1. Are newly listed entities listed through Initial Public Offer (IPO) required to submit their financial results immediately after being listed on the stock exchange?

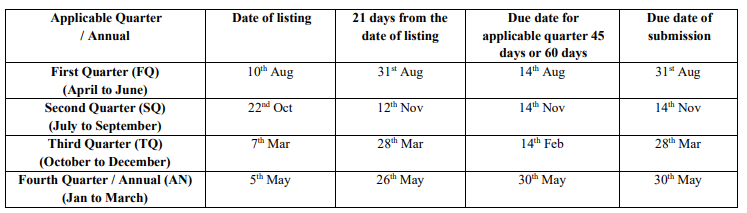

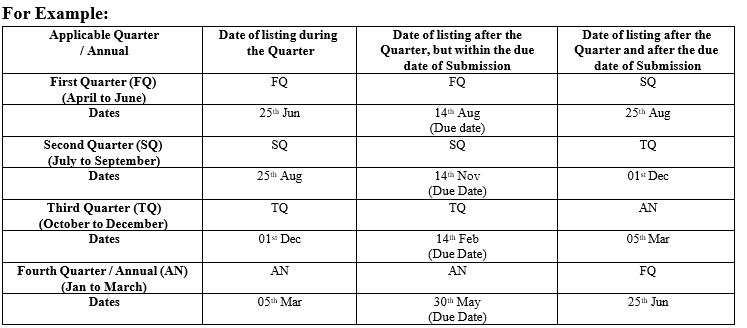

Ans. Yes, as per Regulation 33 (3)(j) the listed entity shall, subsequent to the listing through initial public offer, submit its financial results for the quarter or the financial year immediately succeeding the period for which the financial statements have been disclosed in the offer document, in accordance with the timeline specified in clause (a) or clause (d) of Regulation 33(3), as the case may be, or within 21 days from the date of its listing, whichever is later.

For Example:

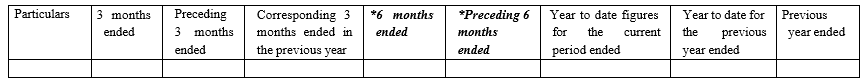

2. Are SME companies who may be submitting quarterly financial results on voluntary basis also required to provide half yearly figures in their financial results submission?

Ans. Yes, while SME companies may voluntarily opt to submit quarterly financial results, half yearly figures are mandatorily required to be provided according to the timelines mentioned in Regulation 33 of SEBI (LODR) Regulations, 2015.

For Example:

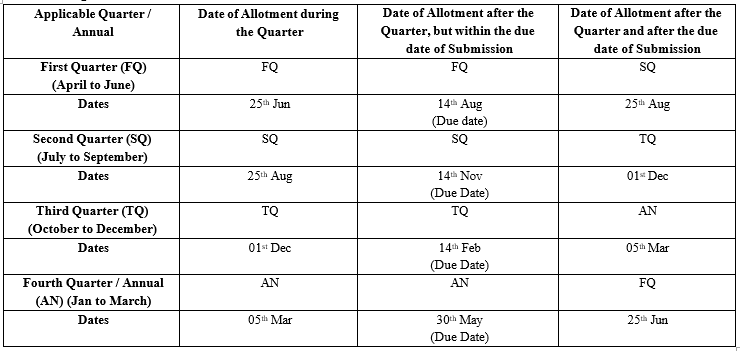

3. Are SME companies whose post issue paid up capital is likely to increase beyond ₹25 crores, required to submit quarterly financial results as per the proviso to Regulation 280 of SEBI (ICDR) Regulations, 2018?

Ans. Yes, the SME companies shall ensure submission of quarterly financial results within the timelines specified under the clause (a) or (d) of Regulation 33(3) of SEBI (LODR) Regulations, 2015 if the date of allotment when their paid-up capital would increase beyond ₹25 crores, is after the end of quarter but on/before due date for submission of said financial results.

If the date of allotment for approval of post-issue paid-up capital beyond 25 crores, is prior to the due date of submission as mentioned in Regulation 33 of SEBI (LODR) Regulations, 2015 for the period as may be applicable, then the SME company is required to submit the financial results for that period.

