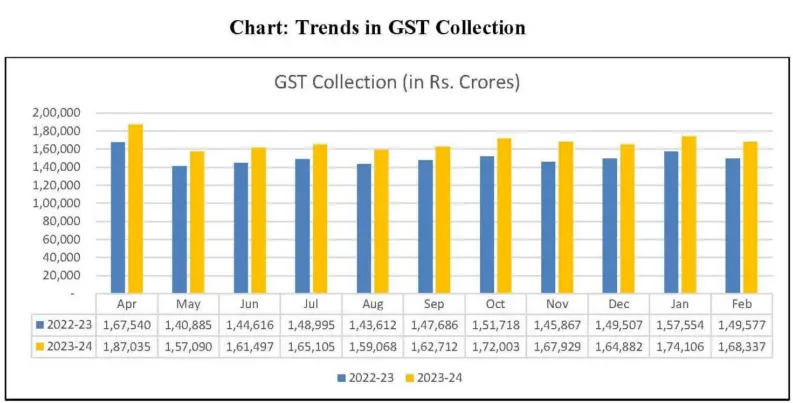

Discover the recent developments in GST, including updates, notifications, and legal Judgements from February 2024.

Relevant GST updates :

- Advisory on ‘Instances of delay in registration reported by some taxpayers despite successful Aadhar Authentication in accordance with Rules 8 and 9 of the CGST Rules, 2017’

In cases for approval of registration applications, where the Aadhar authentication has been completed but detailed verification is required for the processing of registration applications, based on their risk profile, the advisory provides for the registration to be processed within 30 days of submission of application.

- Advisory on ‘Enhanced E-Invoicing Initiatives & Launch of Enhanced Portal’

GSTN announces the launch of the revamped e-invoice master information portal https://einvoice.gst.gov.in for improving taxpayer services. New Features of the revamped E-Invoice Master Information Portal such as “PAN-based Search”, “Automatic E-invoice exemption list”etc. have been introduced. The detailed revamped features provided in the advisory can be referred from the link attached herewith.

- State Notification: Maharashtra Notification No. 04/2024—State Tax dated 21 February 2024

Pursuant to the insertion of Section 122A in the Interim budget announced on 1 February 2024, the captioned notification specifies the special procedure to be followed by a registered person engaged in manufacture of certain goods viz-a-viz Pan masala, tobacco, snuff etc. The said notification is attached herewith.

Relevant Judgements:

M/S ASSOCIATED SWITCH GEARS AND PROJECTS LTD VERSUS STATE OF U.P [2024 (2) TMI 181 – ALLAHABAD HIGH COURT]

In the captioned case, the authorities had transgressed the boundaries of the show cause notice.

The petitioner’s plea w.r.t the contention in show cause notice (SCN) was that the destination where the petitioner’s vehicle was travelling was not mentioned in the invoice, which was accepted by the authorities in the appeal. However, the appellate authority in his appeal order, imposed the penalty on a new ground that the e-way Bill which was accompanied with the goods [detained], had expired.

Hon’ble Allahabad HC delineated the relevance of issuance of SCN and significance of adhering to the confines of a show cause notice, by adverting to various settled Supreme Court judgements.

Further, it was held that, the authorities had travelled beyond reasons provided in the show cause notice, and imposed penalty on the ground that was never provided to the petitioner in the show cause notice and thus, the petitioner never had any opportunity to defend itself on the new ground. Therefore, the show cause notice was directly in teeth of the principles of natural justice, namely, the principle of audi alteram partem.

Additionally, it was held that detention of goods causes serious prejudice to an assesse and the same can only be done on the basis of specific, valid and reasonable grounds. In the captioned case [where there was no requirement of any detention], the stand taken during the detention of goods was completely changed while issuing the appeal order.

Accordingly, the writ of certiorari was issued by the HC and the impugned orders were quashed and set aside.

M/S. RKEC PROJECTS LIMITED VERSUS ADDITIONAL COMMISSIONER [2024 (2) TMI 235 – ANDHRA PRADESH HIGH COURT]

Petitioner in the said case has challenged the SCN issued under Section 74 of the CGST Act, 2017 on the ground that the ingredients for issuance of SCN under said provision are missing. Further, the notice doesn’t contain any reason or particulars of any suppression. Also, the petitioner submitted that the notice could have been issued under Section 73 instead of Section 74 of CGST Act.

