This article presents the most recent updates and detailed insights into the GST notifications, Updates, and legal judgments that emerged in November 2023.

Relevant GST Notifications updates :

- Notification No 56/2023- Central tax dated 28 December 2023

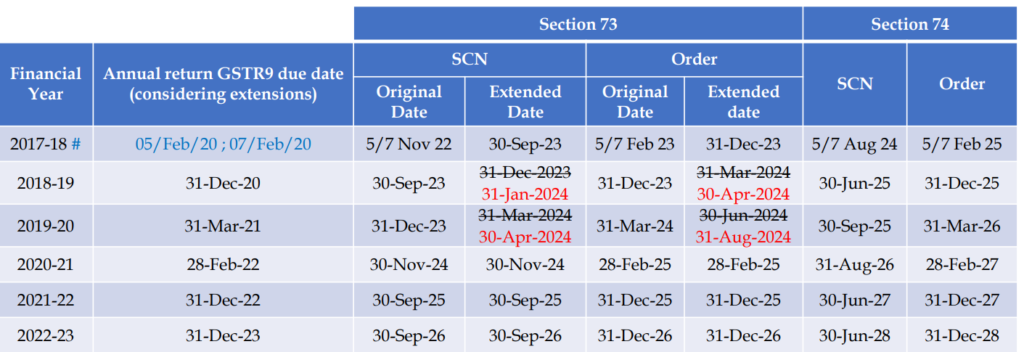

In light of Notification No 56/2023- Central tax dated 28 December 2023, CBIC has extended the due date for passing of Order in terms of Section 73(9) of CGST Act for FY 2018-19 and FY 2019-20. In light of the same, please find below updated summary containing the due date of issuing SCN and passing Order against respective period.

GST- Year wise Time Limits for SCN & Order:

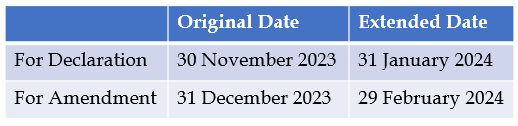

2. Reporting opening balance in Electronic Credit and Re-claimed Statement

The date for reporting opening balance in Electronic Credit and Re-claimed Statement has been extended as depicted in the table below:-

3. Notification by the Ministry of Finance dated 29 December 2023

A recent Notification dated 29 December 2023, issued by the Ministry of Finance, notifying the effective date of constitution of the Principal Bench of the Goods and Services Tax Appellate Tribunal (GSTAT) at New Delhi to be 1 January 2024.

Relevant Judgements:

- M/S Rajkot Nagarik Sahakari Bank Ltd. V. Appellate Authority For Advance Ruling, Gujarat, [2023 (12) Tmi 820]

In this case, the Appellant was provided a base percentage of loan disbursement amount as an incentive. The said incentive varied since the same would be higher in case of higher disbursement of loan. Appellate authority taking a view that the incentive scheme varies based on the performance, it shall be considered as consideration for providing services to the beneficiaries/loanees under the scheme promoted by the State Government of Gujarat. Further, the appellate authority rejected the argument of the Appellant that they provided services only to the person who has availed the loan and to the State Government.

2. S.K. CHAKRABORTY & SONS Vs Union Of India & Ors [2023 VIL 855 CAL]

The Hon’ble Calcutta High Court in this recent judgement allowed the condonation of delay in filing of appeal beyond the limitation period as per the provisions laid down under Section 107 of the CGST Act, 2017. It was observed by the Hon’ble Court that since the provisions of Section 107 of CGST Act, 2017 does not expressly exclude from its purview, the provisions of Section 5 of the Limitation Act thus in cases where required the application for condonation of delay should be decided on the merits.

Thus, the Appellate Authority in this case was requested to consider and decide the case on merits and in turn justify the petitioner’s right to Principle of Natural justice, namely- ‘Audi alteram partem’.

3. M/S R.V. Infrastructural Pvt. Ltd. Versus Commissioner Of Central Tax, New Delhi [2023 (12) Tmi 379 – Cestat New Delhi]

In this case, Tribunal held that there is no clarity on the activities carried by appellant in this case since the SCN is silent on the same. The authorities merely proceeded on the ground that the appellant has not submitted the relevant figures and therefore department had to proceed basis of details available with them. Tribunal also stated that the department cannot take a shelter on account of failure of appellant to produce and supply the documents. It is incumbent upon department to ascertain the actual nature of services for the purpose of levy of tax. Therefore, SCN being vague is liable to be quashed.

