India’s regulators are recognising that appropriate measures in relation to related party transactions are crucial for good governance, and are improving safeguards and disclosures pertaining to them. Significant corporate frauds have happened connected to RPTs or similar arrangements, such as the Satyam scandal, Enron fiasco and WorldCom debacle, to name a few.

In India, RPTs assume even more significance due to the nature of Indian business houses, which are primarily promoter-led and consist of family business structures. If you consider the complexities involved in identifying the related party transactions and conflict of interest issues, certainly, digitization will come to the rescue of Company Secretaries.

The regulators has imposed restrictions for related party transactions for empowering protection to the minority shareholders’ interests through requirement of the approval of the shareholders through a resolution for all material related party transactions, wherein all the related party of the company refrain from voting.

*We will share note on RPT Transaction covering Income Tax Act provisions and Accounting Standards in Series 2.

Definition of Related Party:

|

As per Companies Act [Section 2(76)] |

As per SEBI LODR [Regulation 2 (zb)] |

|

(i) a director or his relative; (ii) a key managerial personnel or his relative; (iii) a firm, in which a director, manager or his relative is a partner; (iv) a private company in which a director or manager or his relative is a member or director; (v) a public company in which a director or manager is a director (vi) any body corporate whose Board of Directors, managing director or manager is accustomed to act in accordance with the advice, directions or instructions of a director or manager; (vii) any person on whose advice, directions or instructions a director or manager is accustomed to act: Provided that nothing in sub-clauses (vi) and (vii) shall apply to the advice, directions or instructions given in a professional capacity; (viii) any body corporate which is— (A) a holding, subsidiary or an associate company of such company; (B) a subsidiary of a holding company to which it is also a subsidiary; or (C) an investing company or the venturer of a company (means a body corporate whose investment in the company would result in the company becoming an associate company of the body corporate); |

“Related party” as (i)related parties defined under section 2(76) of the Companies Act, 2013 or (ii) under the applicable accounting standards. (iii) LODR Regulation further deems any person or entity belonging to the promoter or promoter group of the listed entity and (iv) holding 20% or more of the shareholding of the listed entity, to be a related party. |

Definition of Related Party transactions (RPT):

|

As per Companies Act [Section 2(76)] |

As per SEBI LODR [Regulation 2 (zc) |

|

(a) sale, purchase or supply of any goods or materials; (b) selling or otherwise disposing of, or buying, property of any kind; (c) leasing of property of any kind; (d) availing or rendering of any services; (e) appointment of any agent for purchase or sale of goods, materials, services or property; (f) such related party’s appointment to any office or place of profit in the company, its subsidiary company or associate company; and (g) underwriting the subscription of any securities or derivatives thereof, of the company: |

RPT as any transfer of resources, services or obligations between a listed entity and a related party regardless of whether a price is charged or not and a “transaction” with a related party shall be construed to include a single transaction or a group of transactions |

All Companies are required to comply with Section 188 of the Companies Act, 2013 (the Act) which specifically deals with Related Party Transactions including Section 166 (Duties of Directors), 173 (Meetings of Board), 177 (Audit Committee), and 184 (Disclosure of Interest by Directors).

The 2013 Act puts significant emphasis on:

- Self-regulation with disclosures/ transparency instead of ‘Government Approval’ based regime

- e-Governance and Corporate Governance measures – Accounting and reporting considerations &

- Stricter enforcement to investigate, adjudicate and penalize.

Section 188 is applicable to both private as well as public companies and is applicable with effect from 01.04.2014

The provisions of Sec 188 will not be applicable in case of transactions entered into by the company in its ordinary course of business, which are on arm’s length basis.

*“Arm’s length transaction” means a transaction between two related parties that is conducted as if they were unrelated, so that there is no conflict of interest.