Hon’ble High Court while interpreting the Explanation 2 of Section 74 of the CGST Act stated that the term suppression shall mean non-declaration of facts or information, which a taxable person is required to declare in the return, statement, report or any other document furnished under the Act or the rules made thereunder, or failure to furnish any information on being asked for, in writing, by the proper officer. Whether there is suppression or not, the same can be determined by authorities after the considering the submission made by the petitioner. Since it’s a question of fact the same cannot be determined at this stage in exercise of writ jurisdiction. Further, HC stated if the term ‘suppression’ has not used in the notice it cannot be said conclusively that there is no suppression.

Hence, HC in the said case held that mere mention of provision in the notice is not a determinative of the notice under that provision, the same shall depend upon the contents. Therefore, the writ petition against the SCN was not entertained.

TVL. SAKTHI GANESH TEXTILES PVT. LTD. VERSUS THE ASSISTANT COMMISSIONER [2024 (2) TMI 182- MADRAS HIGH COURT]

The petitioner in the captioned case has questioned the validity of assessment orders passed against him on the following

grounds –

- The demand confirmed in the Order (in particular CGST liability) is higher compared the tax amount mentioned in the SCN.;

- A finding has been recorded that documents w.r.t eligibility of Transitional credit have not been submitted

- Documents namely report of intelligence wing and statement of third parties were not provided and also the opportunity for cross-examining the said parities was not provided

With respect to difference in tax liability, HC held that the tax liability has been indicated in the course of setting out the basis of SCN. Also, for the purpose of these proceedings, it is neither necessary nor desirable to record conclusive findings. Therefore, it appears to be a typographical error resulting in indicating the CGST liability in SCN as zero. As regards the claim of transitional credit, HC held that in order to sustain said claim the petitioner should establish entitlement to such tax credit. Further, if the assessing officer is of the view that additional documents are to be submitted by petitioner for validating the claim, it doesn’t call for interference.

Further, with respect to the last ground of challenge i.e. refusal to provide all documents that were relied upon and permission for cross examination, HC observed that the opinion formed by department with respect to unlawful availment of ITC by petitioner is based on a inspection report received from intelligence wing. Intimation and SCN was issue based on the statements of employees and director of the petitioner. Also, the same has been referred in the Order. HC held that the principle of natural justice cannot be put into straight jacket. The obligation of establishing eligibility of ITC is casted upon the petitioner and therefore it is the responsibility of petitioner to place all material documents to establish the actual purchase and receipt of goods or services. Hence, this ground also doesn’t qualify for exercising discretionary jurisdiction.

PRAHITHA CONSTRUCTION PVT LTD. VS. UOI & ORS. [TS-60-HC(TEL)-2024-GST]

High Court in the said case has dealt with applicability of GST on transfer of land development rights (TDR) under Joint Development Agreement (JDA) by land owner to developer. Also, the petitioner (i.e. the developer) has challenged the vires of Notification No. 4/2018-Central Tax (Rate) dated 25 January 2018 and the amendment made to the said vide Notification No. 23/2019 dated 30 September 2019.

Notification 4/2018- Central Tax (Rate) provides for the time of supply in case of transfer of development rights to a developer or the transfer of construction service against consideration in form of transfer of development rights. Further the amendment to the said Notification provides that nothing contained in Notification No 4/2018 shall apply post 1 April 2019.

The petitioner has contended that transfer of development rights under JDA is akin to Sale of land and therefore covering vide entry no. 5 of Schedule III of the CGST Act, 2017 [It will not treated as Supply].

High Court stated that the transfer of ownership from the landowner goes directly to the purchaser of the constructed property and not in favour of the petitioner unless and until the land stands transferred in his name. Thus, the same cannot be brought within the ambit of sale. Further, HC stated that transferring of the development rights does not result in transfer of ownership rights. Sale of land/transfer of land or undivided share of land would get executed only after issuance of completion certificate of the project. This itself would give a clear indication that the services rendered by the petitioner in execution of JDA was supplied prior to the issuance of completion certificate and would thus be amenable to GST. Also, in absence of any cogent and substantial material to establish right, title and ownership being created in favour of the petitioner/developer, the transfer of development rights is subject to GST and cannot be brought under the purview of Entry 5 to Schedule III to CGST Act.

