Explore the latest GST news and updates in 2024. Stay ahead with our weekly insights into Goods and Service Tax (GST) developments.

FAIRDEAL METALS LIMITED VERSUS ASST. COMMISSIONER OF REVENUE [2024 (2) TMI 240 – CALCUTTA HIGH COURT]

- In this case, department detained the goods transported to the petitioner and levied penalty based on the allegation that the supplier of goods is involved in issuance of fictitious/bogus invoices. Petitioner filed the present writ petition against the Order for detention of goods and subsequent Order levying the penalty.

- Here, the submission of the petitioner was that all the allegations in this case are against the supplier of goods. It was contended that supplier recently took registration under GST. The documents based on which he obtained registration were incomplete. There are certain discrepancies noticed in the GSTR-3B filed by the supplier. Also, the goods transported by supplier were not covered by their GST registration.

- Further, proper officer upon perusal of documents was of the view that the supplier was involved in receiving and passing on fictious/bogus ITC to other parties. Supplier has set up this company solely for the purpose of circulating bogus ITC. Also, the officer contended that the goods appears to be of suspicious origin and the purchase was merely a paper sale to hide the details of original supplier with the intend to evade payment of tax.

- Petitioner categorically submitted that it was not possible for him to find out the background of the supplier. Also, it did not have any mechanism to verify the details of said supplier.

- Petitioner relied upon the judgement of P&H HC in case of M/s. Shiv Enterprises Vs. State of Punjab & Ors, wherein the Court held that the allegation of contravention of provisions of the act was against the supplier and not the petitioner, the impugned notice was liable to be quashed and therefore set-aside.

- Learned advocate representing the respondent submitted that the supplier has been found to be bogus and therefore the goods have been rightly detained. Also, reliance was placed upon the SOP published by Commissioner, CBIC GST Investigation wing, to submit that in cases involving fake invoices, the address of the supplier are often incorrect or incomplete and details provided in registration are also false. He also submitted that there is no proper system in place to verify or scrutinize the data provided at the time of registration, such kind of fraud continues to happen. The supplier in the present case is a dummy company created only for committing fraud.

- HC observed that since the supplier has paid the tax, the allegation that he has evaded tax shall not hold true. Further, High Court held that if the details/documents submitted by supplier for obtaining registration were incomplete, the registration ought not to have been issued. Once the registration is granted and the supplier has paid the tax, the allegations that the supplier is dubious shall not hold true.

- Further, HC also held that the petitioner was no where connected with any of the allegations made against the supplier and therefore, he cannot be made liable to pay the penalty for such allegations. Hence, the Order for detention and subsequent Order for levy of penalty has been set-aside and quashed.

Update on GSTN portal: Notices/Additional Notice & Order tab

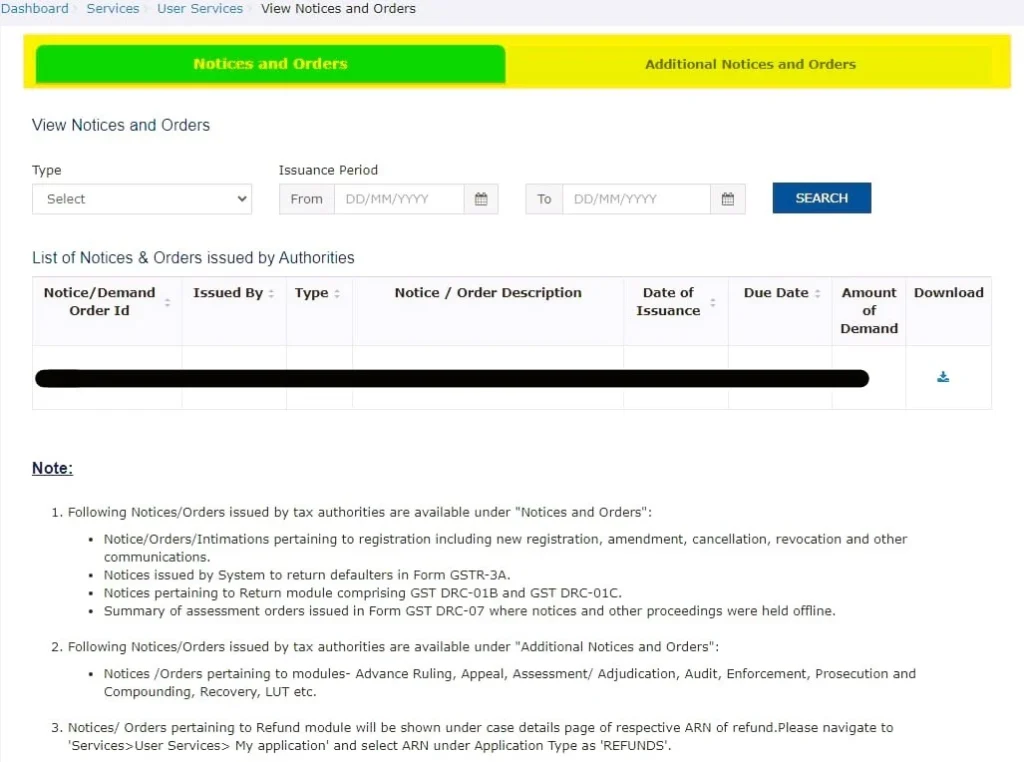

Until now there were two different tabs on GSTN portal under which a taxpayer had to check for Notices & Orders uploaded by authorities i.e. ‘Notices and Orders’ and ‘Additional Notices and Orders’. In ‘Notices and Orders’, notices related to GST registration, default in filing of returns etc. were uploaded. In the later case i.e. Additional Notices and Orders, SCN/Order issued Section 73 or 74, refund related matter etc. were uploaded.

