INTRODUCTION:

Recent developments in corporate law have introduced a range of investment instruments that offer companies diverse mechanisms to raise capital while maintaining managerial control. In the evolving landscape of corporate governance and capital structuring, Differential Voting Rights (DVR) shares serve as an innovative tool to strike a balance between ownership and management. These financial instruments allow Companies- particularly relevant to promoter-led companies and startups, to raise capital while retaining strategic control. DVRs strike a crucial balance between investor participation and promoter autonomy offering flexible equity issuance with varied voting powers while aligning investor interests through compensatory mechanisms such as enhanced dividends.

This comprehensive guide provides a detailed understanding of DVR shares, their legal framework, benefits, conditions and the procedure for their issuance in India.

WHAT ARE SHARES WITH DIFFERENTIAL VOTING RIGHTS (DVRS)?

Shares with Differential Voting Rights (DVRs) are a class of equity shares that carry disproportionate voting power relative to their ownership stake in a company. Unlike ordinary equity shares that typically confer one vote per share, DVRs may offer more or fewer voting rights or even additional economic benefits such as higher dividends, without proportionally increasing the holder’s influence in decision-making processes.

This structure allows a company to customize shareholder rights, enabling a more flexible capital structure. DVRs are particularly valuable to founders or promoters who wish to raise equity capital from external investors while retaining management control.

The concept of Differential Voting Rights (DVRs) was formally introduced into the Indian corporate landscape through an amendment to Section 86 of the Companies Act, 1956. This amendment enabled companies to issue equity shares with differential rights concerning voting, dividends or other attributes. Following this legislative change, two pioneering Indian companies- Tata Motors and Pantaloons Retail India Ltd. became the first Companies to issue DVR shares. These shares carried 1/10th of the voting rights of ordinary equity shares but offered a 5% higher dividend payout, thereby creating a distinct class of shares aimed at attracting investors, focused more on returns than governance influence.

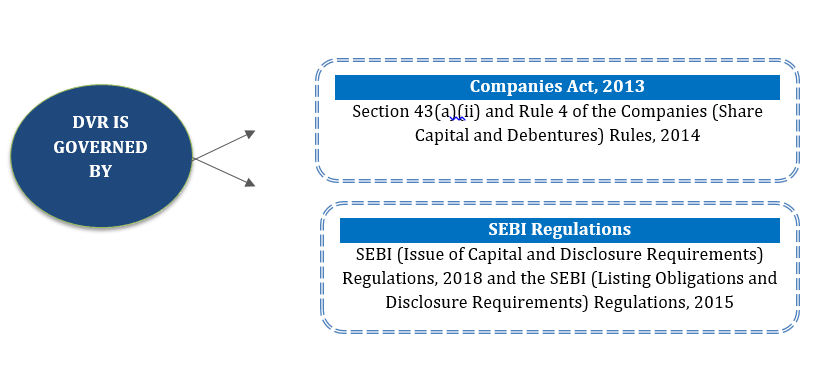

The introduction of Companies Act, 2013 has marked significant changes in the corporate law arena. The Act specifically deals with issue of DVR shares through the provisions under Section 43(a)(ii). Further, Rule 4 of the Companies (Share Capital and Debentures) Rules, 2014, provides for the additional requirements a Company must adhere to before issuing such differential shares.

Pursuant to the recommendations of DVR Group, the Securities and Exchange Board of India (“SEBI”) established a regulatory framework for issuance of shares with Differential Voting Rights in the form of Superior Voting Rights shares (SR shares). This framework is designed to support innovation- driven businesses, particularly in the startup and technology sectors, while maintaining regulatory safeguards.

SEBI categorized this regulatory approach under two primary segments: (i) companies whose equity shares are already listed on recognized stock exchanges, and (ii) companies that are unlisted but intend to go public and offer their equity shares to the public. In line with DVR Group vision this objective can be achieved by (i) issue of shares with superior voting rights to founders (SR Shares) and/or (ii) issue of shares with lower or fractional voting rights to raise funds from private/public investors (FR Shares).