Further HC observed that in light of GST council recommendation, the liability to pay GST on supply of TDR is shifted upon the developer-promoter under reverse charge. The same has been notified vide Notification No. 5/2019 dated 29 March 2019. Upon perusal of the JDA agreement in said case, HC held that there are 2 sets of transaction one is between landowner and petitioner and another is the supply of construction service by petitioner to land owner and only thereafter sale of constructed area to third party buyers. Both these transactions qualify as supply and are liable to GST. Under no circumstances these two supplies can be termed as supply of land in terms of entry 5 of Schedule III to CGST Act.

HC also held that the purpose of issuing Notification No 4/2018, further amended vide Notification 23/2019, was for ensuring ease for landowners and developers as the transfer of development rights happens at the time of execution of JDA. However, handing over of constructed area to landowner happens at a later stage i.e. upon issuance of completion certificate. This notification deals with time of supply of services of development rights which otherwise was always taxable since introduction of GST. In light of this notification time of supply has now been postponed to a time when the petitioner transfers the possession of constructed/developed area to landowner.

JAIN ENTERPRISE V. STATE OF GUJARAT [2024-VIL-124-GUJ]

Gujarat HC in said case has referred to its direction issued in case of Aggarwal Dyeing & Printing. Pursuant to said ruling a standard operating procedure was issued on 1 April 2023, wherein a detailed procedure has been laid down to deal with cancellation of registration. In the said SOP the authorities are informed that the show cause notice issued to the dealer for cancellation of his registration number shall contain all the details and if any documents are relied upon by the authorities, then the documents shall also be provided to the dealer along with the show cause notice. The instructions also contains a specific mention about passing a detailed speaking order after providing reasonable opportunity to the dealer.

In the said, SCN was issued for cancellation of registration without providing detailed reason except for a one-line reason. Learned Advocate appearing on behalf of authorities submitted that the SOP shall be duly complied whereby detailed SCN will be issued after following the procedure prescribed in SOP. HC observed that the authorities have come forward to comply with the SOP. In case the same is not followed i.e. SCN is issued without providing detailed reason and in breach of principle of natural justice, appropriate Orders shall be passed for cost against the officer.

SANKAR NP JAPAN (P) LTD vs THE ASSISTANT COMMISSIONER (ST), CHENNAI [2024 (2) TMI 125 MADRAS HIGH COURT]

The petitioner filed belated GSTR-3B under Section 39 of the TNGST Act, 2017 for the period July 2017 to March 2018. Due to said delay department initiated the proceedings. Petitioner aggrieved by the same filed the writ petition.

High Court noted that the similar issue has already been dealt in case of ‘ M/S EICHER MOTORS LTD. V. ASSISTANT COMM & ORS. [2024 (1) TMI 1111- Madras High Court]’.

Hence, the following principle laid down in case of Eicher motors shall squarely apply:

- Credit to the account of Government shall always occur not later than last date for filing GSTR-3B

- Once the amount is paid by generating GST PMT-06, the same initially get credited to the account of Government. Consequently, the tax liability shall stand discharged to the extent of credit to the account of Government. Hence, for the purpose of accounting it will be deemed to be credited to ECL as stated in explanation (a) to Section 49(11) of CGST Act.

- If the tax amount is deposited or before the last day of filing GSTR-3B, the tax liability shall stands discharged from the date on which said amount is credited to Government. Interest in terms of Section 50(1) of CGST Act shall only be applicable in case where tax amount is deposited post due date of filing of GSTR-3B.

In light of the above, High Court allowed the writ petition in the captioned case. This is another judgement which supports the view that if the taxpayer deposits the amount in its in Electronic Cash Ledger on or before the due date of filing GSTR-3B, the tax liability stands discharged. Hence, in case of delay in filing GSTR-3B interest would not be applicable.

SAHAJAHAN MAJUMDER VERSUS THE STATE OF TRIPURA AND OTHERS 2024 (2) TMI 69 – TRIPURA HIGH COURT

The petitioner in this case filed an application for condonation of delay of 239 days in submitting a revision petition under Section 72 of the TVAT Act, 2004. Petitioner relied upon the provisions of Section 5 of Limitation Act, 1963 while filing the said application.

