The microfinance segment in India has proved to be fundamental for promoting financial inclusion by extending credit to low-income groups that are traditionally not catered to by lending institutions. The essential features of microfinance loans are that they are of small amounts, with short tenures, extended without collateral and the frequency of loan repayments is greater than that for traditional commercial loans.

These loans are generally taken for income-generating activities, although they are also provided for consumption, housing and other purposes. There exist various market players in the microfinance industry viz. scheduled commercial banks, small finance banks, co-operative banks, various NBFCs extending microfinance loans, and NBFCs-MFIs.

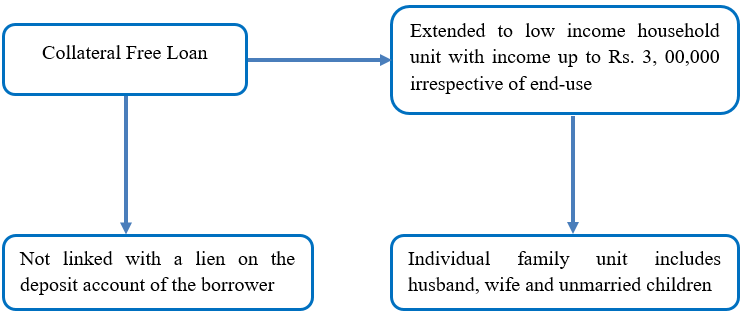

As per the RBI Master Direction – Reserve Bank of India (Regulatory Framework for Microfinance Loans) Directions, 2022, a microfinance loan is defined as follows:

A “NBFC-MFI” means a non-deposit taking NBFC which has a minimum of 75 percent of its total assets deployed towards “microfinance loans”.

Registration norms for Microfinance

A Micro finance company can be registered in two ways:

- As a Non-Banking Finance Companies (NBFC) duly registered with RBI

- As a Section 8 companies (companies formed under Section 8 of the Companies Act 2013)

There are certain pre-requisites that are to be fulfilled in order to register as a microfinance company:

| Pre-requisites | NBFC | Section 8 Company |

| Approval of RBI | Mandatory | Not Required |

| Net owned | Minimum 5 cores | No minimum requirement |

| Director experience | One director must have experience of more than 10 years in financial services | No prior experience required |

| Limit on loans | Maximum of 10% of total assets | Unsecured loan of Rs. 50,000 to small business loan up to Rs. 1.25 lakh to dwelling residence |

| Complexity of Microfinance Company Registration | All processes involved in forming a company have to be performed. | Relatively simple as it is registered as a non-profit organization |

| Adhering to Compliances | It has to adhere to all compliances of an NBFC. | Adhere to compliance of RBI, but they are less stringent in comparison to NBFC |

| No of members | For a private limited company minimum of 2 For a public limited company minimum of 7 | Minimum of 2 members |

| Status of organization | Profit organization | Non-profitable organization |

Registration Process of a Microfinance company as an NBFC

As both the models of microfinance companies are different from each other, the registration process is also considerably different. The following are the steps involved in the registration of a microfinance company through an NBFC:

The provisions of Master Direction—Reserve Bank of India (Non-Banking Financial Company—Scale Based Regulation) Directions, 2023, shall apply to NBFC-MFI.

- Net Owned Fund (NOF) Requirement

The following glide path is provided for the existing NBFC-MFIs to achieve the NOF requirement of Rs. 10 crore:

| NBFCs | Current NOF | By March 31, 2025 | By March 31, 2027 |

| NBFC-MFI | Rs. 5 crore (Rs. 2 crore in NE Region) | Rs. 7 crore (Rs. 5 crore in NE Region) | Rs. 10 Crore |

- Principal Business Criteria:

A company will be treated as an NBFC, if its financial assets are more than 50 per cent of its total assets (netted off by intangible assets) and income from financial assets is more than 50 per cent of its gross income. Both these tests are required to be satisfied as the determinant factor for determining principal business of a company.