This dual-path framework aims to balance the capital-raising needs of emerging businesses with the principles of good governance, accountability, and shareholder fairness.

TYPES OF DVR SHARES:

- Shares with Lower Voting Rights (but higher dividends)

- Shares with Higher Voting Rights (generally for founders/promoters)

|

COMPARISON BETWEEN ORDINARY SHARES AND SHARES WITH DVR |

||

|

FEATURES |

ORDINARY SHARES |

DVR SHARES |

|

Voting Power |

Ordinary shares, commonly referred to as common shares or equity shares, give their stockholders an equal number of votes. Ordinary shares normally have one vote each, allowing shareholders to participate equally in the decision-making processes of the firm, such as choosing the board of directors or voting on significant corporate decisions. |

Compared to regular shares, DVR Shares often have less voting rights. For instance, in comparison to one ordinary share, one DVR share may give 1/10th or any other predefined proportion of voting rights. To enable some investors, frequently long-term strategic ones, to take part in the company’s growth without significantly influencing its governance, DVR shares were issued. |

|

Dividend |

Ordinary shareholders have a dividend right based on the percentage of their shares that they own. Each common shareholder receives a dividend per share they own if the corporation declares dividends. |

DVR shares typically have the same right to dividends as common shares. This indicates that dividends are paid to DVR shareholders in proportion to their ownership of the company, just like regular shareholders. |

|

Price Difference |

Ordinary shares are issued at face value or at a price based on the dynamics of supply and demand in the market. They stand for the typical equity ownership in the business. |

Due to their lower voting power, DVR shares are typically issued at a discount to ordinary shares. The discount reflects the reduced influence of DVR shareholders have over business decisions when compared to common shareholders. |

|

Liquidity and Trading Volume |

Since ordinary shares are not subject to voting limits and are often viewed as more desirable by a wider range of investors, they are more liquid and actively traded. |

Compared to regular shares, DVR Shares may have less market liquidity and trading activity because of their limited voting rights and probable price discounts. |

|

Conversion Option |

Since ordinary shares already represent the typical stock ownership in the company, they do not have a conversion option. |

Some businesses may provide investors with the option to convert their DVR Shares into regular Shares at a later date or under particular circumstances. |

KEY BENEFITS OF ISSUING SHARES WITH DVR:

Shares with Differential Voting Rights (DVR) are issued to achieve the following objectives and are beneficial due to:

- Retention of Promoter Control: One of the most compelling reasons for issuing DVRs is to retain control. In traditional equity financing, raising capital dilutes the voting power of existing shareholders, particularly promoters. DVRs solve this dilution problem by allowing promoters to:

- Raise capital through lower-vote or no-vote shares

- Retain majority voting rights even with a minority economic stake

- Protect the vision and strategy from external influence or boardroom activism

- Capital Raising without dilution: DVRs provide a means of raising capital while minimizing changes to the company’s corporate governance structure. This is ideal for companies that need substantial investment for expansion or Research & Development purposes and those who wish to avoid giving control to institutional or activist investors.

- Investor Segmentation: Many investors, such as income-focused individuals or institutional investors, prioritize returns over governance involvement. This appeals to investors seeking stable income rather than influence over company decisions, thereby broadening the investor base.

- Defence Against Hostile Takeovers: DVRs help mitigate the risk of hostile takeovers by:

- Concentrating voting power with promoters or founders

- Making it more difficult for external entities to acquire controlling interest through market purchases

- Creating anti-takeover structures without breaching corporate governance norms

- Supporting Startup and Tech Founder Ecosystems: For startups, especially in the technology and innovation sectors, access to capital is crucial. However, founders often need to maintain control to pursue long-term, high-risk strategies. DVRs enable the issuance of Superior Voting Rights (SVRs) to founders and capital infusion from Venture Capitals without relinquishing decision-making authority.

- Corporate Structuring Flexibility: DVRs offer flexibility in a variety of strategic contexts:

- Succession planning in family businesses

- Joint ventures and mergers where voting power needs to be balanced differently than capital contribution

- Debt restructuring or equity swap arrangements

Such structuring ensures that control and ownership can be tailored to specific stakeholder needs. This is especially critical in founder-led or family-owned enterprises that seek long-term leadership continuity.