With revamp of ‘Notices and Orders’ tab on the GSTN portal, which has been enabled from today taxpayer would be at great ease while navigating to the Notices/Orders uploaded on GSTN portal. A glimpse of the same is as below:

Kavin Hp Gas Gramin Vitrak Vs The Commissioner Of Commercial Taxes(2023-VIL-896-MAD)

Issue at Hand:

In this case, a petitioner involved in the trade of Petroleum Gases encountered complications regarding the belated claim of Input Tax Credit (ITC) owing to financial constraints. The tax authorities rejected the ITC asserting that the delay in submitting GSTR-3B (tax returns) lacked a valid justification.

The petitioner contended that technical hurdles arose as the prescribed Form GSTR-2, designed for ITC claims, was not officially taken into implementation. The unavailability of the said form incapacitated the petitioner to file the claims electronically. The court acknowledged these challenges and underscored the absence of a functional mechanism for ITC claims.

Ultimately, the court overturned the tax authorities’ decisions, highlighting the unavailability of GSTR-2, which hindered electronic filing. It directed the authorities to permit manual returns and reassess ITC claims. The court emphasized the necessity of adopting a practical approach, particularly in the absence of a well-established system.

The key takeaways from this case include the struggles the petitioner faced in promptly claiming ITC due to technical issues and the non-existence of necessary forms. The court emphasized the significance of addressing practical challenges by allowing manual returns when electronic filing is not viable. The ruling underscores the need for a more accessible system for ITC claims, taking into account the real-world difficulties encountered by businesses.

Suncraft Energy Private Limited and another Vs The Assistant Commissioner, State Tax, Ballygunge Charge & others [2023-VIL-487-CAL]

In the recent judgment pronounced by the Supreme Court in the case of Assistant Commissioner of State Tax, Ballygunje and Others Vs Suncraft Energy Pvt. Ltd. [2023-VIL-99-SC], Apex Court dismissed the SLP filed by the department against the Calcutta High Court judgment. In this case, Calcutta HC passed an Order in favor of the assessed against which the department had gone into appeal before SC. The said decision of HC is discussed below.

Summary of HC judgment:

In this case, the department disputed the ITC claimed by the petitioner on the ground that neither the supplier’s invoices were reflected in GSTR-2A of the Appellant nor the supplier had remitted the tax collected. Petitioner in its support has submitted a copy of tax invoices along with a bank statement substantiating the payment to said vendor. Also, the petitioner submitted that the department has not conducted any inquiry on the supplier particularly when the clarification (Press release dated 18 October 2018) was issued that furnishing of outward supplies in Form GSTR-1 by the supplier and the facility to view the same in Form GSTR 2A by the recipient is in nature of taxpayer facilitation and does not impact the ability of taxpayers to avail ITC on the self-assessment basis in consonance with provisions of Section 16 of CGST Act.

Honorable High Court accepting the contention of the petitioner held that the department without resorting to any action against the supplier has completely ignored the tax invoices and bank statements submitted by the petitioner and therefore this action by the department is arbitrary. Therefore, before directing the petitioner to reverse the ITC and remit the same to the Government, the department ought to have taken action against the supplier. Hence, HC accepted the writ and held that the demand raised on the petitioner in this case is non-sustainable and to be set aside.

Being aggrieved by this Order, the department had filed the SLP before the Apex Court.

Position after the above judgment:

In light of the above judgment, the immediate question that comes to mind is whether the issue pertaining to the reversal of ITC in case of default in payment of tax by vendor is settled.

To answer the above, we need to consider the following positions:

- Amendment in Section 16(2) of CGST i.e. insertion of clause (aa). In light of the same, matching of ITC with GSTR-2B is now compulsory. Therefore, the argument in the above case that GSTR-2A is merely a facilitation may not hold valid for the period post-1 January 2022. Also, for the period post 9 October 2019 onwards, wherein in light of Rule 36(4) matching of ITC with GSTR-2A became a mandatory practice, the said press release dated 18 October 2018 cannot be relied upon.

- Another critical point to ponder upon is that the Apex Court in this case has rejected the SLP filed by the department without getting into the merits. Apex Court held that demand is on the lower side, this court is not inclined to interfere in the matter. Hence, it is plausible that a matter on similar ground is independently evaluated by Apex Court and a divergent view is taken.

- HC in many cases is placing reliance upon the judgment of Apex Court in the case of Ecom Gill Trading Pvt. Ltd. In the said case, Apex Court has highlighted additional details/documents that are required to be produced for substantiating the claim for ITC. The said principle is being now followed in GST with reference to Section 155 of the CGST Act for denying the ITC claim.

Hence, at this stage, it is difficult to conclude that the issue pertaining to the reversal of ITC in the case where the supplier has not remitted the tax to the Government is settled. Therefore, it will be crucial to track the positions which HC may take now in light of the above-referred judgments.

Disclaimer:This article provides general information existing at the time of preparation and we take no responsibility to update it with the subsequent changes in the law. The article is intended as a news update and Affluence Advisory neither assumes nor accepts any responsibility for any loss arising to any person acting or refraining from acting as a result of any material contained in this article. It is recommended that professional advice be taken based on specific facts and circumstances. This article does not substitute the need to refer to the original pronouncement