Globalization has paved way for international financing which helps the organization to engage in cross-border transactions with foreign business partners, such as customers, investors, suppliers, and lenders. Indian companies have an option to mobilize funds through ECB mode from the foreign market to have optimum capital structure.

What is ECB?

Borrowings of commercial loans by eligible resident Indian entities from external sources i.e. entities that are resident outside India are called External Commercial borrowings or ECB. ECB means borrowing from outside India in accordance with the framework decided by the Reserve Bank in consultation with the Government of India.

Basically, it helps Indian organizations to raise funds in foreign currencies from outside India. It can be raised by eligible resident entities from recognized non-resident entities and should conform to parameters such as minimum maturity, permitted and non-permitted end-uses, maximum all-in-cost ceiling, etc.

ECB is different from FDI. It means foreign funding which is not in the form of equity and when it is used in the form of equity capital, then it is called Foreign Direct Investment (FDI).

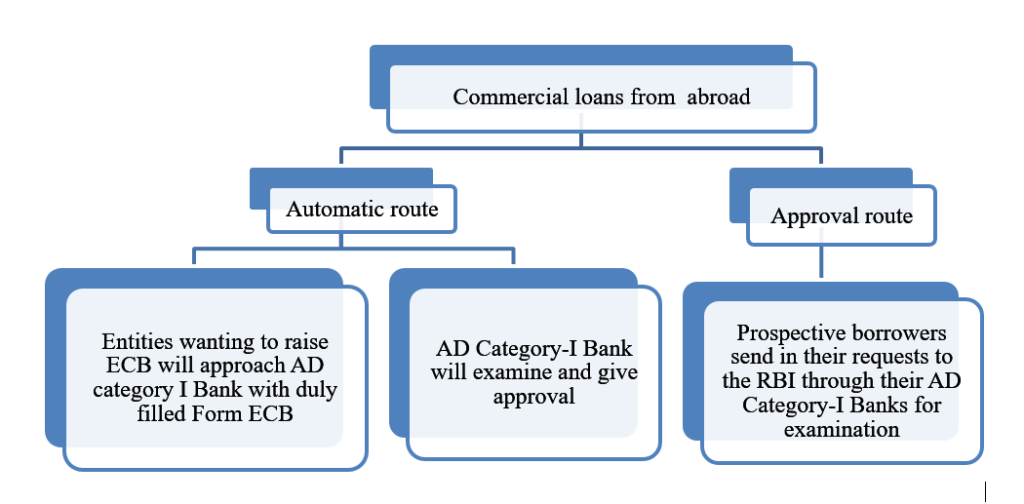

Modes of ECB Resident entities can raise ECB in INR or any freely convertible Foreign Currency from abroad -quantitative, cost and end-use and tenor restriction with minimum maturity of 3 years. ECBs can be raised under automatic route as well as the approval route, under the ECB Framework.

Provisions under Companies Act, 2013

Rule 2 (c) Deposit – does not include any amount received from foreign Governments, foreign or international banks, multilateral financial institutions foreign Governments owned development financial institutions, foreign export credit agencies, foreign collaborators, foreign bodies corporate and foreign citizens, foreign authorities or persons resident outside India subject to the provisions of Foreign Exchange Management Act, 1999 (42 of 1999) and rules and regulations made there under:

- Loan from PRIO

- Loan from members beyond permissible limit under Co. Act

- Loan from Director / Relative of Director

- Export Advance

Different Types of ECB

- Loans including bank loans

- Securitised instruments (such as floating rate notes, fixed-rate notes, bonds, debentures) Other than fully and compulsorily convertible instruments and preference shares in case of INR denominated ECB

- Trade Credits (Buyers Credit/Suppliers Credit) beyond 3 years

- Foreign Currency Convertible Bonds (FCCBs) in case of FCY denominated ECB

- Financial Lease and

- Foreign Currency Exchangeable Bonds (FCEB) in case of FCY denominated ECB.

However, ECB framework is not applicable in respect of the investment in Nonconvertible Debentures (NCDs) in India made by Registered Foreign Portfolio Investors (RFPIs).