ELIGIBILITY CRITERIA FOR ISSUING DVR SHARES:

The issue of shares with DVR cannot be made unless the Company limited by shares meets the following conditions:

- Issue of such shares must be authorized by Articles of Association of the Company.

- Issue is authorised by an Ordinary Resolution passed at the general meeting of Shareholders. (In case of Listed Companies, it must be approved by the Shareholders by way of Postal Ballot).

- The voting power of shares with DVR must not exceed 74% of the total voting power including voting power of shares with DVR already issued.

- The Company should not have defaulted in filing financial statements and annual returns for immediately preceding three financial years.

- The company has no outstanding defaults in any of the following:

- Payment of declared dividends to shareholders

- Repayment of matured deposits

- Redemption of preference shares or debentures that are due

- Payment of interest on deposits or debentures or dividends

- The company has not committed any defaults in:

- Payment of dividend on Preference shares

- Repayment of any term loan from a Public financial institution, State level financial institution or scheduled Bank that has become repayable

- Interest payable on such loans

- Statutory dues related to its employees to any relevant authority

- Crediting amount in Investor Education and Protection Fund (IEPF) to the Central government

A company may issue equity shares with DVR only after the expiry of five years from the end of the financial year in which the said default was made good.

- The company has not been penalized by Court or Tribunal during the last three years for any offence under:

- The Reserve Bank of India Act, 1934

- The Securities and Exchange Board of India Act, 1992

- The Securities Contracts Regulation Act, 1956

- The Foreign Exchange Management Act, 1999

- Any other Act by which the Company is governed

- The company cannot convert its existing equity share capital with voting rights into equity share capital carrying differential voting rights and vice–versa.

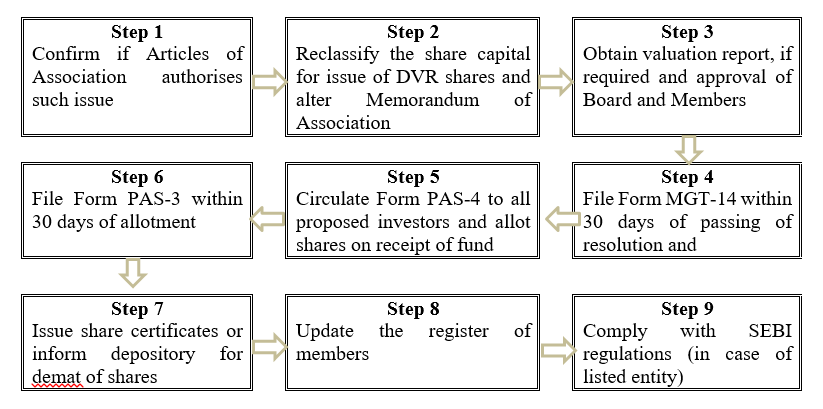

PROCEDURE FOR ISSUING DVR SHARES:

DETAILS OF DVR SHARES TO BE INCLUDED IN BOARD’S REPORT:

When a company issues equity shares with differential voting rights (DVRs), the Board’s Report for that financial year must include the following disclosures, in compliance with applicable rules:

- Total number of DVR shares allotted during the year.

- Specific details of the differential rights, particularly those relating to voting power and dividend entitlements.

- Percentage of DVR shares issued in relation to:

- The total post-issue equity share capital; and

- The voting power such DVR shares carry compared to the total voting rights.

- Issue price of the DVR shares.

- Names and details of promoters, directors or key managerial personnel (KMPs) who were allotted such shares.

- Any change in control or management of the company as a result of the DVR issuance.

- Diluted Earnings Per Share (EPS) for each class of shares, computed as per applicable accounting standards.

- Pre-issue and post-issue shareholding pattern along with corresponding voting rights, disclosed in the prescribed format under Rule 4(2).

