Concept of Significant Beneficial Owner (SBO):

It is well known to us that black money creates imbalances in the economy, finances terror and crimes like money laundering etc., and that it puts the honest at a disadvantage also deprives the State of the much-needed revenues which adversely affects the poor people of the country. One of the ways to siphoning off money and accumulation of black money is through incorporating of shell Companies, which is doing continuous menace in the Indian economic system. It was thus, necessary to formulate regulations to identify person who is the ultimate beneficial owner in such shell Companies in the complicated structures.

To incorporate the concept of significant Beneficial owner Ministry of Corporate Affairs (MCA) notified following sections under Companies Act, 2013, with an aim to get hold of those individuals whose name does not appear in the register of members but who holds the significant Beneficial Interest in a Company

- Section 90 of the Companies Act, 2013,

- Companies (Significant Beneficial Owners) Rules, 2018 and

- Companies (Significant Beneficial Owners) Second Amendment Rules, 2019

Let us have a clear idea of the following terms before we move on to the concept of SBO.

Shares Means: CCD, CCPS, Equity Shares and GDR

Direct Holding means a natural person personally holds shares in the reporting company and his name is registered in the Register of Member of the reporting company.

Indirect Holding means that a natural person holds shares in the reporting company via one or multiple entities and in such case the name of the individual is not appeared in the Register of Members of the reporting Company but the name of the entity through which it holds such beneficial interest.

Further, an individual shall be considered to hold a right or entitlement indirectly in the reporting company, if he satisfies any of the following Criteria, in respect of

If a member of reporting Company is any of the following: –

- Body Corporate (Whether incorporated or registered in India or abroad) and

The individual holding the majority stake of body corporate who is holding shares in reporting Company.

- Hindu Undivided Family (HUF) (through Karta) and the individual is the Karta of the HUF.

The individual is the Karta of the HUF.

- Partnership Entity (Through itself or A Partner) and

The individual, –

Is a partner; or

Holds majority stake in the body corporate which is a partner of the partnership entity; or

Holds majority stake in the ultimate holding company of the body corporate which is a partner of the partnership entity.

- Trust (Through Trustee)

The individual –

Is a trustee in case of a Discretionary Trust or a Charitable Trust;

Is a beneficiary in case of a Specific Trust;

Is the author or settler in case of a Revocable Trust.

- In case the Member of Reporting Company is

(a) A Pooled Investment Vehicle (i.e. Mutual Fund, Venture Capital Fund, etc.); or

(b) An Entity Controlled by the Pooled Investment Vehicle, based in Member State of the FATF on Money Laundering and the regulator of the securities market in such Member State is a member of the IOSCO.

Further, the individual in relation to the Pooled Investment Vehicle is-

(a) A General Partner; or

(b) An Investment Manager; or

(c) A CEO where the Investment Manager of such pooled vehicle is a Body Corporate or a partnership Entity.

Reporting Company: Means a company as defined under section 2(20) of the Companies Act, 2013, which required to comply with the provisions of Section 90 & identify the SBO. Further, cause him to comply with provisions related to SBO. Significant Influence: Means the power to participate, directly or indirectly, in the financial and operating policy decisions of the reporting company but is not control or joint control of those policies.

As per Section 90 of Companies Act, 2013, every individual, who acting alone or together, or through one or more persons or trust, including a trust and person’s resident outside India, has indirect or indirect with direct holdings and such following rights or entitlements are possessed in such reporting company, namely:

- Holds not less than 10% of the shares;

- Holds not less than 10% of the voting rights in the shares;

- Has right to receive or participate in not less than 10% of the total distributable dividend, or any other distribution, in a financial year on his holding

- Has right to exercise, or actually exercises, significant influence or control, in any manner other than through direct holdings alone

Procedural requirement for SBO under Section 90 & Rules made thereunder:

Every Company shall take necessary steps to identify an individual who is a significant beneficial owner in relation to the Company and require him to file a declaration in Form BEN-1 to the reporting Company.

Without prejudice the generality of the procedure as above stated, every reporting company shall give notice, in Form No. BEN-4, to any person (whether he is a member of the company or not) where company believes or has reasonable cause to believe —

- To be SBO of the Company

- To be having knowledge of the identity of a SBO or another person likely to have such knowledge or

- To have been a SBO of the Company at any time during the immediately preceding last 3 years from notice is issued,

Further, who is not registered as a significant beneficial owner with the Company as required under Section 90.

The identified SBO shall file form BEN -1 within 30 days of acquiring such ownership and any change thereon.

Upon receipt of declaration as above, the reporting company shall file a return in Form No. BEN-2 with the Registrar in regards with such declaration, within 30 days along with the fees.

The company shall maintain a register of significant beneficial owners (SBO) in Form No. BEN-3.

Application to the Tribunal (NCLT)

The reporting company shall make the application to the tribunal if:

Such person fails to provide the information required by notice in form BEN-4 within 30 days or

Information required is not satisfactory.

