Section 185 of the Companies Act, 2013 contains prohibition, restriction and exemption for providing Loan, Guarantee, and Security to the Directors of the Company and any of their relatives.

The provisions of Section 185 are divided into four (4) clauses which are as hereunder:

Section 185(1): Prohibition on providing Loan, Guarantee or Security

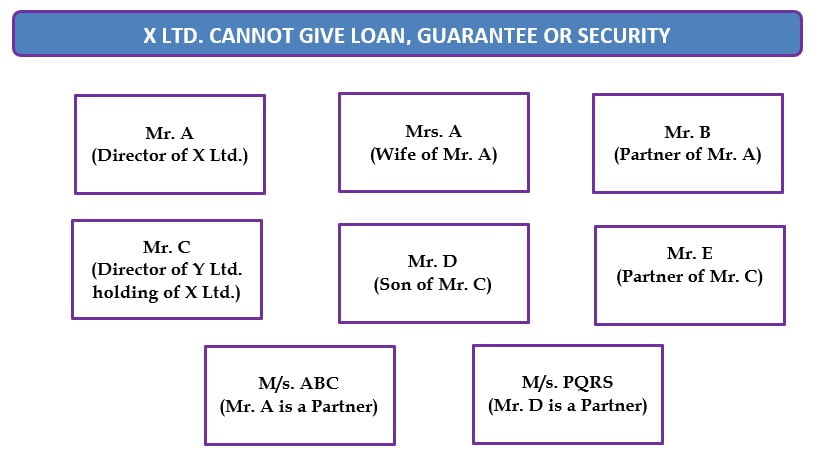

Any Company cannot provide, directly or indirectly, any loan, including any loan represented by a book debt to, or give any guarantee or provide any security in connection with any loan taken by, any of the following persons:

- Any Director of the Company;

- Any Relative of the Director of the Company;

- Any Partner of the Director of the Company;

- Any Director of its Holding Company;

- Any Relative of the Director of its Holding Company;

- Any Partner of the Director of its Holding Company;

- Any Firm in which above mentioned Director is a Partner;

- Any Firm in which Relative of above mentioned Director is a Partner;

Section 185(2): Restrictions on providing Loan, Guarantee or Security:

Any Company can however, provide loan, guarantee or security to “any person in whom any of the director of the company is interested” with certain restrictions.

RESTRICTIONS UNDER SECTION 185 (2) | |

A special resolution is required to be passed by the company in general meeting | The loans are utilized by the borrowing company for its Principal Business Activities. |

Provided that the explanatory statement to the notice for the relevant general meeting shall disclose the full particulars of the loans given, or guarantee given or security provided and the purpose for which the loan or guarantee or security is proposed to be utilized by the recipient of the loan or guarantee or security and any other relevant fact;

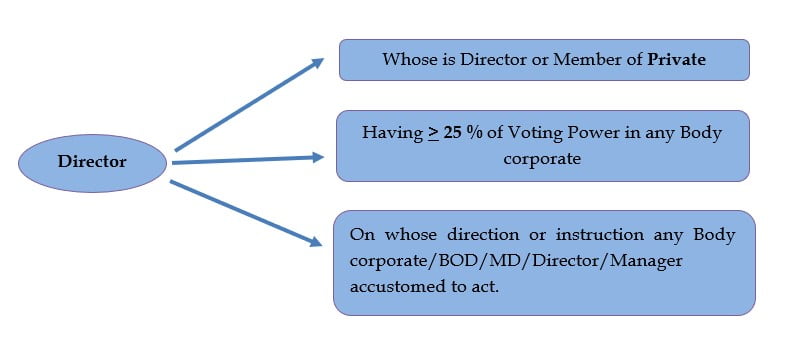

The Expression “any person in whom any of the director of the company is interested” can be understand as follows:

- any private company of which any such director is a director or member;

- any Body-corporate at a general meeting of which not less than twenty-five per cent of the total voting power may be exercised or controlled by any such director, or by two or more such directors, together; or

- any Body-corporate in which the Board of directors, managing director or manager, whereof is accustomed to act in accordance with the directions or instructions of the Board, or of any director or directors, of the lending company.

Section 185(3): Providing Loan, Guarantee or Security without any Restrictions:

A Company can provide loan, guarantee or security without any restrictions under following cases:

- Given to Managing Director or Whole time Director

- as a part of the conditions of service extended by the company to all its employees; or

- pursuant to any scheme approved by the members by a special resolution; or

- Company providing loan in the ordinary course of business activity.

Provided rate of interest charged should be More than equal to rate of interest of provided or derived from Government security for equal tenure.

- Loans given by Holding Company to its Wholly Owned Subsidiary.

- any guarantee given or security provided by a holding company in respect of loan made by any bank or financial institution to its subsidiary company

Provided that the loans made under clauses (c) and (d) are utilized by the subsidiary company for its principal business activities.

Section 185(4): Penalty as under shall be payable:

If any loan is advanced or a guarantee or security is provided or utilized outside the ambit of the any of the provisions of section 185 following penalty shall be payable:

| Company | Officer in Default | Director |

|---|---|---|

| Fine Min. Rs.5,00,000 Max. Rs.25,00,000 | Imprisonment upto 6 Months OR Fine Min. Rs. 5,00,000 Max Rs. 25,00,000 | Imprisonment upto 6 Months OR Fine Min. Rs. 5,00,000 Max Rs. 25,00,000 OR Both |

Conclusion:

The Companies (Amendment) Act, 2017 substituted the original Section 185 under the Companies Act, 2013 relating to loans, guarantees or security to directors. The substituted section deals with restrictions on the Companies in providing any loan or giving any guarantee or security. It also provides for the persons to whom such loans, guarantees or security can be extended and penalties in cases of contravention. However private companies are not exempted from these provisions which were previously provided under the 1956 Act. However, the company whose primary business is that of lending, is exempted from the provisions of Section 185.

Thus it can be summarized that loans, guarantees and/or security can be provided to the Directors or its relatives with certain restrictions under clause 2 and without any restrictions under clause 3 of Section 185 of the Companies Act, 2013.

Reference to provision: –

- Directors as defined under section 2(34) of Companies Act, 2013.

- Relative as defined under section 2(76) of Companies Act, 2013.

Disclaimer : This article has been carefully prepared, but it has been written in general terms and should be seen as broad guidance only. This article cannot be relied upon to cover the specific situation and you should not act, or refrain from acting, upon the information contained therein without obtaining specific professional advice. Please contact Affluence Advisory Private Limited to discuss these matters in the context of your circumstances. Affluence Advisory Private Limited, Its Partners, Directors, Employees, and agents do not accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information in this article or for any decision based on it.