- Register a company:

The first step in registering as a Non – Banking Financial Microfinance Company is to form a private or public company. A private company requires at least 2 members and a capital of Rs. 10 Crore. A public company requires at least 7 members.

- Deposit the capital:

Upon the collection of capital, the next step is to deposit the capital in a bank as a fixed deposit and obtain a ‘No lien’ certificate for the same.

- Apply for license:

Finally, the NBFC must fill out an online application for the license and submit it along with all the certified documents. A hard copy of the application and license must also be submitted at the regional office of the Reserve Bank of India. The documents that must be available with the NBFC at the time of filing are:

- Memorandum of Association and Articles of Association

- Incorporation certificate of the company

- Board resolution copy

- Copy of Auditor’s report of receipt of fixed deposit receipt

- Banker’s Certificate of No Lien stating the net owned fund

- Banker’s report about the company

- Recent credit report of the directors

- Net worth certificate of the directors

- Education/professional qualification proof of the director

- KYC and income proof of the director

- Proof of work experience in the financial sector

- Structure plan of the organization

Registration Process of a Microfinance company as a Section 8 company

The following are the steps involved in the registration of a microfinance company as a Section 8 company:

- Application for Reserving the Name of a Company through Company Incorporation SPICE Forms – Select the Form – RUN/Spice Plus

- Incorporating a company through Simplified Proforma for Incorporating Company electronically (SPICe -INC-32), with eMoA (INC-33), eAOA (INC-34), is the default option and most companies are required to be incorporated through SPICe only.

The primary basic documents required for registering a company under both the models are:

- Obtaining a Digital Signature Certificate (DSC) for all Directors and individual shareholders.

- Director Identification Number (DIN): If unavailable, the same can be applied at the time of incorporation.

- PAN Card copy of all directors/promoters

- Documents for identity proof

- Documents for address proof

- Photograph of all directors/promoters

- Proof of ownership of registered office or rental agreement for the same

- NOC from the owner

- Applicable stamp duty as mandated by the state

- Any other documents as required

Also Read: Section 186 of the Companies Act, 2013: Compliance for Loans and Investments by Companies

Compliances as per NBFC-MFI regulations

Every microfinance company is required to comply with a set of requirements. The same has been provided below:

- Board approved policy

- Flexibility on repayment periodicity

- Indicative methodology for assessment of household income

- Limit on the outflows on account of repayment of monthly loan obligations of a household as a percentage of the Monthly Household Income (MHI) which shall be maximum 50% of the MHI

- Pricing of microfinance loans covering the following:

- Interest rate model for an all-inclusive interest rate

- Delineation of interest rate such as cost of funds, risk premium, margin etc.

- Range of spread of each component

- A ceiling on interest rate

- Conduct of employees and system for their recruitment, training and monitoring

- Minimum qualifications for staff

- Submission of information to CICs

- Ensure compliance with the level of indebtedness

- Ascertainment of the above also from other sources such as bank account of borrower, bank account statements and local enquiries

- Fair Practice Code

- Displayed on the website of the Company

- Due Diligence Process

- Process for engagement of recovery agents

- Up-to-date details of recovery agent to be hosted on the website of the company

- Mechanism

- Identification of borrowers facing repayment related difficulties

- Engagement with borrowers and providing necessary guidance

- Redressal of recovery related grievances

Conclusion

While both the routes have their own advantages and disadvantages, however, registering a microfinance company as a section 8 company is simpler as it does not require RBI approval, is easy to operate and requires less compliances.

Disclaimer: This article provides general information existing at the time of preparation and we take no responsibility to update it with the subsequent changes in the law. The article is intended as a news update and Affluence Advisory neither assumes nor accepts any responsibility for any loss arising to any person acting or refraining from acting as a result of any material contained in this article. It is recommended that professional advice be taken based on specific facts and circumstances. This article does not substitute the need to refer to the original pronouncement

CLICK HERE DOWNLOAD PDF