Within a period of 15 days of the expiry of the period specified in the notice, for order directing that the shares in question be subject to restrictions with regards to Transfer of interest, Suspension of all rights (right related to dividend or voting right) attached with the shares. Any other restriction. Further, the tribunal after giving the opportunity of being heard to both the concerned parties, pass the order as deemed fit, within 60 days of receipt of application. Further, if any party is aggrieved by the order, may make application for relaxation or lifting of the restrictions within 1 year from the date of order. If no such application has been filed within a period of 1 year from the date of the order, such shares shall be transferred, without any restrictions, in the Government bank’s account i.e. IEPF Account.

Non- Applicability of the Said Rules and Regulation:

The SBO Rules shall apply to every Company except to the extent the share of the reporting company is held by: –

- The authority constituted under sub-section (5) of section 125 of the Act (i.e. IEPF);

- Its holding reporting Company: provided that the details of such holding Company shall be reported in Form No. BEN-2;

Note: A holding reporting Company means a Company which required to file Form BEN-2.

- The Central Government, State Government or any local Authority;

- A reporting Company or a Body Corporate or an entity, controlled by the Central Government or by any State Government or Governments, or partly by the Central Government and partly by one or more state Governments;

- Securities and Exchange Board of India registered Investment Vehicles such as mutual funds, alternative investment funds (AIF), Real Estate Investment Trusts (REITs), Infrastructure Investment Trust (lnVITs) regulated by the Securities and Exchange Board of India,

- Investment Vehicles regulated by Reserve Bank of India (RBI), or Insurance Regulatory and Development Authority of India (IRDAI), or Pension Fund Regulatory and Development

Example 1

Note: As per Companies (Significant Beneficial Owners) Amendment Rules, 2019,

Where the member of the reporting company is a body corporate (whether incorporated or registered in India or abroad), other than a limited liability partnership, and the individual:

- Holds majority stake in that member;

- Holds majority stake in the ultimate holding company (whether incorporated or registered in India or abroad) of that member.

In this case Mr. C is beneficial owner and need to give declaration of beneficial holding in form BEN-1.

Further Mr. X, Mr. Y and Mr. Z does not need to give declaration as their holding in M/s. NM LLC is lesser than 50 %.

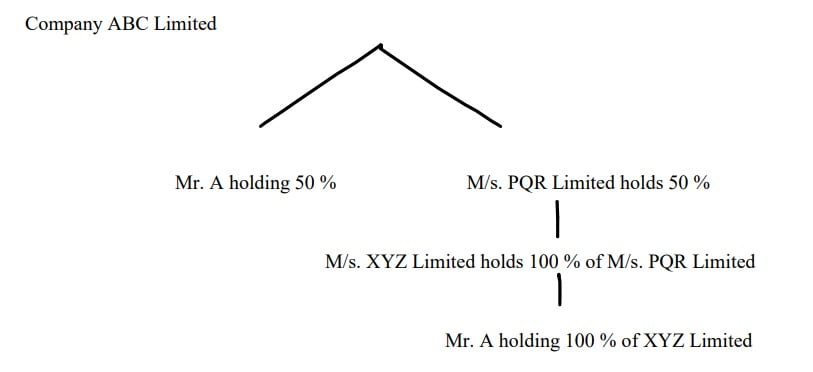

Example 2

In this case Mr. A is beneficial owner and needs to give declaration of beneficial holding in form BEN-1.

Example 3

M/s. ABC Limited has issued 100 Equity Shares, 100 CCPSs and 100 CCDs in following way

|

Sr. no |

Particulars |

Equity Shares |

CCPS |

CCD |

|

1 |

Mr. A |

99 |

80 |

90 |

|

2 |

M/s. NMS LLC |

1 |

20 |

10 |

|

TOTAL |

100 |

100 |

100 |

|

In above scenario whether BEN-1 needs to be given?

Yes, M/s. NMS LLC need to give BEN-1 declaration since holding is more than 10 %

Penalty for non-Compliance or not filing of BEN-2

In case of Registered Member & Beneficial Owner: –

If any person (both the registered member & beneficial owner) fails to do so shall be punishable with: –

- fine which may extend to Rs. 50,000/- and

- With a further fine of Rs. 1000/- for every day during which the failure continues.

In case of the Company: –

The Company & every officer in default shall be punishable with fine.

- which shall not be less than Rs.500/- and

- may extend to Rs. 1000/-and

- with a further fine of Rs. 1000/- for every day during which the failure continues

Conclusion: If any individual becomes the significant beneficial owner (SBO), Then, he is required to comply with the provisions of the section 90 of Companies Act, 2013, Companies (Significant Beneficial Owners) Rules 2018 and Companies (Significant Beneficial Owners) second Amendment Rules, 2019. Further, reporting companies are also required to file declaration to ROC and shall be required to comply with the above-mentioned provisions. Accordingly, there is responsibility for both.

Disclaimer: This article provides general information existing at the time of preparation and we take no responsibility to update it with the subsequent changes in the law. The article is intended as a news update and Affluence Advisory neither assumes nor accepts any responsibility for any loss arising to any person acting or refraining from acting as a result of any material contained in this article. It is recommended that professional advice be taken based on specific facts and circumstances. This article does not substitute the need to refer to the original pronouncement

CLICK HERE TO DOWNLOAD PDF