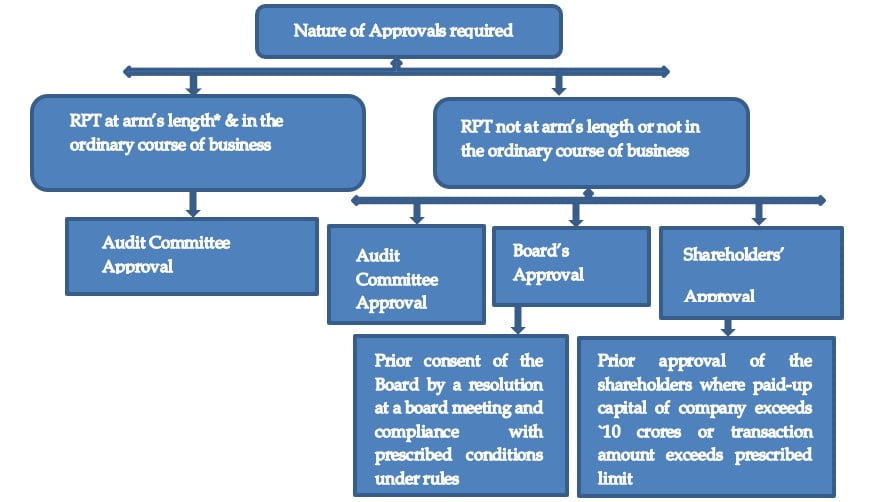

Provisions in respect of RPT’s where a company cannot enter into any contract or arrangement with a related party except with the prior approval of Board or Shareholders as the case may be with respect to following transactions:

|

Related Party Transactions u/s 188 which requires prior approval of the Board of Directors |

Limits of Transactions exceeding which approval from the shareholders is required |

|

Sale, purchase, or supply of any goods or material, directly or through the appointment of any agent* |

10% or more of the turnover of the Company |

|

Selling or otherwise disposing of or buying property of any kind, directly or through the appointment of agent* |

10% or more of the Net Worth of the Company |

|

Leasing of property of any kind* |

10% or more of the turnover of the Company |

|

Availing or rendering of any services, directly or through the appointment of agent* |

10% or more of the turnover of the Company |

|

Such related party’s appointment to any office or place of profit in the Company, its subsidiary or associate Company |

at a monthly remuneration exceeding Rs. 2,50,000/- |

|

Underwriting the subscription of any securities or derivatives thereof, of the company |

1% of the net worth of the Company |

- All the above limits are to be taken on all transactions done on a financial year basis and the turnover or net worth shall be taken on the basis of the Audited Financial Statement of the preceding financial year;

- Related Party to abstain from voting on such special resolution approving any contract or arrangement which may be entered into by the company in which he is an interested party thereto;

- In case of WOS, Special resolution passed by the Holding Company is sufficient.

Companies may for convenience take omnibus approval for certain RPT’s from the Audit Committee:

For taking such omnibus approval, there are Specified Criteria that the Audit Committee shall consider and satisfy itself before giving such approval as follows:

a) Maximum value of transactions, in aggregate, which can be allowed under the omnibus route in a year;

b) Maximum value per transaction which can be allowed;

c) Extent and manner of disclosures to be made to the audit committee at the time of seeking omnibus approval;

d) Review of related party transactions entered into by the company pursuant to each of the omnibus approval. The intervals at which such review is to be done can be decided by the audit committee;

e) Transactions which cannot be entered into subject to omnibus approval by the audit committee.

and that such Omnibus approval shall be applicable in respect of transactions which are repetitive in nature;

f) The audit committee shall satisfy itself regarding the need for such omnibus approval and that such approval is in the interest of the Company;

g) the omnibus approval shall specify: The name(s) of the related party, Nature of transaction, Period of transaction, Maximum amount of transactions that shall be entered into, The indicative base price / current contracted price and The formula for variation in the price if any; and Such other conditions as the audit committee may deems fit.

Note: Approval of Omnibus transaction without fulfilling the above criteria: Where the need for related party transaction cannot be foreseen and required details are not available, audit committee may grant omnibus approval for such transactions subject to their value not exceeding Rupees One Crore per Transaction.

Duty of Audit Committee:

The audit committee shall review (at such interval as the Audit Committee may deem fit) the details of RPT’s entered into by the Company pursuant to each of the omnibus approvals given.

Terms of Omnibus Approval: Omnibus approvals shall be valid for a period not exceeding one year and shall require fresh approvals after the expiry of one year.

Note: Omnibus approval shall not be made for transactions in respect of selling or disposing of the undertaking of the Company.

Disclosures Requirements:

- The Notice of Board Meeting proposing such RPT shall disclose all the information in respect to such transaction. Also, disclosures to be made in the explanatory statement to be annexed to notice of general meeting.

- The interested director or member who is in any way, whether directly or indirectly, concerned or interested in a contract or arrangement or proposed contract or arrangement entered into or to be entered into shall disclose such interest in the Board or General meeting as the case may be.

- Company to make disclosure of such RPT’s as applicable in Form AOC-2 to be annexed to the Board’s Report.

- Company to maintain records of such RPT’s in Register of Contracts or arrangements in which directors are interested.

