Ministry of Corporate Affairs has vide notification dated 27th October 2023 inserted rules to amend the Limited Liability Partnership Rules, 2009 which will be called the LLP (Third Amendment) Rules , 2023.

In the Limited Liability Partnership Rules, 2009, after rule 22, the following rules shall be inserted, namely:

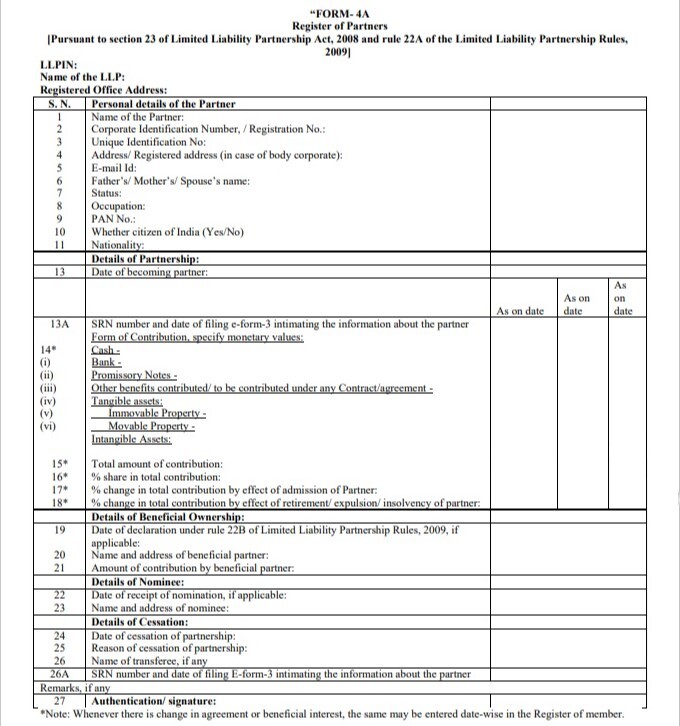

“22A. Register of Partners

(1) Every limited liability partnership shall, from the date of its incorporation, maintain a Register of its partners in Form 4A which shall be kept at the registered office of the Limited Liability Partnership:

APPLICABILITY FOR EXISTING LLP

Every LLP existing on the date of commencement of the said rules is required to maintain the Register of Partners in Form 4A within 30 days of commencement of the amendment rules.

APPLICABILITY FOR NEWLY INCORPORATED LLP

As per the newly inserted provision, Rule 22A, if a Limited Liability Partnership (LLP) is incorporated subsequent to the date on which the amendment rules came into effect, it is required to maintain a register of its partners in Form 4A, from the date of its incorporation.

The register of partners shall contain the following particulars, in respect of each partner, namely.

- name of the partner; address (registered office address in case the member is a body corporate); e-mail address; Permanent Account Number or Corporate Identification Number; Unique Identification Number, if any; father or Mother or spouse’s name; occupation; status; Nationality; name and address of nominee;

- Date of becoming the partner;

- Date of cessation;

- amount and nature of contribution (indicating tangible, intangible, movable, immovable or other benefit to the Limited Liability Partnership, including money, promissory notes, other agreements to contribute cash or property, and contracts for services performed or to be performed) with monetary value; and

- Any other interest, if any,

REPORTING OF CHANGE IN ENTRIES MADE IN THE REGISTERS

- Any changes to the amount of the contribution, the names and contact information of the partners in the LLP agreement, or the termination of the partnership interest must be reported by registering the change in the Register within seven days of the said change taking effect.

- If the LLP makes any corrections to the register kept under this rule in response to an order issued by the appropriate authority under any law, the relevant register must include a written justification for the correction along with the necessary reference to the order.

