Amendment to SEBI Alternative Investment Funds (AIF) Regulations, 2012 whereby SEBI mandates AIF to make investments in Demat form and appointment of Custodian for all the Categories.

Securities and Exchange Board of India (SEBI) at its 203rd meeting held on Saturday, November 25, 2023, amended the SEBI (Alternative Investment Funds) Regulations, 2012 to facilitate ease of compliance and strengthen the protection of interest of investors in Alternative Investment Funds.

To facilitate ease of compliance and to strengthen investor protection in Alternative Investment Funds (AIF), the Board approved the following proposals-

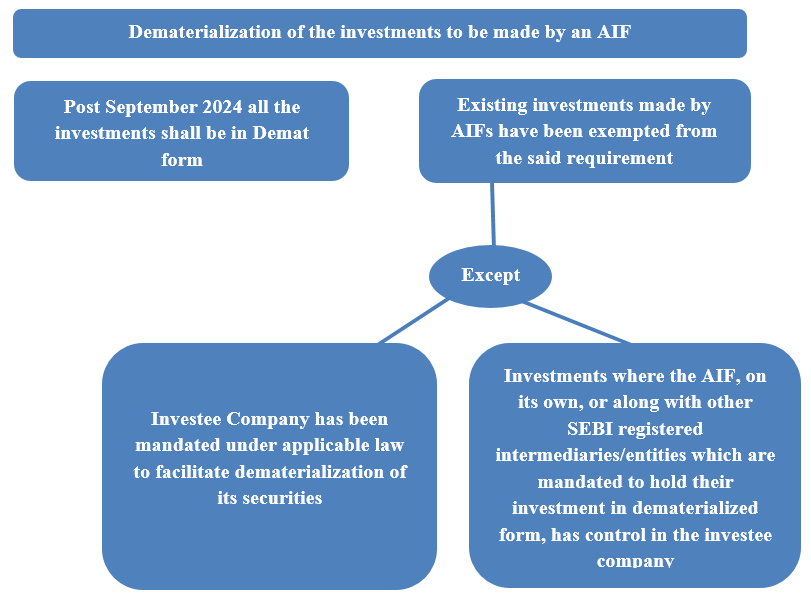

- Dematerialization of the investments to be made by an AIF

- All the fresh investments made by an AIF after September 2024 shall be held in demat form.

- The existing investments made by AIFs have been exempted from the said requirement, except in cases where –

- Investee company has been mandated under applicable law to facilitate the dematerialization of its securities (For instance, Investments made by AIF in a private limited company wherein it has been mandated by the Ministry of Corporate Affairs to private limited companies to issue their securities in demat form); and,

- Investments where the AIF, on its own, or along with other SEBI registered intermediaries/entities which are mandated to hold their investment in dematerialized form, has control in the investee company.

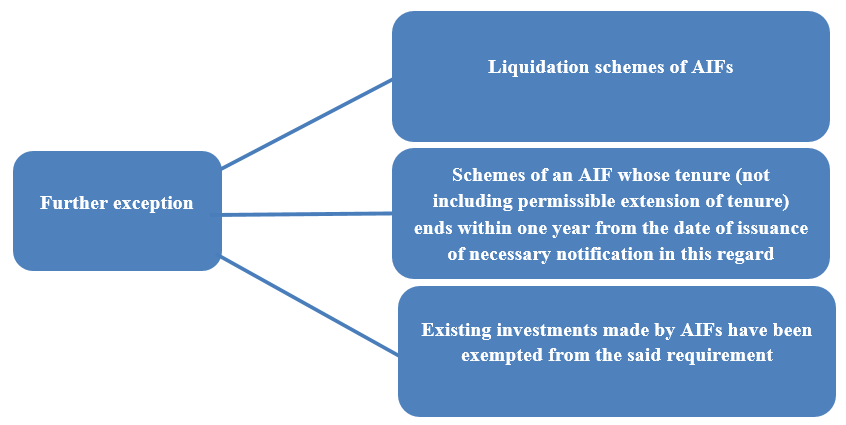

- Further, the said requirement is exempted for investments held by

- Liquidation schemes of AIFs

- Schemes of an AIF whose tenure (not including permissible extension of tenure) ends within one year from the date of issuance of necessary notification in this regard and

- Schemes of an AIF which are in extended tenure as on the date of issuance of the notification.

Impact: Thus, all AIFs to ensure that any fresh investments made post September 2024 shall only be in dematerialized form and AIFs to ensure that the portfolio entities for whom it has been mandated under applicable law to facilitate dematerialization of its securities shall dematerialize the same.

- Mandatory appointment of Custodian

- All Category I and II AIFs shall have to appoint a custodian irrespective whether their corpus is more than INR 500 crore or not.

- AIFs may appoint a custodian who is an associate of manager or sponsor of the AIF, subject to conditions similar to those prescribed under SEBI (Mutual Funds) Regulations, 1996 for permitting related party of sponsor of a Mutual Fund to act as its custodian.

- The Board also noted that the cost of compliance to the schemes coming under the said mandate was an average of approximately Rs.88, 000 per annum for availing custodial services, based on analysis of sample data.

Impact: All Category I & II AIFs irrespective of their size of corpus shall mandatorily appoint a custodian with immediate effect as per the terms provided under the applicable law.

Disclaimer: This article provides general information existing at the time of preparation and we take no responsibility to update it with the subsequent changes in the law. The article is intended as a news update and Affluence Advisory neither assumes nor accepts any responsibility for any loss arising to any person acting or refraining from acting as a result of any material contained in this article. It is recommended that professional advice be taken based on specific facts and circumstances. This article does not substitute the need to refer to the original pronouncement

CLICK HERE DOWNLOAD PDF