Author: Ankit Baid, Research Analyst at Affluence Advisory

The nation has always dealt with bad loans, but let’s discuss how they ended up with such a mess in their books and what triggered the rise of ARCs in India, drawing from the likes of the International Bank for Reconstruction and Development.

The Issue?

The issue started when India was crippling with High NPA, High Current account deficit and currency crisis. Meanwhile, Raghuram G. Rajan had taken over as the governor of the RBI in September 2013. It was only towards late 2014 that he started talking about the fact that banks were not recognizing bad loans and how the corporates had taken the banks for a ride.

The only mistake the bank did was ever-greening the loans and not disclosing it. Rajan had at his disposal a small army of RBI inspectors and conducted a major bank audit in 2015. The system underwent a comprehensive examination. The idea was to figure out how big the bad money hole was. The findings revealed a distressing picture of the state of Indian banks.

The lending share of PSU Banks started falling drastically not that the credit demand was weak but the banks were hesitant to lend to corporates and industries as they had a huge pile-up of loans which they did evergreen or their ex-superiors in place did before they resigned.

Many big loans were officially in good shape, but in reality, had gone bad, with very slim chances of being repaid as corporates had their reasons. At the same time, many industrial projects for which debt had been taken and which officially were supposed to be in good shape, actually weren’t keeping the economy slowdown in the picture. The debt taken for these projects was never likely to be repaid as bank either ever greened the loan book expecting cash flow to return once the project resumed or corporates not using the loans in working capital and rather siphoned the funds through non-existent entities. As Rajan admitted: ‘I got a sense that the numbers were hiding a darker problem.

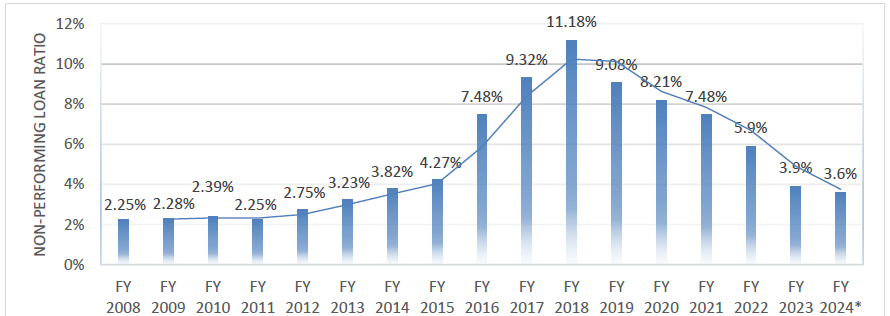

Gross non-performing loan ratio SCBs India FY 2008-2023, with estimates for FY 2024

The level of gross NPAs (GNPAs) of scheduled commercial banks (SCBs) stood at 7.5% at the end of March 2021. The Financial Stability Report of July 2021 published by the Reserve Bank of India (RBI) indicates that the GNPA ratio of SCBs may transition to 9.80% in the baseline scenario by March 2022 and may increase to 10.36% and 11.22% under the other stress scenarios.

The evolution of ARC’s through changing landscape – The role of ARC’s

The fundamental operation of banks revolves around lending, which is crucial for their profitability. Stakeholders and investors expect banks to prioritize their core business activities rather than straying from them. Banks are at the fore-front powering the economic engine. However, not all loans extended by banks prove to be sound investments; some deteriorate into non-performing assets (NPAs), posing significant challenges to the bank’s financial health. Accumulating bad loans tarnishes the bank’s reputation, dissuading new investments and impeding its ability to borrow funds at reasonable rates. Consequently, the bank’s ability to extend new loans

Diminishes and depositors lose confidence on the banks, there by adversely affecting other businesses reliant on bank credit.

Also if at all businesses face bankruptcy, their ability to repay loans diminishes, leaving banks burdened with a plethora of bad debts that are unlikely to be fully recovered.

Compounding this issue is the lingering aftermath of previous waves of bad loans, unresolved since the early half of the last decade as mentioned above. Despite efforts by banks to recoup losses, challenges persist, particularly when dealing with uncooperative promoters and collateral that may consist of stalled real estate projects or power stations. The complexity deepens as effective resolution often requires expertise beyond traditional banking practices. Taking control of struggling companies, restructuring their finances, or fundamentally altering their business models may be necessary, tasks demanding specialized professionals. However, for large banks juggling numerous responsibilities, dedicating resources to such endeavors proves challenging, remember the very purpose of banks is to lend and profit from those operation only and not to indulge in ad-hoc activities.

One strategy to mitigate this risk involves segregating bad loans from healthy ones, allowing the bank to focus on viable assets. Asset Reconstruction Companies (ARCs) emerged as key players in this process, offering to purchase distressed assets from banks at discounted rates. Although ARCs initially faced resistance from banks due to pricing concerns, they present a viable solution for banks to offload non-performing assets and regain financial stability. Thereby pooling all the un-viable loans under one umbrella, centering their core focus to recover those dues.