22B. Declaration in respect of a beneficial interest in any contribution

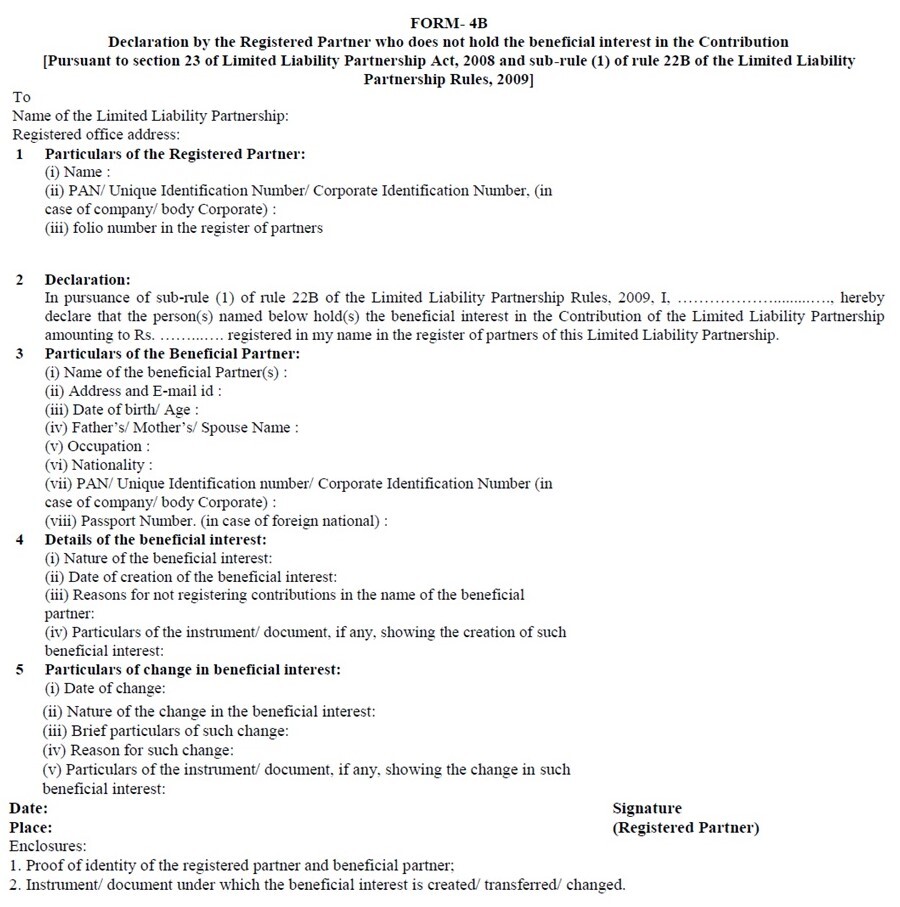

- A person whose name appears in a Limited Liability Partnership’s register of partners but who does not, in whole or in part, hold any beneficial interest in any contribution (henceforth referred to as “the registered partner”) must, within thirty days of the date on which his name appears in the register of partners, file with the LLP a declaration to that effect in Form 4B, which must include the name and other details of the person who actually holds any beneficial interest in such contributions:

With the caveat that if the beneficial interest in such contribution changes, the registered partner must notify the LLP in Form 4B of the change within thirty days from the date of such change came into effect.