Currency of borrowings in case of ECB

ECBs can be raised in Indian National Rupees (INR) or any other freely convertible currency. Any unit raising INR denominated ECB is not permitted to convert the liability of this ECB into liability of foreign currency in any manner or assume foreign currency risk in any way by entering into derivative contract or otherwise.

| FCY denominated ECB | INR denominated ECB | ||||||||||||||||||

Currency of borrowing | Any freely convertible Foreign Currency | Indian Rupee (INR)

| ||||||||||||||||||

Eligible Borrowers | All entities eligible to receive FDI. Further, the following entities are also eligible to raise ECB: i. Port Trusts; ii. Units in SEZ; iii. SIDBI; and iv. EXIM Bank of India. | a) All entities eligible to raise FCY ECB; and b) Registered entities engaged in micro-finance activities, viz., registered Not for Profit companies, registered societies/trusts/ cooperatives, and Non-Government Organizations. | ||||||||||||||||||

Prohibited sectors | The FEMA Rules prescribe certain sectors/ activities in which FDI is totally prohibited, viz., lottery business, gambling, betting, chit funds, real estate business, nidhi company, manufacturing of cigars, etc.

Therefore, an Indian entity that is engaged in the business of prohibited sectors (as per FEMA Rules) is not eligible to raise ECB either under automatic route or approval route. | |||||||||||||||||||

Minimum Average Maturity Period (MAMP)

| MAMP for ECB will be 3 years. Call and put options, if any, shall not be exercisable prior to completion of minimum average maturity. However, for the specific categories mentioned below, the MAMP will be as prescribed therein:

For the categories mentioned at (b) to (e) – (i) ECB cannot be raised from foreign branches / subsidiaries of Indian banks (ii) the prescribed MAMP will have to be strictly complied with under all circumstances. | |||||||||||||||||||

All-in-cost ceiling per annum

| Benchmark Rate plus 550 bps spread: For existing ECBs linked to LIBOR whose benchmarks are changed to ARR.

Benchmark rate plus 500 bps spread: For new ECBs. | Benchmark rate plus 450 bps spread.

| ||||||||||||||||||

Benchmark rate | Benchmark rate in case of FCY ECB/TC refers to any widely accepted interbank rate or ARR of 6-month tenor, applicable to the currency of borrowing. | Benchmark rate in case of Rupee denominated ECB/TC will be prevailing yield of the Government of India securities of corresponding maturity. | ||||||||||||||||||

Who can lend ECB i.e. Eligible Lender?

The lender should be a resident of FATF or IOSCO (International Organization of Securities Commission) compliant country, including on transfer of ECBs. However:

- Multilateral and Regional Financial Institutions where India is a member country will also be considered as recognized lenders;

- Individuals as lenders can only be permitted if they are foreign equity holders or for subscription to bonds/debentures listed abroad; and

- Foreign branches / subsidiaries of Indian banks are permitted as recognized lenders only for FCY ECB (except FCCBs and FCEBs). Foreign branches / subsidiaries of Indian banks, subject to applicable prudential norms, can participate as arrangers/underwriters/market-makers/traders for Rupee denominated Bonds issued overseas. However, underwriting by foreign branches/subsidiaries of Indian banks for issuances by Indian banks will not be allowed.

Foreign Equity holder is a person who owns

- Direct equity stake with minimum 25% by the lender in the borrowing entity,

- Group company with common overseas parent (XYZ Inc holding 51% of ABC Pvt Ltd and 51% of LMN Pte Ltd, hence in this case XYZ Inc is overseas parent and ABC Pvt ltd and LMN Pte Ltd are group companies)

- Indirect equity holder with minimum indirect equity holding of 51%, (LMN Pte Ltd holding 51% in ABC Pvt Ltd and XYZ Inc holding 51% of LMN Pte Ltd that means XYZ Inc holds indirectly in ABC Pvt Ltd)

- Disposal of shareholding not allowed during tenure of the loan

End- Uses i.e. ECB cannot be utilized for the following:

- Real estate activities.

- Investment in capital market.

- Equity investment.

- Working capital purposes, except in case of ECB from foreign equity holder and from others- Minimum Average Maturity Period is more than 10 years.

- General corporate purposes, except in case of ECB from foreign equity holder and from others- Minimum Average Maturity Period is more than 10 years.

- Repayment of Rupee loans, except in case of ECB from foreign equity holder with Minimum Average Maturity Period is more than 5 years, ECB availed for capital expenditure with Minimum Average Maturity Period of 7 years and other than capital expenditure with Minimum Average Maturity Period of 10 years.

- On-lending to entities for the above activities, except in case of ECB raised by NBFCs or working capital purposes or general corporate purposes with Minimum Average Maturity Period is more than 10 years.

The most notable development with regard to the relaxation in policy is that of the new permissibility of ECB usage for working capital, and general corporate purposes with a minimum average maturity period (MAMP) of 10 years.