The question here dealt by HC is that whether delay in filing the review petition under Section 72 of TVAT Act, 2004 is condonable or not as the said provisions (Special statue) does not provide for condonation beyond 60 days.

The petitioner referred to Supreme Court judgement (Superintending Engineer/Dehar Powerhouse Circle Bhakra Beas Management Board v. Excise and Taxation Officer (2020) 17 SCC 692) to support his contention that in absence of express or implied exclusion under the TVAT Act being the special statute, application of Limitation Act for condonation of delay is not impermissible. Also, petitioner has provided sufficient explanation for condonation of delay.

High Court accepted the argument of petitioner and held that while the Section 72 of TNVAT Act is silent on the aspect of condonation of delay beyond 60 days, there is no express or implied exclusion of application of Limitation Act. Therefore, condonation of delay in said is maintainable.

The above judgement can be referred for condonation of delay in GST regime since similar to TVAT Act there is no express or implied exclusion pertaining to application of Limitation Act. Further, the similar principle was followed in recent judgement in case of delay in filing the appeal before appellate authority has been condoned in case of SK Chakraborty & Sons Vs. Union of India (2023-VIL-855-Calcutta HC).

M/S. METAL TRADE INCORPORATION KOTHARI VERSUS ASSISTANT COMMISSIONER [2024 (2) TMI 360 – MADRAS HIGH COURT]

The petitioner in the said case has submitted that the conclusions of the intelligence wing were not dealt by the assessing officer. Also, it is submitted that a reasonable opportunity to submit relevant documents or to be personally heard was not provided. Further, he submits that the intimation and SCN is vague to the extent the details of supplies or suppliers to establish the purchase has not been mentioned in the SCN. Therefore, impugned Order in said case call for interference.

High Court held that even in case an opportunity of being heard was granted before the last date for filing the reply against the SCN, the same should have been attended by the petitioner. Since the petitioner did not attend the hearing, principle of natural justice is not violated.

Further, HC accepted the contention of the petitioner that the impugned Order did not contain any findings on the conclusion of Intelligence wing. However, HC held that in terms of Section 16 of CGST Act read with Rule 36 of CGST Rules, the registered person is under obligation to establish the purchase, including receipt of goods or services. Also, HC went ahead to state that the petitioner would ordinarily be required to produce invoices, e-way bills, payment receipts, lorry receipts, delivery challans and the like to establish purchase and receipt of goods. Since the impugned Order is issued primarily on the basis that such documents were not submitted by petitioner, HC held that it is not appropriate to adjudicate this issue in exercise of discretionary jurisdiction when the petitioner has an alternate remedy.

M/S. SUZUKI MOTOR GUJARAT PVT LTD. [2024 (2) TMI 848] – Gujarat AAR

The Questions dealt in this ruling along with decision of AAR is summarised as below:

Q1. Whether deducting nominal amount from employees availing canteen facilities in factory premises be considered as “Supply” u/s 7 of the CGST Act, 2017?

Ruling: The AAR here made reference to the Circular No. 172/04/2022-GST dated 6 July 2022. The said circular clarified that perquisites provided by the ’employer’ to the ’employee’ while and in terms of contractual agreement, entered into between the employer and the employee, would not be subjected to GST. Further, AAR found that factually there is no dispute with respect to the canteen facility provided by the applicant to the employees as mandated in Section 46 of the Factories Act,1948. Additionally, the copy of Meal Policy was also perused.

Therefore, in light of the above and entry 1 of Schedule III of CGST Act, 2017, it was held that deduction made by the applicant from the employees who are availing canteen facilities in the factory would not be considered as a ‘supply’ in terms of section 7 of the CGST Act, 2017.

