The Ministry of Corporate Affairs has notified an amendment in the Companies (Specification of Definitions Details) Rules, 2014 that come into force from 15th September, 2022. The Amendment has been introduced to provide ease of doing business and to reduce the burden of compliance from a large number of companies as the definition has been widened to cover more companies.

According to the recent amendment, a Small Company means a Private Company which satisfies the following two conditions:

|

Paid-up share Capital |

Turnover |

|

Which does not exceed INR 4 Crores |

Which does not exceed INR 40 Crores |

However, nothing in the above clause shall apply to:

- A Holding Company or Subsidiary Company;

- A Company registered under Section 8;

- A Company or Body Corporate registered under any Special Act;

The amendments to the definition of a Small Company have always been to increase the limit of the paid-up share capital and turnover so that more and more companies can be covered within the definition and thereby avail of the benefits of a Small Company.

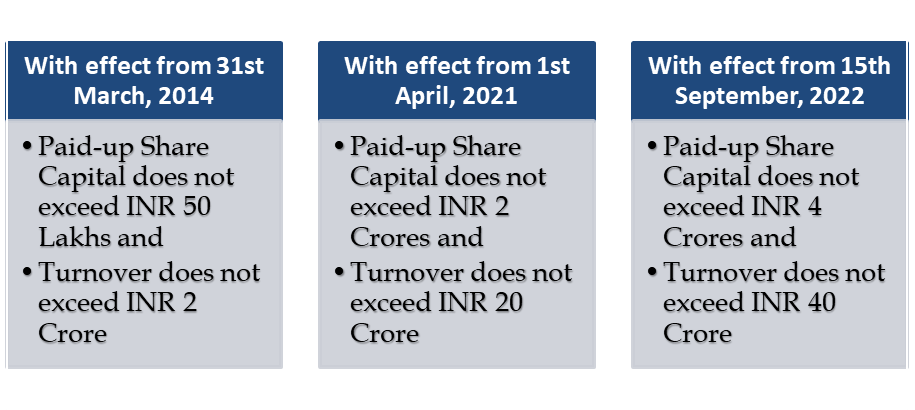

Let’s analyze various amendments to the threshold in the past few years:

Some privileges and exemptions are offered by law to companies holding the status of a ‘small company’. They enjoy various relaxations or advantages over other companies, some of which are as follows:

|

Section |

Nature of privilege granted |

|

Section 2(40) |

Cash flow statement: The financial statements of a small company need not include a cash flow statement. |

|

Section 92(1) |

The signing of annual return: The annual return of a small company needs to be signed by the company secretary, or where there is no company secretary, by the company’s director. However, it need not be signed by a company secretary in practice. |

|

Section 134 (3)(A) and Rule 8 of Companies (Accounts) Rules, 2014 |

Matters in Board’s report: For the purpose of compliance with Section 134(3)(A), the Board’s report of a small company shall be prepared in an abridged form as prescribed by the Central Government. Small companies are exempted from the matters to be included in the Board’s report as per Rule 8 of Companies (Accounts) Rules, 2014. |

|

Section 173(5) |

The number of board meetings: Unlike other companies that need to hold four Board Meetings in a calendar year, a small company is needed to hold at least one meeting of the Board of Directors in each half of a calendar year and the gap between the two Board meetings must not be less than ninety days. |

|

CARO, 2020 |

CARO: The reporting requirements laid down under the Companies (Auditor’s Report) Order, 2020 for matters to be included in an auditor’s report do not apply to a small company. |

|

Section 143(3) |

Auditor’s report: The auditor’s report in the case of a small company is not required to indicate whether there are adequate internal financial controls in place (with reference to financial statements) and the operating effectiveness of such controls. |

|

Section 139(2) |

Rotation of auditors: Every company needs to mandatorily change its auditor by rotation in pursuance of Section 139(2) of the Companies Act 2013. However, a small company need not comply with this section and hence is exempt from meeting the requirements of this section. |

|

Section 446B |

Lesser penalties: If a penalty is payable by a small company for non-compliance with any of the provisions of the Companies Act, then such company and its officer in default shall be liable to a penalty not more than one-half of the penalty specified in such provisions. But this is subject to a maximum of Rs. 2 lakh in the case of a company and Rs. 1 lakh in the case of an officer who is in default or any other person, as the case may be. |

|

Section 25 |

Fast Track Merger Process : The merger process between small companies is less cumbersome and less expensive and hence, on a fast track basis as compared to the other one.

|

Conclusion:

As most of the sections and provisions of the Companies Act are drafted from the perspective of a larger organization, it has become a burden for small companies both financially as well as operationally to comply with various provisions of the Act. Hence, through the latest amendment, the Government has widened the bracket so that most Companies may worry less about compliances and concentrate more on their core business activity.

Disclaimer: This article has been carefully prepared, but it has been written in general terms and should be seen as broad guidance only. This article cannot be relied upon to cover the specific situation and you should not act, or refrain from acting, upon the information contained therein without obtaining specific professional advice. Please contact Affluence Advisory Private Limited to discuss these matters in the context of your circumstances. Affluence Advisory Private Limited, Its Partners, Directors, Employees, and agents do not accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information in this article or for any decision based on it.