MSME registration helps the Micro, Small and Medium (MSME) industries to obtain various benefits provided by the government for their growth. In a developing country like India, MSME industries are the backbone of the economy. When these industries grow, the country’s economy grows and flourishes. These industries are also known as small-scale industries or SSIs.

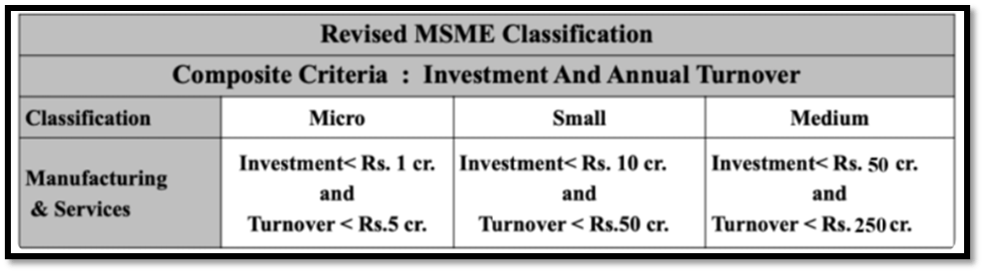

All manufacturing, service industries, wholesale, and retail trade that fulfil the revised MSME classification criteria of annual turnover and investment can apply for MSME registration. Thus, the MSME registration eligibility depends on an entity’s annual turnover and investment. The following entities are eligible for MSME registration:

- Individuals, startups, business owners, and entrepreneurs

- Private and public limited companies

- Sole proprietorship

- Partnership firm

- Limited Liability Partnerships (LLPs)

- Self Help Groups (SHGs)

- Co-operative societies

- Trusts

Revised thresholds for classification among Micro, Small and Medium under ‘Micro, Small and Medium Enterprises Act, 2006’ are as under:

The Budget 2023 provides tax benefits and other measures for the Micro, Small and Medium Enterprises (MSMEs) and startups in the country, which helps them grow and boost their businesses which are as follows:

Collateral-Free Bank Loans:

The Government of India has made collateral-free credit available to all small and micro-business sectors. This initiative guarantees funds to micro and small sector enterprises. Under this scheme, both the old as well as the new enterprises can claim the benefits. A trust named The Credit Guarantee Trust Fund Scheme was introduced by the Government of India, SIDBI (Small Industries Development Bank of India) and the Ministry of Micro, Small and Medium Enterprise (MSME) to make sure this scheme is implemented (Credit Guarantee Scheme) for all Micro and Small Enterprises. Budget has introduced revamped scheme which will take effect from 1st April 2023 through infusion of ` 9,000 crore in the corpus. It will enable additional collateral-free guaranteed credit of ` 2 lakh crore. Further, the cost of the credit will be reduced by about 1 percent.

Protection against Payments (Delayed Payments):

MSMEs constantly face the risk of delayed payments which in turn disturbs their entire business. To protect registered companies, the Supreme Court has mandated that any buyer of goods or services from registered MSMEs is required to make the payment on or before the agreed date of payment or within 15 days from the day they had accepted the goods or services. If the buyer delays the payment for more than 45 days after accepting the products or services, then the buyer must pay interest on the amount that was agreed to be paid. The interest rate is three times the rate that is notified by the Reserve Bank of India. To support MSMEs and to promote timely receipt of payments, it proposed to allow deduction for expenditure incurred on payments made to them only when payment is made.

Increased Exportability of Products:

Registered businesses can export their products worldwide without restriction. They will also be able to take advantage of Indian trade agreements with other countries. international trade-related events, craft fairs, exhibitions, and exchange programs are all organized by the Indian government. Being a micro, small, or medium enterprise grants access to these venues for international cooperation on trade-related issues with various countries and encourages new commercial relationships. the government also provides subsidies, tax breaks, and technical assistance to MSMES exporting goods and services. The concessional Basic Custom Duty of 2.5 percent on copper scrap is also being continued to ensure the availability of raw materials for secondary copper producers who are mainly in the MSME sector.

Tax-linked Benefits:

Numerous benefits can help you save money that could otherwise be subject to taxation. enterprises can benefit from a potential taxation basis, which relieves them of the need to maintain thorough audit procedures and comprehensive books of accounts. MSMEs are growth engines of our economy. Micro enterprises with turnover up to ` 2 crore and certain professionals with turnover of up to ` 50 lakh can avail the benefit of presumptive taxation. It proposed to provide enhanced limits of ` 3 crore and ` 75 lakh respectively, to the taxpayers whose cash receipts are not more than 5 per cent. It also provides an option to pay tax at a concessional rate of 15% for a new co-operative society established on or after 01/04/2023, commencing production or manufacture by 31/03/2024 and does not avail of any specified deduction or incentive.

Relief to startups in carrying forward and setting off losses:

The Budget 2023 provided relief to startups by giving the MSME benefits of carry forward of losses on a change of shareholding of startups from seven years to ten years. The condition of continuity of a minimum of 51% shareholding to set off of carried-forward losses is relaxed for eligible startups if all company shareholders continue to hold those shares. Certain startups are eligible for tax benefits if they are incorporated before 01/04/2023. The period of incorporation of such eligible startups for receiving tax benefits is extended by one more year, i.e. 01/04/2024.

Ease in claiming amortization deduction of preliminary expenditures:

At present, the assessee or a concern approved by the Board should carry out the activity of an enterprise for claiming amortization of certain preliminary expenses. To simplify the process of claiming amortization of preliminary expenses, Budget 2023 proposed to remove the condition of a concern approved by the Board to carry out the activity in connection with these expenses. The government will prescribe the format for reporting such expenses by the assessee.

Vivad Se Vishwas I – Relief for MSMEs:

In the case of failure to execute contracts by MSMEs during the Covid period, the government and government undertakings will return 95% of the forfeited amount relating to performance or bid security to them.

Agriculture Accelerator Fund for Agri-startups:

An Agriculture Accelerator Fund to be set up to promote and encourage Agri-startups by budding entrepreneurs in rural areas. The Fund will aim to bring affordable and innovative solutions for challenges faced by farmers. It will also help to bring modern technologies to transform agricultural practices and increase profitability and productivity.

Entity Digi Locker for MSMEs:

An Entity Digi Locker will be set up for use by MSMEs and large businesses. It will be towards sharing and storing documents online securely with various regulators, banks, authorities and other business entities.

Click here to Download PDF

Disclaimer: This article has been carefully prepared, but it has been written in general terms and should be seen as broad guidance only. This article cannot be relied upon to cover the specific situation and you should not act, or refrain from acting, upon the information contained therein without obtaining specific professional advice. Please contact Affluence Advisory Private Limited to discuss these matters in the context of your particular circumstances. Affluence Advisory Private Limited, Its Partners, Directors, Employees, and agents do not accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information in this article or for any decision based on it.