specified from a university or an institution recognized by the Central Government or any State Government or a recognised foreign university or institution or association or a professional qualification by completing a Post Graduate Program in the Securities Market (Investment Advisory) from NISM of a duration not less than one year or a professional qualification by obtaining a CFA Charter from the CFA Institute; |

In case of Partnership Firm/LLP, Principal Officer shall at all times have a professional qualification or graduate degree or post-graduate degree or post graduate diploma (minimum two years in duration) in finance, accountancy, business management, commerce, economics, capital market, banking, insurance or actuarial science or other financial services as may be specified from a university or an institution recognized by the Central Government or any State Government or a recognised foreign university or institution or association or a professional qualification by completing a Post Graduate Program in the Securities Market (Investment Advisory) from NISM of a duration not less than one year or a professional qualification by obtaining a CFA Charter from the CFA Institute; |

In case the applicant is body corporate, Principal Officer shall at all times have a professional qualification or graduate degree or post-graduate degree or post graduate diploma (minimum two years in duration) in finance, accountancy, business management, commerce, economics, capital market, banking, insurance or actuarial science or other financial services as may be specified from a university or an institution recognized by the Central Government or any State Government or a recognised foreign university or institution or association or a professional qualification by completing a Post Graduate Program in the Securities Market (Investment Advisory) from NISM of a duration not less than one year or a professional qualification by obtaining a CFA Charter from the CFA Institute; |

|

An individual investment adviser registered under SEBI RIA Regulations, persons associated with investment advice, and in case of investment adviser being a partnership firm, the partners thereof who are engaged in providing investment advice, shall have at all times relevant NISM certification as specified by the SEBI from time to time. |

A principal officer of a non-individual investment adviser registered under SEBI RIA Regulations, persons associated with investment advice, and in case of investment adviser being a partnership firm, the partners thereof who are engaged in providing investment advice, shall have at all times relevant NISM certification as specified by the SEBI from time to time. |

|

|

All persons associated with investment advice shall, at all times, have a minimum qualification of graduate degree in any discipline from a university or institution recognized by the Central Government or any State Government or a recognized foreign university or institution. |

||

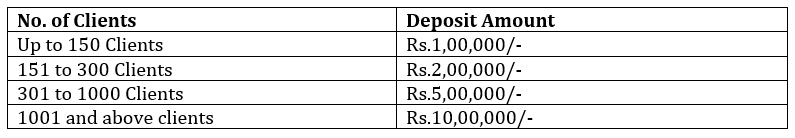

Deposit Requirements: An investment adviser shall maintain a deposit of such sum, as specified by SEBI from time to time. The deposit shall be maintained with a scheduled bank marked as lien in favor of Investment Adviser Administration and Supervisory body (IAASB), in the manner and form as may be specified by IAASB. The deposit requirements shall be based on the maximum number of clients of Investment Advisor on any day of the previous financial year, as under:

Other General Requirements:

- The Applicant, its partners, principal officer and persons associated with investment advice, if any, are fit and proper persons based on the criteria as specified in Schedule II of the Securities and Exchange Board of India (Intermediaries) Regulations, 2008.

- The Applicant shall have necessary infrastructure such as Office Space, Equipment, Furniture and Fixtures, Communication Facilities, Research Capacity, Research Software for undertaking investment advisory services.

- If the Applicant or any person directly or indirectly connected with the applicant has in the past been refused certificate by the SEBI and if so, the grounds for such refusal.

- There shall not be any disciplinary action taken by the SEBI or any other regulatory authority against any person directly or indirectly connected to the applicant under the respective Act, rules or regulations made thereunder

- In case a bank or an NBFC proposes to undertake investment advisory services, whether it has been permitted by Reserve Bank of India and the application is made through a subsidiary or separately identifiable department or division.

- In case any non-individual, other than a Bank or NBFC, which proposes to undertake investment advisory services, whether the application is made through a separately identifiable department or division.

- In case an entity incorporated outside India undertakes to provide investment advisory services under SEBI RIA Regulations, whether, it has set up a subsidiary in India and whether such subsidiary has made the application for registration.