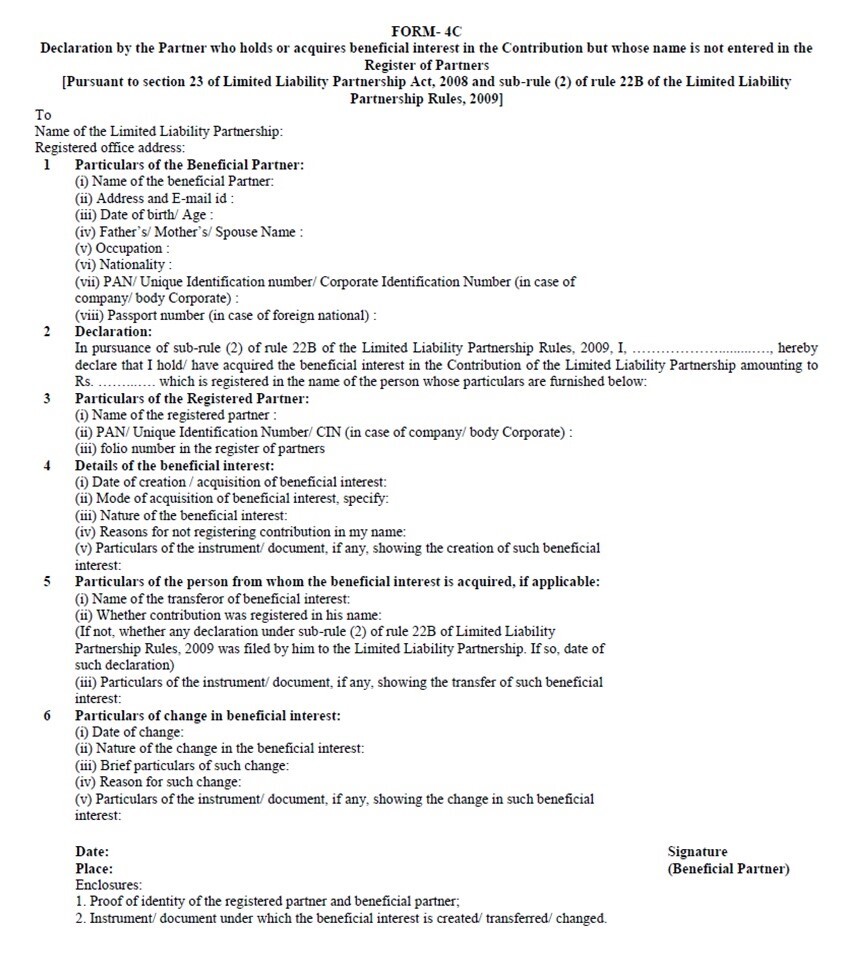

- Upon acquiring a beneficial interest in the contribution of a LLP, an individual whose name is not listed in the register of partners (henceforth referred to as “the beneficial partner”) must file a declaration of such interest in Form 4C with the LLP within thirty days of doing so. The form must specify the nature of the individual’s interest and the partner’s details in whose name the contribution is registered in the limited liability partnership’s books.

With the caveat that if the beneficial interest in such contribution changes, the registered partner must notify the LLP in Form 4C of the change within thirty days from the date of such change came into effect.

With the additional caveat, a registered partner will not be obliged to file such a declaration if his beneficial interest in a contribution is restricted to the amount listed against his name in the partners’ register and he does not hold a beneficial interest in a contribution against any other registered partner.

- Any declaration received by the LLP under sub-rule (1) or sub-rule (2) must be recorded in the register of partners, and the LLP must file a Form 4D return to the Registrar along with any applicable fees within thirty days of receiving the declaration.

- Each LLP must name a designated partner who will be in charge of providing information about the beneficial interest in contributions made by the Partnership to the Registrar or any other officer authorized by the Central Government, as well as extending cooperation in doing so. The designated partner’s details must be filed in Form 4 with the Registrar.

With the caveat that each designated partner will be considered accountable for providing information about a beneficial interest in contribution under this sub-rule and for cooperating in doing so until a designated partner is named under sub-rule (4).

The recent rule 22A and 22B as per LLP (Third Amendment) Rules, 2023 introduced by MCA would assist LLPs in maintaining clarity and transparency in their compliance with the law. The primary benefit of this rule is that all the information will be provided at once, saving time, and any modifications to the information will be recorded in a single register.

Disclaimer: This article provides general information existing at the time of preparation and we take no responsibility to update it with the subsequent changes in the law. The article is intended as a news update and Affluence Advisory neither assumes nor accepts any responsibility for any loss arising to any person acting or refraining from acting as a result of any material contained in this article. It is recommended that professional advice be taken based on specific facts and circumstances. This article does not substitute the need to refer to the original pronouncement

CLICK HERE DOWNLOAD PDF