Timeline – Chronological Evolution of important legal and regulatory framework

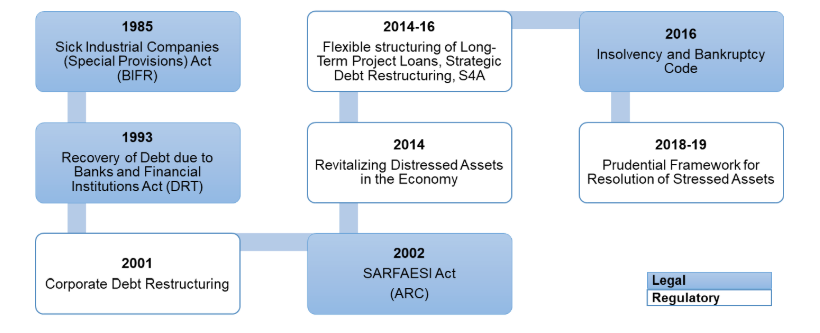

The management of non-performing assets (NPAs) has garnered significant attention from both the RBI and the Government due to its crucial role in maintaining the health of the banking system over an extended period.

- 1985: The introduction of the Sick Industrial Companies (Special Provisions) Act (SICA) aimed to detect and resolve insolvency issues promptly, managed by the Board for Industrial and Financial Reconstruction (BIFR)

- 1993: The Recovery of Debt due to Banks and Financial Institutions Act (RDDBFI Act) facilitated swift debt recovery through Debt Recovery Tribunals (DRTs)

- 2002: The introduction of the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act enabled secured creditors to enforce security interests without court intervention and led to the establishment of asset reconstruction companies (ARCs)

- 2003: Due to inefficiencies such as legal delays and lack of timely decisions, SICA was repealed

- 2013: Relevant provisions from SICA were incorporated into the Companies Act, and the National Company Law Tribunal (NCLT) took over BIFR’s functions

- 2016: Culminating these efforts, the Insolvency and Bankruptcy Code (IBC) was enacted, consolidating insolvency and bankruptcy frameworks, emerging as a significant tool for recovery and resolution of stressed assets

However, the success of this approach hinges on substantial government support to ensure the effective functioning of ARCs and their ability to recover dues from distressed assets. Overall, the establishment of ARCs holds promise in addressing India’s pervasive bad loan crisis, albeit with uncertainties surrounding its implementation and effectiveness.

Reserve Bank of India (Asset Reconstruction Companies) Directions, 2024

- An ARC before commencing/ undertaking securitization and asset reconstruction activities and functions provided under Section 10 of the Act shall obtain a certificate of registration (CoR) from the RBI

- Those who want to resolve bad assets, playing the role of so-called resolution applicant, would need Rs 1,000 crore in capital.

- ARC is authorized to invest in the equity share capital of another ARC and utilize its funds for restructuring acquired loan accounts, following a Board-approved policy.

- No ARC shall invest in land or building. However, this restriction shall not apply to –

- Investment by the ARC in land and building for its own use up to 10% of its owned funds;

- An ARC shall not raise monies by way of deposit.

- The Directions outline guidelines on Asset Reconstruction and Securitization, requiring every ARC to establish a transparent ‘financial asset acquisition policy’ approved by the Board.

- Participation in financial asset auctions is permitted for ARCs, provided transparency and market-driven pricing are ensured.

- Every ARC shall frame a Board-approved ‘financial asset acquisition policy’ within ninety days of grant of the CoR

- ARCs must devise asset realization plans within specified periods, incorporating measures outlined in the Directions.

- Obtaining consent from secured creditors holding at least 60 percent of the outstanding amount is mandatory for ARCs to enforce security interest.

- ARCs are directed to formulate Board-approved policies defining the parameters for converting debt into equity of borrower entities.

- According to the Securitization policy, Security Receipts are recognized as securities under the Securities Contracts (Regulation) Act, 1956, with features combining aspects of both equity and debt.

- Section IV mandates that every ARC maintains a minimum capital adequacy ratio of 15 percent of its total weighted assets.

- Every ARC shall prepare its balance sheet and profit and loss account as on 31st March every year. ARCs are advised to classify all the liabilities due within one year as ‘current liabilities’ and assets maturing within one year along with cash and bank balances as ‘current assets’ in their balance sheet.

- Assets held by ARCs must be categorized into standard assets and NPAs, considering well-defined credit weaknesses and collateral dependency

- Investment in SRs issued by the trusts floated by the ARC: ARCs shall, by transferring funds, invest in the SRs at a minimum of either 15% of the transferors’ investment in the SRs or 2.5% of the total SRs issued

- An effective internal control system ensuring periodic checks and reviews of asset acquisition procedures and reconstruction measures is required.

- ARCs are obligated to become members of at least one credit information company certified by the RBI, providing accurate borrower data periodically.

- At the next stage, the board of directors, including at least two independent directors, will look into any recommendation and decide whether it’s the best option.

