This edition of September 2024 GST Newsletter, covers important government notifications, compliance deadlines, and other essential updates that businesses should be aware of. This roundup will help you stay informed and meet your compliance requirements. Let’s understand the key highlights from this past month!

SECTION A News & Updates :

- Introduction of RCM Liability/ ITC statement

A statement called RCM liability/ ITC statement has been introduced on GST portal. The same has been introduced with a motive of enhanced accuracy and transparency by capturing the RCM liability figures depicted in Table 3.1(d) of GSTR-3B and corresponding ITC claimed in Table 4A(2) and 4A(3) of GSTR-3B.

The said statement is applicable from August 2024 for monthly return filers and from July to September 2024 quarter for quarterly return filers.

Reporting of RCM ITC balances:

|

Particulars |

To report negative or positive value |

|

Excess RCM liability paid in GSTR 3B however ITC has not been availed |

The said positive value of ITC to be reported as ‘Opening balance’ |

|

Excess RCM ITC availed in GSTR 3B however corresponding tax has not been paid |

Negative value of ITC is to be reported as Opening balance |

|

Reclaimed RCM ITC which was reversed in earlier tax period in table 4(B)(2) of Form GSTR3B |

The said ITC can be reclaimed by reporting in Table 4A(5) of GSTR-3B. Since the same cannot be claimed through Table 4(A)2 and Table 4(A)3, it shall not form part of this statement. |

Steps for reporting the RCM ITC balances:

The taxpayers can report the opening balance in the statement by following below navigation:

Login >> Report RCM ITC Opening Balance or Services >> Ledger >> RCM Liability/ITC Statement >> Report RCM ITC Opening Balance. The timeline to declare the opening balance on portal is 30 October 2024. Further, taxpayer will be provided 3 opportunities to rectify any error in reporting the opening balance till 30 November 2024.

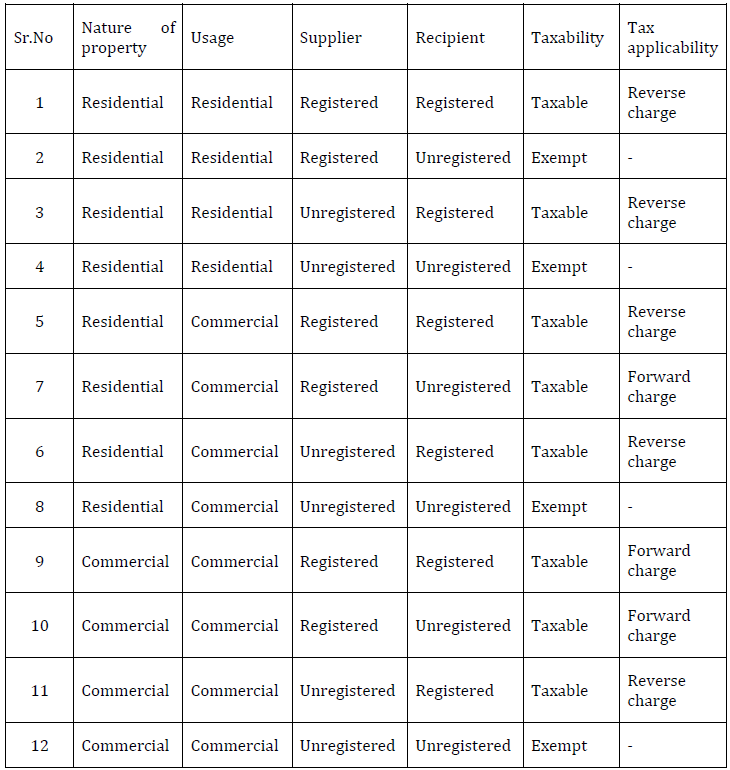

- Summary of RCM applicability on renting of commercial and residential property

In the recently held 54th GST Council meeting, it recommended to bring renting of commercial property by unregistered person to a registered person under RCM. In light of the same, we have summarized the taxability in case of renting of residential or commercial property as below:

- Notification No.17/2024 dated 27 September 2024

In light of Notification No. 17/2024- Central Tax dated 27 September 2024, CBIC has notified the date from which the provisions of Finance (No. 2) Act, 2024 shall be effective. A gist of key provisions of Finance Act and the corresponding provisions in CGST Act along with the effective date is summarized as below:

SECTION B – Case Laws (GST)

M/S PEPSICO INDIA HOLDINGS PRIVATE LIMITED VERSUS UNION OF INDIA [2024(9) TMI 160 – PATNA HIGH COURT]

The captioned petition is filed on the ground that the impugned SCN issued is illegal since the same is not in compliance with provisions of GST Act.

Petitioner made a reference to Section 61 of CGST Act read with Rule 99 of Bihar GST Rules, stating that Section 61, speaks of scrutiny of returns after which there is an obligation to inform the assessee about any discrepancy noticed, and call for the assessee’s explanation. Sub-section (2) provides for the dropping of the proceeding if the explanation offered is accepted. In case no satisfactory explanation is furnished, then appropriate action could be taken under Sections 65 to 67 or Section 73 or 74. Rule 99 of the Bihar GST Rules, 2017 mandates that when a return furnished by the registered person is selected for scrutiny, the Proper Officer should issue a notice to the said person in Form GST ASMT-10 under the provisions of Section 61 with reference to the information available with the Proper Officer and details of discrepancy noticed.