- In case a foreign citizen proposes to undertake investment advisory services, whether the applicant has set up an office in India and proposes to undertake investment advisory services through such office.

Application for grant of Certificate of Registration:

An Application shall be made in Form A of First Schedule of SEBI RIA Regulations. Every applicant shall pay non-refundable application fees along with the Application for Grant of Certificate of Registration as under:

- For Individual and Firms: Rs.2000/-.

- For Company/LLPs: Rs.10000/-.

Exemption from Registration:

The following persons shall not be required to seek registration subject to the fulfillment of the conditions stipulated:

- Any person who gives general comments in good faith in regard to trends in the financial or securities market or the economic situation where such comments do not specify any particular securities or investment product.

- Any insurance agent or insurance broker who offers investment advice solely in insurance products and is registered with Insurance Regulatory and Development Authority for such activity.

- Any pension advisor who offers investment advice solely on pension products and is registered with Pension Fund Regulatory and Development Authority for such activity.

- Any distributor of mutual funds, who is a member of a self-regulatory organisation recognised by the SEBI or is registered with an association of asset management companies of mutual funds, providing any investment advice to its clients incidental to its primary activity.

- Any advocate, solicitor or law firm, who provides investment advice to their clients, incidental to their legal practise.

- Any member of Institute of Chartered Accountants of India, Institute of Company Secretaries of India, Institute of Cost and Works Accountants of India, Actuarial Society of India or any other professional body as may be specified by the SEBI, who provides investment advice to their clients, incidental to his professional service.

- Any stockbroker or sub-broker registered under SEBI (Stockbroker and Sub-Broker) Regulations, 1992, portfolio manager registered under SEBI (Portfolio Managers) Regulations, 1993 or merchant banker registered under SEBI (Merchant Bankers) Regulations, 1992, who provides any investment advice to its clients incidental to their primary activity:

Provided that such intermediaries shall comply with the general obligation(s) and responsibilities as specified in Chapter III of SEBI RIA Regulations:

Provided further that existing portfolio manager offering only investment advisory services may apply for registration under SEBI RIA Regulations after expiry of his current certificate of registration as a portfolio manager.

- Any fund manager, by whatever name called of a mutual fund, alternative investment fund or any other intermediary or entity registered with the SEBI.

- Any person who provides investment advice exclusively to clients based out of India:

Provided that persons providing investment advice to Non-Resident Indian or Person of Indian Origin shall fall within the purview of SEBI RIA Regulations.

Grant of Certificate of Registration:

The SEBI on being satisfied that the applicant complies with the requirements Specified shall send intimation to the applicant and on the receipt of such intimation, the applicants are required to pay the Registration Fees as under:

- For Individual and Firms: Rs.3000/-.

- For Body Corporates and LLPs: Rs.15000/-.

The certificate of registration granted shall be valid till it is suspended or cancelled by the SEBI.

An investment adviser who has been granted a certificate of registration, to keep its registration in force, shall pay fee specified below every five years, from the date of grant of certificate of registration or from the date of grant of certificate of registration granted prior to the commencement of the Securities and Exchange Board of India (Change in Conditions of Registration of Certain Intermediaries) (Amendment) Regulations, 2016, as the case may be, within three months before expiry of the period for which fee has been paid:

- For Individual and Firms: Rs.1000/-.

- For Body Corporates and LLPs: Rs.5000/-.

The fee referred above shall be paid by the applicant within fifteen days from the date of receipt of intimation from the SEBI by way of direct credit into the bank account through NEFT/RTGS/IMPS or online payment using the SEBI Payment Gateway or any other mode as may be specified by the SEBI from time to time.

Disclaimer: This article provides general information existing at the time of preparation and we take no responsibility to update it with the subsequent changes in the law. The article is intended as a news update and Affluence Advisory neither assumes nor accepts any responsibility for any loss arising to any person acting or refraining from acting as a result of any material contained in this article. It is recommended that professional advice be taken based on specific facts and circumstances. This article does not substitute the need to refer to the original pronouncement.