- The settlement amount should ideally be paid lump-sum. If the borrower is unable to pay, the IAC will decide on the minimum upfront lump-sum payment and maximum repayment period.

- Yet another new norm that will change the way the ARC business is done is that any management fee charged or incentives given towards the asset reconstruction or securitization activity should come only from the recovery of underlying financial assets.

- Determinants of fit and proper status of sponsors of ARCs by RBI

Also Read: Global Economic concerns and policy narratives

Various channels by banks for recovery of their NPAs

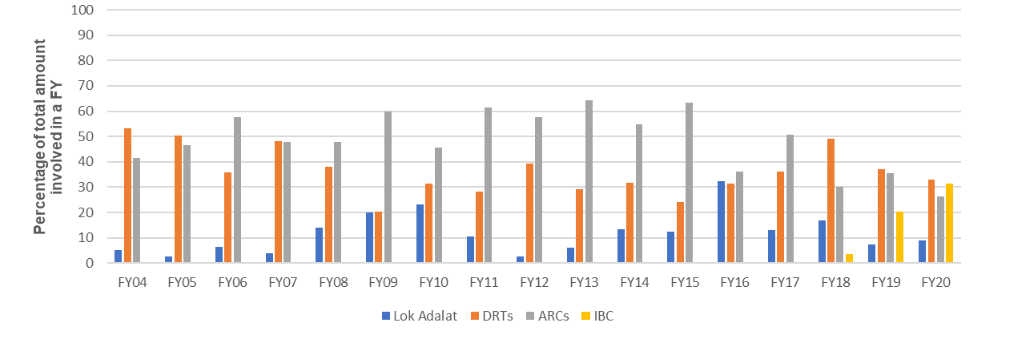

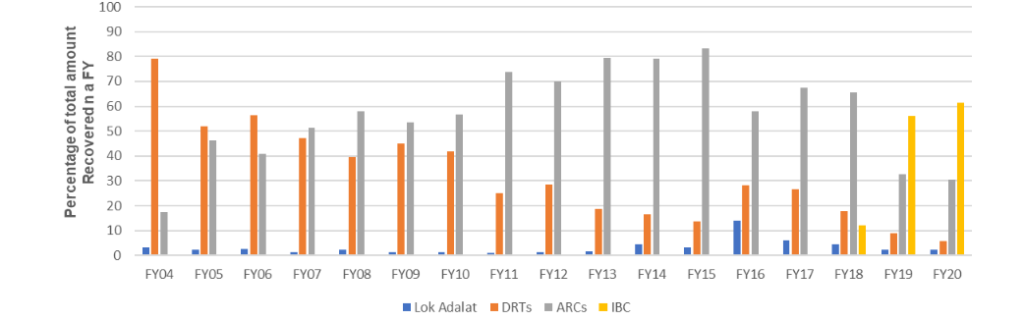

Shift towards IBC is driven by: Promises of timely recovery and insolvency resolution, and lackluster performance of ARC sector in recovery and business revival.

Data indicates that after their introduction in 2003, ARCs have been a major channel of recovery for banks until FY19. In FY20, however, banks took more NPAs for resolution through IBC compared to the ARC channel. Data also suggests that from FY19 onwards, recovery through IBC has been greater than the recovery through ARCs

- Preference given to ARCs by banks is largely on account of three fundamental needs that ARCs are able to fulfil

- ARCs allow banks/ FIs to focus on their core function of lending by removing the sticky stressed assets from their books and thereby freeing up their capital and management for productive use

- Second, where lenders invest in security receipts (SRs), ARCs make recovery for lenders by acting as the manager of the stressed assets

- Third, ARCs can help the borrowers in reviving their businesses. Revival of businesses is a significant need both for protecting the viable and productive assets of the economy and for ensuring better return to lenders from their stressed assets

The Future Landscape – ARC

In India, the ARC sector holds significant promise alongside considerable obstacles. A major hurdle for ARC firms is assessing the value of distressed assets, a task often laden with subjectivity, requiring profound comprehension of the underlying business and industry dynamics.

In 2HY 2023, ARCs conveyed their interest in broadening their purview to the Reserve Bank of India. They proposed acquiring financial assets from asset management companies (AMCs) and alternative investment funds (AIFs). Arguing for an expanded mandate, ARCs stressed that this expansion would not only accelerate the resolution of stressed assets but also provide an exit strategy for mutual funds and AIFs. Currently limited to procuring distressed assets solely from banks and financial institutions, ARCs are seeking regulatory sanction to widen their role to include assets originating from AMCs and AIFs. Typically, AMCs and AIFs invest in debentures and bonds of companies, and when these entities or their assets become non-performing, AMCs and AIFs find themselves ensnared in such problematic holdings.

Another challenge the ARC faces is the complex legal and regulatory issues associated with the assets. Well ARC’s could navigate and sail across the regulatory hurdle, the environment set for ARC’s, one can thrive with government commitment to resolve NPAs and implementation of structural reforms such as IBC creates a win-and-win ecosystem for banks, government, economy.

CLICK HERE DOWNLOAD PDF