Q2. Can applicant avail ITC for GST charged by the Canteen Service Provider? [ ‘CSP’]

Ruling: AAR observed that, providing canteen facilities by the applicant was mandatory under the Factories Act, 1948 read with Gujarat Factories Act, 1963, thus, ITC with respect to food and beverages in said canteen facility for employees shall be available to the applicant. However, such ITC would be restricted only to the extent of the cost borne by the applicant alone. Further, AAR held that ITC pertaining to the canteen facilities provided to temporary/contract workers, employees on deputation, employees on business travel, shall be ineligible ITC in terms of Section 17(5)(b)(i) of the CGST Act. Thus such ITC cannot be availed by the applicant in view of Section 16 of the CGST Act, 2017.

Q3. Whether recovery of charges from temporary/contract workers towards canteen facility would to constitute as “supply”.

Ruling: The AAR observed that the temporary/contract workers, employees on deputation and employees on business travel, do not pass the test of employer-employee relationship and therefore do not fall within the ambit of entry 1 of Schedule III of CGST Act, 2017. The said arrangement for supply of food to contractual workers, employees on deputation or on business travel would qualify as transaction incidental or ancillary to the main business in view of Section 2(17)(b) of the CGST Act. Thus, AAR in this case, categorised the applicant as “supplier” in terms of Section 2(105) of the CGST Act and held that the said charges recovered from temporary/contract workers would qualify as consideration and therefore shall qualify to be a ‘Supply’ in terms of Section 7(1)(a) of the CGST Act even though the food is supplied at subsidised rates.

Q4. Can ITC be availed w.r.t inputs i.e. equipment and kitchen utensils utilized for providing canteen facilities?

Ruling: The applicant in this scenario contended that, it was an obligation on the applicant to provide the CSP with kitchen utensils and equipment like watercooler, dishwasher, plates, and worktable. The ownership of said utensils and equipment remains with the applicant. Additionally, the application contended that the inward supply of kitchen utensils and equipment are in the course or furtherance of business, thus ITC is eligible.

AAR referred to Notification No. 13/2018-CT (Rate) dated 26 July 2018 wherein the GST rate provided in the said Notification is without input tax credit. Thus, in light of the same and in view of Section 17(5)(b)(i) of the CGST Act, 2017, AAR held that, the applicant is not eligible for ITC on kitchen utensils and equipment like watercooler, dishwasher, plates, worktable, table etc.

M/S. MINDRILL SYSTEMS AND SOLUTIONS PRIVATE LIMITED [2024 (2) TMI 553]- WB AAAR

The captioned case deals with eligibility of ITC relating to inward supplies of goods or services used for construction of immovable property for use by lease or tenant.

AAR held that in terms of clause (d) of Section 17(5) of CGST Act, the Input Tax Credit on input/input services used for construction of warehouse, which is to be let out, shall not be eligible if said expenses are capitalised in books of accounts. However, where construction expenses are not capitalised in books, the claim of ITC is admissible. Appellant filed the instant appeal against this decision of AAR.

AAAR held that the clauses (c) and (d) of section 17 (5) of CGST Act clearly states that Input Tax Credit is not available in respect of works contract services or goods or services or both received for construction of an immovable property. Therefore, for the purpose of construction, the law is unambiguous in the main clauses (c) and (d) of section 17 (5) of the CGST Act that Input Tax Credit will not be available and thus it will be a blocked credit. It is only the Explanation part, where the law extends the ineligibility criteria for Input Tax Credit to the arena of re-construction, renovation, additions, alterations or repairs and that too conditionally, i.e. Input Tax Credit for such portion of the expenses pertaining to re-construction, renovation, additions, alterations or repairs which are capitalized stands ineligible.

The AAR has erred in interpreting the afore-stated provisions by applying the conditions of capitalisation both for construction as well as for reconstruction, renovation, additions or alterations or repairs.

Appellant in said case has constructed one warehouse and let it out. This being a ‘construction’ and therefore will attract the provisions of the clauses (c) and (d) of section 17(5) of CGST Act and not the Explanation part for determining the eligibility criteria for Input Tax Credit. Thus, the input tax credit for such construction shall not be available to the respondent.

M/S. INDIA ADVANTAGE FUND & ORS. V. THE COMMISSIONER OF CENTRAL EXCISE [2024 (2) TMI 1086 – KARNATAKA HIGH COURT]

The appellant in the captioned case was a Venture capital trust [established under the Indian Trust Act, 1882]. The Investment manager managed the funds contributed by the Institutional Investors to the Appellant. The key question in this matter was whether managing the assets of trust/fund shall qualify as service and accordingly liable to pay service tax. Aggrieved by the CESTAT order, this appeal had been filed before the High Court of Karnataka.