ECB Limit

All eligible borrowers can raise ECB up to USD 750 million or equivalent per financial year under the automatic route.

Both ECB and equity amounts will be calculated with respect to the foreign equity holder.

In case of FCY denominated ECB raised from direct foreign equity holder ECB liability-equity ratio for ECBs raised under the automatic route cannot exceed 7:1. However, this ratio will not be applicable if the outstanding amount of all ECB, including the proposed one, is up to USD 5 million or its equivalent.

Currency of Borrowing

- Can be raised in any freely convertible foreign currency as well as Indian Rupees.

- Change of one foreign currency to another foreign currency or Indian Rupees is permitted.

- Change of currency of ECB into INR can be at the exchange rate prevailing on the date of the agreement (or less) between the parties concerned for such change.

- Change of INR to FC is not permitted.

No Guarantees

Issuance of guarantee, standby Letter of Credit, letter of undertaking or letter of comfort by banks, Financial Institutions and NBFCs from India relating to ECB is not permitted.

Parking of ECB Proceeds

ECB proceeds meant for Rupee expenditure in India (local sourcing of capital goods, on-lending to Self Help Groups or for micro credit, payment for spectrum allocation, etc.) to be brought to India immediately. It should be credited to Rupee accounts with AD Category I Banks in India. ECB borrowers are also allowed to park ECB proceeds in term deposits with AD Category I banks in India for a maximum period of 12 months cumulatively. These term deposits should be kept in unencumbered position.

ECB proceeds meant for expenditure in Foreign Currency can be retained abroad and till utilization can be parked in (a) deposits or Certificate of Deposit or other products offered by banks rated not less than AA (-) by Standard and Poor/Fitch IBCA or Aa3 by Moody’s; (b) Treasury bills and other monetary instruments of one-year maturity having minimum rating as indicated above and (c) deposits with foreign branches/subsidiaries of Indian banks abroad.

ECB/TC proceeds cannot be used for payment of interest/charges.

Onus of Compliance with ECB guidelines

The primary responsibility for ensuring that the borrowing is in compliance with the applicable ECB guidelines is that of the borrower concerned. Structures which bypass/circumvent ECB guidelines in any manner and/or raising borrowings in any other manner which is not permitted/disguising borrowing under the wrap of other kind of transactions and/or contravening provisions of Foreign Exchange Management (Borrowing and Lending in Foreign Exchange) Regulations, 2018 would also invite penal action under FEMA.

Effect of ECB in the Balance sheet

ECBs will be shown under the head Long term borrowings in the balance sheet. The Companies has to choose ECB mode of funding wisely as this could lead to companies borrowing with abandon and could lead to higher debt on the balance sheet of the company, thereby adversely affecting financial ratios. Since raising funds through External Commercial Borrowing is done in foreign currencies, the principal and the interest shall have to be paid in foreign currencies. As such, the company opens itself up to the risks associated with exchange rates. Hedging costs may have to be incurred by the company, thereby leading the company to incur heavy losses. Thus, the ECB funds must be utilized in an effective manner.

Benefits of ECB:

Lower Interest Rates: Companies tend to avail loans at minimum interest rates, which they wouldn’t have got within the local limits.

Debt–oriented funds: External Commercial Borrowings not necessarily be equity-oriented, i.e. they will not dilute the proprietorship of the present members. This will not give voting powers to the lender & retain the control of the present stakeholders of the company.

Enhance Economy: The Government can manage the funds’ flow more towards a particular sector of the economy which will enhance the economy.

Diverse Investor Base: Easy access to funds through diversified foreign investors.

Fulfilling Larger Necessities: Since the possibility of borrowing is increased by crossing local limits, it aids the companies to fulfil their requirements which might not be achievable within local limits.

Conclusion:

It is clear that due to the relaxation of norms by RBI in minimum average maturity period and end-use restrictions, ECB can be availed as a primary vehicle by eligible borrowers to bring foreign funds in India. Master Directions issued by the Reserve Bank of India, from time to time with relaxed norms have improved the effortlessness of doing business in India. It has helped the eligible Indian organizations to combat their funding needs and this will enable the entity to grow, which will enhance the economy ultimately.

Bibliography:

Foreign Exchange Management (Borrowing and Lending) Regulations, 2018 notified vide Notification No. FEMA.3(R)/2018-RB dated December 17, 2018

RBI/FED/2018-19/67 FED Master Direction No.5/2018-19

Master Direction – External Commercial Borrowings, Trade Credits and Structured Obligations dated June 09, 2022