Ministry of Corporate Affairs “MCA” has vide its notification dated 29th August, 2022 amended the Companies (Acceptance of Deposits) Rules, 2014 and introduced the new Web-based form DPT-3 under section 73 of Companies Act, 2013.

On the introduction of the Web based Forms by MCA, the digitization reforms are boosted. The web-based Forms has also helped to widen the scope of information in the form of reporting by the stakeholders.

The object was to institute a transparent and technology driven in house mechanism and simultaneously creating a database online for easy identification and verification of information submitted by stakeholders.

The Revised Format of the Web version has undergone the following changes:

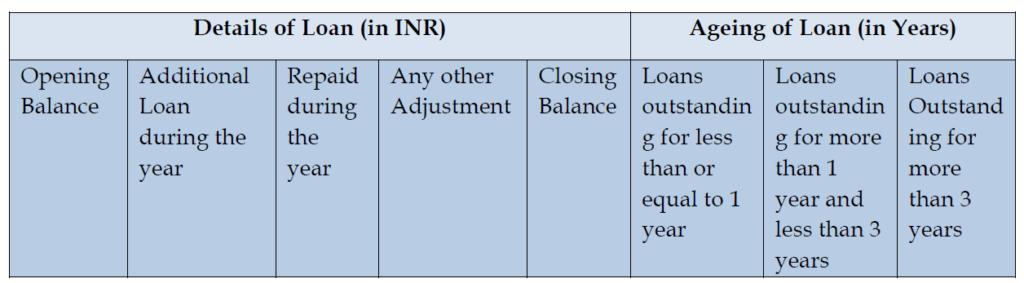

- In case of reporting of details of exempted deposits outstanding at the year-end was the only information to be disclosed earlier, however now onwards details w.r.t opening balance along with additions, repayments, adjustments made during the year and closing balance with timeline disclosing the tenure since when the loan has been outstanding.

- The above-mentioned detailed requirement is probably made for greater transparency. Revised format is as follows:

- Details relating to particulars of charge has been changed, earlier Date of entering trust deed, Name of the trustee, short particulars of the property on which change is created for securing depositors and Value of the property was asked. Now Number of Charges and SRN of CHG-1/CHG-9 filed for creation of charge is to be disclosed, if charge is created on such deposits.

- The attachments are changed from only Auditor’s certificate (if applicable) to Copy of trust deed and List of depositors (excel format).

- It also allows to specify SRN of GNL form in which DPT-1 is filed and total amounts of outstanding money or loan received by a company but not considered as deposits in terms of rule 2(1)(c) of the Companies (Acceptance of Deposits) Rules, 2014 as specified in rule 16(A)(3)

- Declaration by Statutory Auditor has been made compulsory which was not the case earlier.

Conclusion:

The Stakeholders are now required to ensure that the Financials are audited within the stipulated timeframe so that the disclosure made w.r.t outstanding deposits including exempted deposits in Web Form DPT-3 by 30th June every year in an accurate and appropriate manner so that the true essence of this form is maintained with enhanced transparency.