For Example:

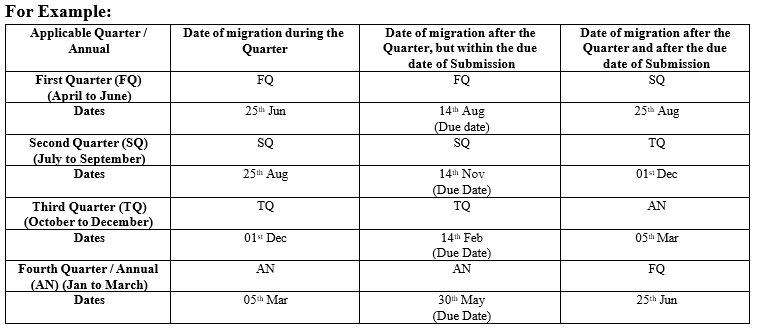

4. Are listed entities migrating from SME Board to Main Board of any Exchange required to submit quarterly financial results?

Ans. Yes, the listed entities shall ensure submission of financial results in accordance with Regulation 33 and within the timelines as specified under the clause (a) or (d) of Regulation 33(3) of SEBI (LODR) Regulations, 2015, if migrated after the end of the quarter but on/before due date for submission of said financial results.

If the date of migration is prior to the due date of submission as mentioned in Regulation 33 of SEBI (LODR) Regulations, 2015 for the period as may be applicable, then the SME company is required to submit the financial results for that period.

5. Are entities getting listed through a Scheme of Arrangement on the Main Board or SME Board required to submit financial results?

Ans. Yes, the listed entities shall ensure submission of financial results in accordance with Regulation 33 and within the timelines as specified under the clause (a) or (d) of Regulation 33(3) of SEBI (LODR) Regulations, 2015, if listed after the end of the quarter but on/before due date for submission of said financial results.

If the date of listing through scheme of arrangement is prior to the due date of submission as mentioned in Regulation 33 for the period as may be applicable, then the listed entity is required to submit the financial results for that period.

The entities listed through scheme of arrangement on the SME Board shall also refer to Regulation 33 (5) of SEBI (LODR) Regulations, 2015.

6. Regulation 33(3)(b) requires the listed entity which has subsidiaries, in addition to the requirement at clause (a) of sub-regulation (3), to also submit quarterly/year-to-date consolidated financial results.

Ans. In case the Listed entity excludes any of their subsidiaries, associate & joint ventures for the purpose of preparing the consolidated financial results, the Listed entity shall accordingly provide a detailed explanation in notes to the financial results along with their submission.

7. Are listed entities operating in a single segment required to disclose segment reporting details?

Ans. Yes, the Listed entity which are operating in single segment are also required to disclose single segment details in notes to the financial results according to IND AS/ AS, as maybe applicable.

8. Is the Listed entity required to confirm applicability of submission of consolidated financial results, in case only the standalone financial results are applicable?

Ans. The listed entities that submit standalone financial results are required to mention in their notes section of the financial results that the listed entity does not have any subsidiary/associate/joint venture entity(ies) for the respective period.

In case the company has subsidiary/associate/joint venture entity(ies) for the respective period and does not submit the consolidated financial results, it shall accordingly provide a detailed explanation in notes to the financial results along with the submission.

9. Is the Listed entity required to provide clarification in case the amounts in the standalone and consolidated financial results submitted by the Listed entity are the same?

Ans. Yes. The Listed entity while submitting the quarterly/half yearly/yearly financial results is required to specify the reason and provide a detailed explanation in notes to the financial results along with the submission in case the amount in the standalone and consolidated financial results submitted by the Listed entity are the same.

10. Is the listed entity required to provide a note stating that the figures for last quarter are the balancing figures for the entire financial year?

Ans. Yes. As per Regulation 33(3)(e), with respect to the last quarter, the listed entity needs to provide the financial results for the entire financial year along with a disclosure note stating that “The figures for the last quarter are the balancing figures between audited figures in respect of the full financial year and the published year-to-date figures up to the third quarter of the current financial year.”

11. Is revised Integrated Filing-Financial XBRL required to be submitted in case of revision of financial results submission for a certain period

Ans. Yes, in following cases the company shall submit the revised XBRL of financial results.

- In case there is any mismatch in figures in comparison between the PDF & XBRL submission.

- In case of revision of financial results for a particular period before or after the due date of submission as per the Regulation 33.

- In case where the financial results are restated by the listed entities due to any reasons.

- In case of voluntary revision of XBRL by the listed entities due to any other reason as may be applicable.

The listed entities are required to provide a detailed explanation for such revision in the revision remarks section, furthermore they are advised to download and submit latest utilities as may be applicable on the date of submissions.