HC made an observation upon perusal of Annexure to SCN, that a communication was sent to petitioner to clarify on the discrepancy noticed. While the same did not contain the heading as ASMT-10, from the language it appears to be identical to Form ASMT-10. In communication sent to petitioner, it was pointed out that there is a discrepancy insofar as the ITC declared in the annual return not having been reconciled with the financial statement (Table 14T of Form 9C). To said observation, petitioner filed a reply stating that the reporting of details in Table 14T of Form GSTR-9C was optional and the unreconciled ITC appearing in Column T is an auto-populated figure. HC with respect to said response stated that if the petitioner was aware of the fact that the figure appearing in Table 14T is optional, then it is incumbent upon him to provide an explanation for the same rather than taking a contention that Table 14 was optional.

In light of the above, HC held that there is no reason to entertain the writ petition on the grounds of illegality of SCN. A communication was issued seeking an explanation for the discrepancy, to which the petitioner filed a response and the same was found to be unsatisfactory. Since SCN has already been issued, petitioner is entitled to appear and raise the objections. Writ petition has been dismissed.

M/S. ATULYA MINERALS VERSUS COMMISSIONER OF STATE TAX, CUTTAK AND ANOTHER [2024(8) TMI 1381 – ORISSA HIGH COURT]

In this case, the petitioner has filed the writ petition for seeking to quash the Order passed by the Deputy Commissioner of State tax blocking ITC in terms of Rule 86A of Orissa GST Rules.

Petitioner argued that the impugned Order cannot sustain in eyes of law since the officer has no jurisdiction to pass such Order. In order to support this argument, petitioner relied upon circular dated 02/11/2021 wherein the CBIC has issued guidelines for disallowing debit of electronic credit ledger under Rule 86A of CGST Rules. The said circular also prescribes the threshold limit for blocking the ITC qua the officer.

HC held that the captioned argument of petitioner shall not sustain since the circular referred above has not been accepted by State Government. The circular dated 02/11/2021 is only applicable to Central authorities. Therefore, the captioned Order passed by Deputy Commissioner State tax blocking the ITC is within the power granted under Rule 86A(1) of OGST Rules.

M/S. SHIVOY ENTERPRISES VERSUS COMMISSIONER OF CGST, DELHI NORTH AND ORS. [2024 (7) TMI 1296 – DELHI HIGH COURT]

The captioned case deals with cancellation of registration based on the allegation that upon verification of principal place of business, the petitioner found to be non-existent. Petitioner filed an application for revocation of GST registration on the ground that petitioner was operating from the additional place of business as reflecting in GST registration, however the same was not inspected.

Honourable HC held that the petitioner cannot be denied registration solely on the ground that it failed to rectify the address of principal place of business as the records clearly reflect the place of business from where petitioner carries on its business being the additional place of business as reflecting in its GST registration certificate.

SECTION B Case Laws (SERVICE TAX)

SHAH FOODS LIMITED VERSUS C.C.E. & S.T.-AHMEDABAD-III [2024 (8) TMI 1405 – CESTAT AHMEDABAD]

The facts of the case is that while the appellant was liable to pay service tax under reverse charge but the same was discharged by service provider. Tribunal held that it is a settled position that once the service provider discharged the service tax where the service recipient was liable to pay the service tax, demand of service tax on the same service from the service recipient shall not sustain. The rationale behind the same is that the particular service which already suffered the service tax cannot be suffer the service tax twice on the same service.

SHRI TAKHAT RAJ SAHU AND M/S KRN ALLOYS PVT.LTD. VERSUS COMMISSIONER OF CENTRAL EXCISE & CGST – JODHPUR [2024(8) TMI 1275 –CESTAT NEW DELHI]

This case deals with passing of fraudulent CENVAT Credit on the basis of fake invoices without actual supply of goods. In an investigation initiated by Anti evasion department against the supplier, it was alleged that the supplier has not received the goods from its supplier and therefore the question of supplying the same to appellant does not arise.

Tribunal noted that the department has failed to bring on record any worthwhile evidence indicating non-supply of goods by the supplier to the appellant. However, appellant has provided various evidence such as details of transporter including their receipts, invoice, proof of payments, proof of receipt of goods in their premises, and their output indicating that goods were actually received. Further, department did not provide an opportunity to cross examine the statements recorded. The stand of department in upholding the second link in the chain of evidence is purely based on presumptions and assumptions i.e. supply of goods by supplier to the appellant. Therefore, there is no reason to doubt the documentary evidence indicating receipt of goods from supplier. Hence, department has failed to establish a case against the appellant making them eligible for credit.

Disclaimer: This newsletter provides general information prevailing at the time of preparation, and we take no responsibility to update it with the subsequent changes in the law. The information provided hereinabove is intended as a news update, and Affluence Advisory neither assumes nor accepts any responsibility for any loss arising to any person acting or refraining from acting as a result of any material contained in this newsletter. It is recommended that professional advice be taken based on specific facts and circumstances. This newsletter does not substitute the need to refer to the original pronouncement.

CLICK HERE GST UPDATES NEWSLETTER– SEPTEMBER 2024

CLICK HERE Monthly Statutory Compliance Calendar for F.Y. 2024-25