Listed Companies to comply with Regulation 23 of SEBI (LODR) Regulation, 2015:

|

Regulation 23(1) |

Formulate a policy on materiality of related party transactions and on dealing with related party transactions including clear threshold limits duly approved by the BOD and such policy shall be reviewed by the BOD at least once every 3 years and updated accordingly |

Provided that, -> PT’s will be considered material if the transactions to be entered into individually or collectively during a financial year exceeds 1000 crores or 10 percent of the annual consolidated turnover of the listed entity as per the last audited financial statements of the listed entity |

|

Regulation 23(1A) |

where a transaction involves payments made to a related party with respect to brand usage or royalty shall be considered material if the transaction(s) to be entered into individually or taken together with previous transactions during a financial year, exceeds 5 percent of the annual consolidated turnover of the listed entity as per the last audited financial statements of the listed entity |

|

|

Regulation 23(2) |

All RPT’s & subsequent modifications shall require prior approval of the Audit Committee of the listed entity |

Provided that, -> Such approval must be from independent directors who are members of such Audit Committee of the listed Entity & i. Such material modification must be defined and disclose it as part of policy on materiality of RPT’s & on dealing with RPT’s ii. where RPT to which subsidiary of listed entity is party but listed entity is not a party, it shall require prior approval of Audit Committee of listed entity if value of such transaction exceeds 10% of Annual consolidated turnover, as per last audited FS of listed entity iii. W.e.f, 1st April, 2023 where RPT to which subsidiary of listed entity is party but listed entity is not a party, it shall require prior approval of Audit Committee of listed entity if value of such transaction exceeds 10% of Annual standalone turnover, as per last audited FS of subsidiary Co. iv. prior approval of Audit Committee of listed entity shall not be required where RPT to which listed subsidiary is a party but listed entity is not a party, if reg 23 and 15(2) are applicable to such listed subsidiary. |

|

Regulation 23 (3) |

Audit Committee may grant omnibus approval for RPT’s proposed to be entered into by the listed entity subject to the following conditions: a)It shall lay down criteria for granting the omnibus approval in line with the policy on RPT of the listed entity and such approval shall be applicable in respect of transactions which are repetitive in nature; b) It shall satisfy itself regarding the need for such omnibus approval and that such approval is in the interest of the listed entity; c) It shall specify the name of related party, nature, period and maximum amount of transactions entered, indicative base price / current contracted price and the formula for variation in the price if any & such other conditions as the audit committee may deem fit d) the audit committee shall review, atleast on a quarterly basis the details of RPT’s entered into by listed entity pursuant to each of the omnibus approvals given. e) Such omnibus approvals shall be valid for a period not exceeding 1 year and shall require fresh approvals after the expiry of 1 year. |

Provided that, ->where the need for RPT cannot be foreseen and aforesaid details are not available, audit committee may grant omnibus approval for such transactions subject to their value not exceeding rupees 1 crore per transaction. |

|

Regulation 23(4) |

All material RPT’s and subsequent modifications as defined by Audit Committee under sub-regulation (2), shall require prior approval of the shareholders through resolution & no related party shall vote irrespective that the entity is a related party to the particular transaction or not |

->Provided that, prior approval of the shareholders of a listed entity shall not be required for a RPT to which the listed subsidiary is a party but the listed entity is not a party, if regulation 23 and 15 (2) of these regulations are applicable to such listed subsidiary. * For RPT’s of unlisted subsidiaries of a listed subsidiary as referred above, the prior approval of the shareholders of the listed subsidiary shall suffice ->Provided further that the requirements specified under this sub-regulation shall not apply in respect of a resolution plan approved under section 31 of the Insolvency Code, subject to the event being disclosed to the recognized stock exchanges within one day of the resolution plan being approved. |

|

Regulation 23(5) |

The provisions of sub-regulations (2), (3) and (4) shall not be applicable in the following cases:

(a) transactions entered into between two government companies;

(b) transactions entered into between a holding company and its WOS whose accounts are consolidated with such holding company and placed before the shareholders at the general meeting for approval.

(c) transactions entered into between two WOS of the listed holding company, whose accounts are consolidated with such holding company and placed before the shareholders at the general meeting for approval |

|

|

Regulation 23(6) |

The provisions of this regulation shall be applicable to all prospective transactions |

|

|

Regulation 23(7) |

For the purpose of this regulation, all entities falling under the definition of related parties shall not vote to approve the relevant transaction irrespective of whether the entity is a party to the particular transaction or not. |

|

|

Regulation 23(8) |

All existing material related party contracts or arrangements entered into prior to the date of notification of these regulations and which may continue beyond such date shall be placed for approval of the shareholders in the first General Meeting subsequent to notification of these regulations. |

|

|

Regulation 23(9) |

The listed entity shall submit to the stock exchanges disclosures of related party transactions in the format as specified by the Board from time to time, and publish the same on its website: |

->Provided that a ‘high value debt listed entity’ shall submit such disclosures along with its standalone financial results for the half year; ->Provided further that the listed entity shall make such disclosures every 6 months within 15 days from the date of publication of its standalone and consolidated financial results; ->Provided further that the listed entity shall make such disclosures every 6 months on the date of publication of its standalone and consolidated financial results w.ef, April 1, 2023. |

SEBI has provided clarifications vide its notification dated 9th November, 2021 pertaining to Related Party and RPT’s.