The decision of the HC was enunciated by providing clarifications in following questionnaire stated as below –

Q1. Whether the Appellant can be called a juridical person?

Held that: Although, the statutes such as Securities Exchange Board of India {SEBI}, GST, Insolvency and Bankruptcy Code {IBC} identifies trust as a “person”, however, the Finance Act does not define trust as a “person”.

Since the law intends the definition clauses of each statute must be read with the object and purpose of that statute only, the appellant cannot be held as a juridical person because the Finance Act does not define trust as a “person”.

Q2. Whether the status of the Appellant Trust be recognized as “pass-through” for the purpose of taxation statutes?

Held that: The Appellant Trust merely consolidates the funds from the contributories and invests the same in portfolio companies as per the advice of the Investment manager. The fund/trust neither makes any profit for itself nor provides any service to the contributories. Thus, it was held that the Appellant Trust was a “pass-through” and not liable for service tax.

Q3. Whether the Appellant’s management of contributor’s fund be understood as service to self?

Held that: The Appellant and the contributor, although being institutional investors could not be dissected in this case, because of the fact that contributors investment was held in trust by the fund and it was invested as per the advice of investment manager. The Appellant trust was not doing any act on its own. Thus, the Appellant Trust could not provide service to self. HC held that, since the doctrine of mutuality applies when commonality is established between the contributors and participators, incidentally, the said doctrine applies in this case.

TVL. FUTURE GENERAL INDIA INSURANCE CO. LTD. V. THE ASSISTANT COMMISSIONER [2024 (2) TMI 1005 – MADRAS HIGH COURT]

The petitioner is engaged in the business of providing general insurance service. Assessing officer has recorded the following findings in the Order against which the petitioner has filed a writ petition before HC:-

- There is difference in turnover as per P&L A/c & Balance Sheet on one hand and GSTR-9 on the other hand. Based on said contention, CGST and SGST was imposed @18% each (instead of 9% each).

- Determination of Transitional credit

Petitioner had contended that the assessing officer has recorded findings without applying his mind to the fact that the turnover of an entity operating in multiple States in India, as reflected in Financial Statements, and the turnover attributable to its operations in Tamil Nadu would vary. For the purpose of providing information relating to turnover specific to Tamil Nadu, a CA certificate specifying the turnover pertaining to said State was submitted. HC observed that the tax liability was imposed merely because CA certificate did not provide State-wise turnover. HC held that this finding shall not stand because only the bifurcation of total turnover and turnover of Tamil Nadu State is relevant. With respect to error in computing tax liability, HC held that tax liability with respect to turnover of Tamil Nadu State has been duly discharged. Therefore, in light of total tax imposed due to incorrect calculation (i.e. CGST and SGST @ 18% each) and the patent errors justify interference with the assessment Order even without examining the Order with respect to other defects for which liability is imposed. Hence, the said Order shall not sustain. Accordingly, the Order is quashed and remanded for reconsideration.

JAGANNATHDHAM SUPERSTRUCTURES PVT. LTD. & ORS. V. DEPUTY DIRECTOR, D.G.G.I & ORS. [2024 (2) TMI 121 – ORISSA HIGH COURT]

High Court in the said case held that the process of investigation in tax evasion cases cannot be construed to be over upon issuance of Show Cause Notice by the competent authority. Further, the investigative process can be said to be completed only when the quantum of evasion has been determined or it has been concluded that there was in fact no evasion of taxes or contravention of law by the process of adjudication/appeal.

Further, HC stated that the in case where the question of launching the prosecution is to be decided, which is a natural extension of an investigation and if it were to be assumed that an investigation is deemed to be concluded on issuance of Show Cause Notice and that the order sheet/note sheet recorded in the case file were to be disclosed, the person against whom prosecution is proposed to be launched by the department would gain an unfair advantage.

Also, HC stated that the order sheet/ note sheet in a particular case file invariably contain the source of information upon which the investigation is initiated. Disclosure of such information would reveal the identity of the source of information/informant and the nature of information, which can prejudicially effect the informant and also any future investigations. Moreover, the order sheet/note sheet sought from an investigation file may contain information pertaining to a third party against whom an investigation may be ongoing or actively under consideration and any disclosure of such information would jeopardize the investigation against such third entity.