4. M/S. A.S.E. India Versus The Union Of India And 4 Others [2023 (12) Tmi 66 – Telangana High Court]

In this case, the authorities by way of a notice blocked the electronic credit ledger of the petitioner. It was stated in the notice that upon investigation it was found that few vendors are bogus and therefore ITC availed on the basis of the fake invoices issued by them is blocked. HC held that the said notice is neither an Order for attachment of ITC nor an Order under Section 74 of CGST Act. Also, HC held that if at all the same is the notice or Order for blocking of ITC the same is in contravention of Rule 86A of CGST Rules.

5. STAR ENGINEERS (I) PVT. LTD. VERSUS UNION OF INDIA, STATE OF MAHARASHTRA AND DEPUTY COMMISSIONER OF STATE TAX-GST [2023 (12) TMI 729 – BOMBAY HIGH COURT]

In this case, petitioner at the time of reporting of invoices in GSTR-1, inadvertently reported the GSTIN of ship-to party instead of putting the GSTIN of the bill to party. The petitioner tried amending these invoices in its November return of following year, however the same couldn’t be done.

High Court held that the sub-section (3) of Section 37, read with Section 38 and sub-sections (9) and (10) of Section 39 of CGST Act, cannot be purposively interpreted in a manner which would devoid the assesse from making any bonafide and inadvertent rectification/correction, especially, when it is accompanied with the fact that there is no loss to revenue whatsoever in permitting the correction of such mistake. Also, HC held that any contrary interpretation of Section 37(3) read with Section 39 (9) & (10) of CGST Act would lead to absurdity considering that every aspect of the returns has a cascading effect. This shall be borne in mind considering the cases of inadvertent human errors creeping into the filing of GST returns. Further, HC held that State officer should have allowed rectification or return either online/manually. HC also specifically stated that the department needs to avoid unwarranted litigation on such issues and make the system more assesse friendly.

6. M/S. MONDELEZ INDIA FOODS PRIVATE LIMITED VERSUS THE DEPUTY COMMISSIONER ST [2023 (12) TMI 1193- Telangana High Court]

In the captioned case, Hon’ble Telangana High Court held that the Show cause notice had been issued in a mechanical manner without application of mind since it lacks necessary information, source and the material on which the authorities found it necessary to issue the SCN. The SCN neither had any cogent sufficient material available nor the basic scrutiny/ investigation was made, which could conclude that there was evasion of tax or there is suppression of material facts.

Learned Counsel for department submitted that since the writ petition is at the show cause stage, it is always open for the petitioner to have responded to SCN with all clarifications, explanations and documentary proof. If everything would have found to be in order, the show cause proceedings could have been dropped at this juncture. Therefore, this is not the proper stage where writ jurisdiction has to be exercised.

The Hon’ble High Court, accepted the argument made by the petitioner that since the very provision of Section 73 of CGST starts with the words “where it appears to be for the authority concerned”, it itself would mean that there ought to be some material information or even sort of a complaint available with the officer so as to regard the suspicious transactions or the alleged evasion of tax made by the Taxpayer. Hence, HC held that the said SCN shall not sustain as they are bereft of facts and materials. Therefore, the same deserves be set aside/quashed.

7. M/S Shiv Trading Versus State Of U.P. And 2 Others [2023 (11) Tmi 1157 – Allahabad High Court]

In this case, Appellant purchased goods from a vendor who found to be non-existent. In order to substantiate its claim for the ITC availed on purchase made from said vendor, the Appellant produced tax invoice, e-way bill, weighment receipt before & after loading, bilty etc. HC held that the petitioner has failed to discharge its onus to prove and establish beyond doubt the actual transaction, actual physical movement of goods and genuineness of the transactions. Therefore, HC rejected the appeal.

Disclaimer: This article provides general information existing at the time of preparation and we take no responsibility to update it with the subsequent changes in the law. The article is intended as a news update and Affluence Advisory neither assumes nor accepts any responsibility for any loss arising to any person acting or refraining from acting as a result of any material contained in this article. It is recommended that professional advice be taken based on specific facts and circumstances. This article does not substitute the need to refer to the original pronouncement

CLICK HERE GST UPDATES NEWSLETTER– December 2023

CLICK HERE Monthly Compliance Calendar