Where Company has approved the RPT by Audit Committee and Shareholders prior to 1st April, 2022, it will not be required to obtain fresh approval from the Shareholders. But where such approval continues beyond such date and becomes material as per revised materiality threshold then it shall be placed for approval at the first General Meeting to be held after 1st April, 2022

Disclosure:

- Details of all material Related Party Transactions to be disclosed quarterly along with the compliance report on corporate governance

- Policy on dealing with Related Party Transactions to be disclosed on the Company’s website and Annual Report

Working Group (WG) Recommendations on RPT:

With an aim to review and strengthen the regulatory norms pertaining to RPTs, undertaken by listed entities in India, SEBI constituted a Working Group in November 2019 comprising members from the Primary Market Advisory Committee (PMAC), including persons from the Industry, Intermediaries, Proxy Advisors, Stock Exchanges, Lawyers, Professional bodies, etc.

The proposed Recommendations of WG is as follows:

1. Definition of Related Party widened:

All persons or entities belonging to the ‘promoter’ or ‘promoter group’ irrespective of their shareholding in the listed entity, should be deemed to be related parties;

|

Current Provision in the LODR

|

Proposed Changes |

|

2(zb) “related party” means a related party as defined under sub-section (76) of section 2 of the Companies Act, 2013 or under the applicable accounting standards: Provided that any person or entity belonging to the promoter or promoter group of the listed entity and holding 20% or more of shareholding in the listed entity shall be deemed to be a related party. Provided further that this definition shall not be applicable for the units issued by mutual funds which are listed on a recognised stock exchange(s) |

2(zb) “related party” means a related party as defined under sub-section (76) of section 2 of the Companies Act, 2013 or under the applicable accounting standards: Provided that: (i)any person or entity belonging to the promoter or promoter group of the listed entity (ii)any person or any entity, directly or indirectly (including with their relatives),holding 20% or more of the equity shareholding in the listed entity, shall be deemed to be a related party. Provided further that this definition shall not be applicable for the units issued by mutual funds which are listed on a recognised stock exchange(s) |

|

Current Provision in the LODR

|

Proposed Changes |

|

2(zb) “related party” means a related party as defined under sub-section (76) of section 2 of the Companies Act, 2013 or under the applicable accounting standards: Provided that any person or entity belonging to the promoter or promoter group of the listed entity and holding 20% or more of shareholding in the listed entity shall be deemed to be a related party. Provided further that this definition shall not be applicable for the units issued by mutual funds which are listed on a recognised stock exchange(s) |

2(zb) “related party” means a related party as defined under sub-section (76) of section 2 of the Companies Act, 2013 or under the applicable accounting standards: Provided that: (i)any person or entity belonging to the promoter or promoter group of the listed entity (ii)any person or any entity, directly or indirectly (including with their relatives),holding 20% or more of the equity shareholding in the listed entity, shall be deemed to be a related party. Provided further that this definition shall not be applicable for the units issued by mutual funds which are listed on a recognised stock exchange(s) |

2. Definition of RPTs covers combination of transactions:

|

RPT Means transaction between: |

Date on which it becomes effective |

|

a. Listed Entity and Related party of listed entity; b. Subsidiary and Related party of listed entity; c. Listed Entity and Related party of Subsidiary & d. Subsidiary and Related party of Subsidiary |

W.e.f, 01st April, 2022 |

|

a to d; e. Listed entity and any other person/entity, purpose and effect of which is to benefit a RP of the listed entity/subsidiary & f. Subsidiary and any other person/entity, purpose and effect of which is to benefit a RP of the listed entity/subsidiary |

W.e.f, 01st April, 2023 |

WG recommends broadening definition of RPT’s to include transactions which are undertaken, whether directly or indirectly, with the intention of benefitting related parties & excluding certain corporate actions which, by their very nature treat all shareholders equally, such as payment of dividend, sub-division or consolidation of securities, buy-back, rights and bonus issue of securities. Further, corporate actions which are subject to procedures specifically laid down by SEBI in its other regulations, such as preferential allotment, should also fall outside the purview of RPTs.