HC held that mere issuance of SCN does not mean that the process of investigation is concluded, and a final decision is arrived at, rather, it is only one of the steps to arrive at a final decision. Disclosure of any information at this stage to the petitioner would impede the process of investigation which is deemed to be complete only after the final adjudication about the liability has been made. Hence, until the matter has gone through all the stages of appeals and revisions and a final decision about prosecuting or not prosecuting such person has been taken by the competent authority, the adjudication shall not be deemed to be completed.

M/S. ENGINEERING TOOLS CORPORATION, REPRESENTED BY ITS PARTNER VERSUS THE ASSISTANT COMMISSIONER (ST), CHENNAI [2024 (2) TMI 855 – MADRAS HIGH COURT]

In this case, the Input Tax Credit (ITC) availed by petitioner was reversed on the ground that the GST registration of relevant supplier was cancelled with retrospective effect. The petitioner contended that despite submission of tax invoices, e-way bills, transport documents and proof of payment to the supplier, the said ITC has been reversed only on the ground that supplier’s registration has been cancelled.

High Court held that the petitioner may be called upon to produce evidence of the existence of the supplier at the relevant point of time. In addition, the petitioner may also be called upon to prove that the transaction was genuine by providing relevant documents such as tax invoices, e-way bills, lorry receipts, delivery challans, proof for payment and the like. It appears that the petitioner has submitted all these documents, however the same have been disregarded. Hence, the impugned assessment Order is unstainable.

Therefore, the impugned assessment order is quashed and the matter is remanded for reconsideration. Also, HC directed the assessing officer is directed to consider whether the transaction was genuine by examining all relevant documents. The ITC claim shall not be rejected upon such reconsideration solely on the ground that the supplier’s GST registration was cancelled with retrospective effect and a fresh assessment order shall be issued upon reconsideration, after providing a reasonable opportunity to the petitioner.

M/S. SRI SHANMUGA HARDWARE ELECTRICALS vs THE STATE TAX OFFICER [2024 (2) TMI 1126 MADRAS HIGH COURT]

In this case, the petitioner contended that he has erroneously and inadvertently filed NIL GSTR-3B returns. The petitioner also contended that he is eligible for Input Tax Credit in each of the assessment period under dispute and the said credit is duly reflecting in the GSTR-2A returns. Further, the petitioner states that he has duly filed GSTR-9 (annual) returns duly reflecting the said ITC.

The ITC claim was rejected solely on the ground that the petitioner had not claimed ITC in his GSTR-3B returns. The learned counsel representing the respondent argues that the petitioner should have pursued statutory remedies instead of approaching the court and that the burden of proving ITC eligibility lies with the petitioner.

High Court held that when the petitioner asserts that he is eligible for ITC by referring to GSTR-2A and GSTR-9 returns, the assessing officer should examine whether the ITC claim is valid by examining all relevant documents, including by calling upon the petitioner to provide such documents. In this case, it appears that the claim was rejected entirely on the ground that the GSTR-3B returns did not reflect the ITC claim. Hence, the impugned Order is quashed and remanded back for reconsideration.

M/S SHREE RAM GLASS BACHAULI KUFTABAD BEEKAPUR vs STATE OF U.P. [2024 (2) TMI 1006 – ALLAHABAD HIGH COURT]

In this case, the respondent authority, citing the absence of business activities at the registered address, cancelled the petitioner’s registration and contended that the reply to SCN had not been filed.

Petitioner filed an application for revocation of registration along with an application for fresh inspection of business premises. The premises were inspected where no goods were found on the said place of business. The landlord was present and his signatures and other identifications papers were taken by the inspecting team. While rejecting the application for revocation, it was stated that no goods were found in the business premises of the petitioner and that the signature of the landlord did not match from two rent agreements entered into between the petitioner and the landlord.

The first appellate authority rejected the appeal of the petitioner on the ground that signatures of the landlord did not tally and it was a sham registration. Petitioner has challenged the order by way of the captioned writ petition.

