- INTRODUCTION:

The procedure for seeking ’Refund under GST’ has been evolving ever since the GST law has been implemented. There have been quite a few circulars issued clarifying the procedure for seeking refund under different categories. Timely refund not only helps the businesses in smooth functioning, it also gives a boost to the working capital.

In this article, we have attempted to summarize the computation of refund amount under different categories along with broadly outlining the process.

- CATEGORIES UNDER WHICH REFUND CLAIMS CAN BE MADE:

We would like to first broadly highlight the categories under which a GST refund claim can be filed:

- Export of goods or services

- Supplies to SEZs units and developers

- Refund of accumulated Input Tax Credit on account of rate of tax on inputs being higher than the rate of tax on output supplies (inverted duty structure)

- Refund of tax paid on supply which is not provided, either wholly or partially, and for which invoice has not been issued or where a refund voucher has been issued

- Refund of tax paid under wrong head i.e. instead of CGST & SGST, IGST has been discharged or vice versa

- Deemed exports

- Refund of taxes on purchases made by specialized agency of the UN, consulate, or embassy of foreign countries, etc.

- Refund arising on account of judgment, decree, order, or direction of the Appellate Authority, Appellate Tribunal or any Court

- Refund of tax or interest or any other amount paid by the applicant provided the incidence of such tax and interest has not been passed to any other person

- Refund to International tourists of tax paid on goods purchased in India and carried abroad at the time of their departure from India

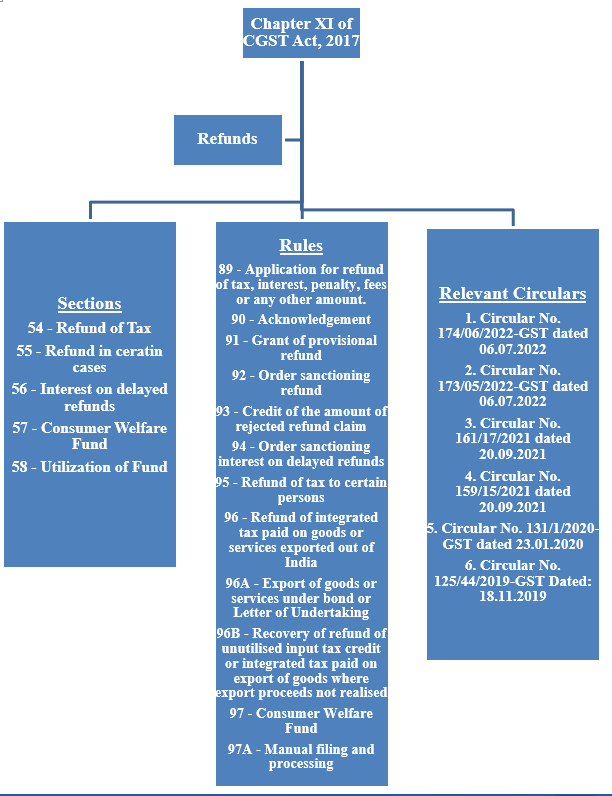

- STATUTORY PROVISIONS, RULES AND LATEST CIRCULARS PERTAINING TO REFUNDS

We have captured the statutory provisions i.e. Sections & Rules, relevant Circulars dealing with refund under GST regime as below:

- TIME LIMIT FOR FILING REFUND

- The application for GST refund claim is required to be filed within 2 years from the relevant date. Explanation to Section 54 of the CGST Act, 2017 provides the definition of “refund” and “relevant date”. The same are discussed as below:

The definition of “refund” reads as below:-

“refund” includes refund of tax paid on zero-rated supplies of goods or services or both or on inputs or input services used in making such zero-rated supplies, or refund of tax on the supply of goods regarded as deemed exports, or refund of unutilized input tax credit as provided under subsection (3).