PRACTICAL CHALLENGES FACED WHILE ISSUING DVR SHARES:

Issuing Differential Voting Rights (DVR) shares, though strategically beneficial, presents a series of practical and regulatory challenges for companies. In the case of Anand Pershad Jaiswal v. Jagatjit Industries Ltd, the Company Law Board (CLB) upheld the issuance of DVR shares by Jagatjit Industries, where the promoter’s voting rights were disproportionately higher than their economic stake. The CLB ruled that the issuance was in accordance with Section 86 of the Companies Act, 1956, and the Companies (Issue of Share Capital and Differential Voting Rights) Rules, 2001. This judgment highlighted the legal permissibility of DVRs but also raised concerns about potential misuse to entrench promoter control.

- The foremost challenge faced while issuing DVR Shares is regulatory compliance. Both the Companies Act, 2013 and SEBI regulations impose stringent conditions that must be met before a company can issue DVRs. These include requirements such as a clean record of dividend payments, no defaults on loans or statutory dues, and consistent profitability. Additionally, issuers are mandated to provide comprehensive disclosures regarding the structure, voting rights, and financial impact of DVR shares, increasing the compliance burden significantly.

- Another major hurdle is market acceptance and investor perception. In India, DVRs are still relatively new and not widely embraced by the investor community. Shares with limited or fractional voting rights often trade at a discount compared to ordinary equity shares, which may hinder the company’s capital-raising objectives. Institutional investors, who typically value governance rights, often shy away from DVRs due to reduced voting power, thereby limiting the potential investor base and affecting market depth and valuation.

- Corporate governance concerns also play a significant role in discouraging DVR issuance. Minority shareholders and proxy advisory firms may view DVRs as tools to entrench promoter control, raising the risk of reputational damage or investor activism. For listed companies, maintaining transparency and shareholder confidence becomes even more challenging when differential rights are introduced. Additionally, SEBI places restrictions on the listing and conversion of Superior Voting Rights (SR) shares, affecting liquidity and strategic flexibility for promoters or founders.

- Lastly, DVR structures can introduce operational complexities in shareholding management, voting processes, and accounting treatment. Multiple share classes require careful handling during corporate actions such as dividends, mergers, or buybacks, which can strain administrative and legal functions. These practical challenges mean that while DVRs are powerful tools for capital structuring, they must be deployed with careful legal planning, governance safeguards, and strategic clarity.

CONCLUSION:

Shares with Differential Voting Rights (DVRs) offer a unique and flexible solution for companies looking to raise capital while maintaining control, particularly for founders and family-run businesses. It represents a dynamic evolution in corporate finance and governance, offering a strategic solution for companies by allowing certain shareholders to have more or fewer voting rights than others. DVRs provide a way to balance the need for external investment with the desire to keep strategic decision-making in the hands of those who built the company.

The legal framework set out by the Companies Act, 2013 and SEBI regulations makes it possible for companies to issue these shares in a controlled manner, ensuring transparency and fairness. While DVRs unlock several advantages such as control retention, investor segmentation, and protection against hostile takeovers, their deployment must be navigated with a deep understanding of the regulatory landscape and potential pitfalls. Challenges relating to compliance, investor perception and governance transparency underscore the need for robust planning, transparent disclosures and ongoing discussions with stakeholders. Additionally, the market has not fully embraced DVR shares, and companies may face difficulties in getting widespread acceptance from institutional investors.

Despite these hurdles, in a corporate ecosystem like India’s, the thoughtful and judicious use of DVRs can serve as a catalyst for entrepreneurial growth without compromising governance standards. However, to truly realize their potential, it is essential for companies to build trust through responsible structuring and for regulators to continue fostering an enabling yet accountable environment. As the Indian capital markets evolve, DVRs when used ethically and strategically can offer a flexible yet resilient path for sustainable corporate development.

Disclaimer: This article provides general information existing at the time of preparation and we take no responsibility to update it with the subsequent changes in the law. The article is intended as a news update and Affluence Advisory neither assumes nor accepts any responsibility for any loss arising to any person acting or refraining from acting as a result of any material contained in this article. It is recommended that professional advice be taken based on specific facts and circumstances. This article does not substitute the need to refer to the original pronouncement.

CLICK HERE DOWNLOAD PDF