High Court observed that, considering the provisions contained under Section 29 (2) of CGST Act along with the facts of the present case, it is noticed that there is no denial of the fact that the petitioner has, in fact, conducted business from the said address in as much as returns have been filed for the financial years 2021-22 and 2022-23 and this fact has not been denied by any of the authorities. Both the authorities should have taken into consideration the returns filed by the petitioner who had disclosed substantial business activities conducted by him for two financial years.

The court emphasized the significant consequences of registration cancellation, as it deprives citizens of their fundamental right to engage in lawful business activities. Therefore, a presumption does exist as to such registration having been granted upon due verification of necessary facts. If the respondents propose to cancel the registration thus granted, a heavy burden lay on the respondent authority to see that statutory provisions contained under Section 29 (2) of the Act of 2017 are fulfilled and any one of the five conditions are placed to the assesse for cancellation.

In light of the facts of case, HC held that findings of adjudicating authority and appellate authority is perverse in as much as the petitioner submitted that he had filed his returns. No further examination of the same was undertaken. Merely because at the place of business no stock was found, it was concluded that the petitioner did not conduct any business activity. There is no law which mandates a businessman to always retain stock at the place of business. In order to arrive at such a conclusion the authorities should have undertaken further exercise to indicate that the returns filed by the assessee were fraudulently filed only to claim Input Tax Credit. The authorities have failed to discharge the duties and merely because the place of business did not contain any stock, the registration of the petitioner was cancelled.

In light of the above, HC was of the considered opinion that both the impugned orders are illegal and arbitrary and accordingly set aside. The writ petition succeeds and is allowed.

FAIRDEAL METALS LIMITED VERSUS ASST. COMMISSIONER OF REVENUE [2024 (2) TMI 240 – CALCUTTA HIGH COURT]

- In this case, department detained the goods transported to the petitioner and levied penalty based on the allegation that the supplier of goods is involved in issuance of fictitious/bogus invoices. Petitioner filed the present writ petition against the Order for detention of goods and subsequent Order levying the penalty.

- Here, the submission of the petitioner was that all the allegations in this case are against the supplier of goods. It was contended that supplier recently took registration under GST. The documents based on which he obtained registration were incomplete. There are certain discrepancies noticed in the GSTR-3B filed by the supplier. Also, the goods transported by supplier were not covered by their GST registration.

- Further, proper officer upon perusal of documents was of the view that the supplier was involved in receiving and passing on fictious/bogus ITC to other parties. Supplier has set up this company solely for the purpose of circulating bogus ITC. Also, the officer contended that the goods appears to be of suspicious origin and the purchase was merely a paper sale to hide the details of original supplier with the intend to evade payment of tax.

- Petitioner categorically submitted that it was not possible for him to find out the background of the supplier. Also, it did not have any mechanism to verify the details of said supplier.

- Petitioner relied upon the judgement of P&H HC in case of M/s. Shiv Enterprises Vs. State of Punjab & Ors, wherein the Court held that the allegation of contravention of provisions of the act was against the supplier and not the petitioner, the impugned notice was liable to be quashed and therefore set-aside.

- Learned advocate representing the respondent submitted that the supplier has been found to be bogus and therefore the goods have been rightly detained. Also, reliance was placed upon the SOP published by Commissioner, CBIC GST Investigation wing, to submit that in cases involving fake invoices, the address of the supplier are often incorrect or incomplete and details provided in registration are also false. He also submitted that there is no proper system in place to verify or scrutinise the data provided at the time of registration, such kind of fraud continues to happen. The supplier in the present case is a dummy company created only for committing fraud.

- HC observed that since the supplier has paid the tax, the allegation that he has evaded tax shall not hold true. Further, High Court held that if the details/documents submitted by supplier for obtaining registration were incomplete, the registration ought not to have been issued. Once the registration is granted and the supplier has paid the tax, the allegations that the supplier is dubious shall not hold true.

- Further, HC also held that the petitioner was no where connected with any of the allegations made against the supplier and therefore, he cannot be made liable to pay the penalty for such allegations. Hence, the Order for detention and subsequent Order for levy of penalty has been set-aside and quashed

CLICK HERE GST UPDATES NEWSLETTER– FEBRUARY 2024

CLICK HERE Monthly Compliance Calendar