3. Prior approval of shareholders for Material RPTs:

The WG had recommended quite stringent threshold for determination of a Material RPT:

Material RPT = transaction(s) to be entered into individually or taken together with previous transactions during a financial year, exceeds:

Rs.1,000 crore; or

5% of the annual total revenues on a consolidated basis; or

5% of total assets on a consolidated basis;

5% of net worth on a consolidated basis;

as per the last audited financial statements of the listed entity, whichever is lower.

However, SEBI has approved a comparatively simpler criteria i.e. Rs. 1000 crore or 10% of annual consolidated turnover of the listed entity, whichever is lower.

4. More RPTs will be subject to review by Audit Committee (AC):

Significant RPTs by subsidiaries undertaken with a related party other than the listed entity itself, will require prior approval of AC of the parent entity.

Significant RPT= Transactions Value whereof (whether entered into individually or taken together with previous transactions during a financial year) exceeds:

- 10% of consolidated turnover of the listed entity;

- 10% of the standalone turnover of the subsidiary (w.e.f, April 1, 2023).

Quantum of information to be placed before AC in terms of Schedule II has been increased multifold.

Further, all RPTs and subsequent material modifications, as defined by AC will require prior approval of AC.

5. Enhanced disclosure before AC for prior approval for RPTs:

As per the WG report, following enhanced disclosures were proposed:

a. Type, material terms, particulars of RPT, name of related party and relationship;

b. Tenure of proposed RPT – cannot be indefinite or open ended;

c. Value of proposed RPT – with upper limit and aggregate value and time period (in case of recurring or continuous transaction);

d. Value of proposed RPT vis-à-vis percentage of the listed entity’s annual total revenue, total assets and net worth, on consolidated basis;

e. Value of proposed RPT vis-à-vis percentage of the subsidiary’s annual total revenue on standalone basis;

In case of financial transactions, following to be disclosed:

a. disclosure of source of funds in connection with the proposed RPT;

b. nature of indebtedness, cost of funds, tenure;

c. applicable terms and purpose for which the funds will be utilized by the ultimate beneficiary

d. Justification how the RPT is in the interest of the listed entity;

e. Copy of Valuation report or other external report relied upon;

f. Percentage of counterparty’s annual total revenues, total assets and net worth, that is represented by the value of the proposed RPT (voluntary).

g. Status of long-term (more than one year) or recurring related party transactions on an annual basis.

One will have to ascertain the actual disclosures approved by SEBI once the amendment notification is issued.

6. Disclosure of RPTs under Reg. 23 (9):

Presently, the timeline is as under:

For equity listed entities: within 30 days from the date of publication of date of publication of its standalone and consolidated financial results for the half-year;

For HVDLE: along with the standalone financial results for the half-year (on ‘comply or explain’ basis till March 31, 2023).

SEBI has approved stricter timeline

W.e.f, April 1, 2022: Within 15 days from the date of publication of standalone/ consolidated financial results for the half-year.

W.e.f, April 1, 2023: Simultaneously along with the financials.

7. Reasoned disclosure in the explanatory statement:

As per WG Report following additional information will be required to be furnished in the explanatory statement annexed to notice being sent seeking approval for any proposed material RPT.

=> Summary of the information provided by the management of listed entity to the AC;

=> Recommendations of AC justifying how the RPT is in the interest of the listed entity and whether the approval of AC was unanimous;

=> In case of Financial transactions, following to be disclosed:

- Disclosure of source of funds in connection with the proposed RPT;

- Nature of indebtedness, cost of funds, tenure;

- Applicable terms and purpose for which the funds will be utilized by the ultimate beneficiary;

- Valuation report or external report, if any, relied upon by the listed entity (available at registered office for inspection);

- % of counterparty’s annual total revenues, total assets and net worth, that is represented by the value of the proposed RPT (voluntary)

Consequences for Non-Compliance:

|

As per Companies Act, 2013 |

As per SEBI LODR, 2015 |

|

Company may proceed against a director / employee, who had entered into contract or arrangement in contravention of the provisions, for recovery of any loss sustained by it as a result of such contract or arrangement. • Such a director shall be disqualified for a period of 5 years. • In case of a listed company, such director / employee may be punishable with imprisonment for a term up to 1 year and/or with fine of `25,000 – `5,00,000. • In case of any other company, such director / employee may be punishable with fine of `25,000 – `5,00,000.

|

Non-compliance with disclosure of related party transactions on consolidated basis. ₹ 5,000 per day.

|