Further, the definition of relevant date has been discussed in the following table:

| Categories of Refund claim | Relevant date shall be |

| A. (i) Goods exported out of India by sea or air; (ii) Goods exported by land, or (iii) Goods exported by post |

The date on which Ship or Aircraft in which goods are loaded leaves India; Date on which goods pass the frontier, or Date of dispatch of goods to place outside India by the concerned Post Office |

| B. Goods qualifying as “Deemed Exports” | Date of filing return relating to such deemed exports |

| Ba) Supply to SEZ developer or unit | Due–date of filing GSTR-3B for the corresponding period |

| C. (i)Export of Services – when the supply of service is completed before receipt of payment (ii) Export of Services – when payment is received in advance before the issue of invoice |

(i) date of receipt of payment in convertible foreign exchange (ii) date of issue of invoice |

| D. Tax refund on account of judgment, decree, order or direction | Date of communication of such judgment, decree, order or direction |

| E. Refund in case of Inverted Duty structure | Due date of filing GSTR-3B for period in which such claim for refund arises |

| F. Where tax is provisionally paid | The date of adjustment of tax after the final assessment thereof |

| G. Person other than supplier, who has received the goods and/or services | Date of receipt of goods or services by such person |

| H. Any other case | Date of payment of tax |

- COMPUTATION OF REFUND AMOUNT:

We shall now discuss the computation of GST refund amount under the following categories namely:-

- Export of goods with payment of tax

- Export of services with payment of tax

- Export of goods and services without payment of tax

- Inverted duty structure

- Refund of integrated tax paid on export of goods:

- This refund is governed by Rule 96 of the CGST Rules, 2017 and the same is processed by the Custom authorities

- No separate refund application is required to be filed by the exporter

- The shipping bill filed by the exporter shall itself be treated as the refund application, provided, a valid return in Form GSTR-3B has been filed and the person in-charge of the conveyance carrying the goods to be exported has furnished an export manifest/report.

- Customs authorities at the port of export, after validation of figures reflecting in the Form GSTR-3B, shall process the claim for refund and an amount equal to the integrated tax paid in respect of each shipping bill shall be electronically credited to the bank account of the exporter.

- Additionally, the details of zero-rated supplies declared in Table 6A of return in Form GSTR-1 are matched with the corresponding details available in the Customs Systems based on the details provided in the shipping bills/bills of export. For the convenience of the exporters, the details available in the Customs System have been made available for viewing in their Indian Customs Electronic Gateway (ICEGATE) login.

- Taxpayer shall ensure the taxable value and IGST figures have been correctly captured in GSTR-1 and GSTR-3B to avoid challenges in processing of refund claim. Thus, in the said case

Refund Amount = IGST and compensation cess component in Shipping Bill (as reflecting in GSTR-3B for the same period)

- Notification No.1/2023 – Integrated Tax dated 31 July 2023 notifies certain class of goods such as Pan Masala, tobacco etc. which cannot be exported with payment IGST.

Export of service:

- Before discussing the refund computation in case of export of service, it is important to discuss the parameters related to export of service.While the procedure for seeking refund in case of export of goods is fairly straight forward, the same is challenging in case of export of service.

- The definition of Export of services has been enunciated in Section 2(6) of the IGST Act, 2017, which is reproduced as below – “Export of services” means the supply of any service when,-

- the supplier of service is located in India;

- the recipient of service is located outside India;

- the place of supply of service is outside India;

- the payment for such service has been received by the supplier of service in convertible foreign exchange [or in Indian rupees wherever permitted by the Reserve Bank of India]; and

- the supplier of service and the recipient of service are not merely establishments of a distinct person in accordance with Explanation 1 in section 8;

- In case the supplier is located in India providing service to a recipient located outside India, place of supply of such service is outside India and the payment is received in convertible foreign exchange, the said supply of service shall qualify as an export of service. Additionally, it is to be noted that in case the supplier is providing service to its branch office located outside India and thereby qualifying as distinct person, then the supply of service to said branch office shall not qualify as an export of service. Hence, it is relevant to understand that in which cases the supplier and recipient shall be treated as establishment of a distinct person. Explanation 1 of Section 8 is reproduced as below for ready reference:- “Where a person has,-

- An establishment in India and any other establishment outside India;

- An establishment in a State or Union territory and any other establishment outside that State or Union territory; or

- An establishment in a State or Union territory and any other establishment registered within that State or Union territory, then such establishments shall be treated as establishments of distinct persons.”

- With respect to place of supply it is pertinent to evaluate whether the particular service is falling under sub-section (3) to (13) of Section 13 of IGST Act. If not, the place of supply in said case shall be determined in terms of sub-section (2) i.e. location of recipient of service. The place of supply has been a subject matter of dispute in case wherein department may contend that the supplier is an intermediary rather than an exporter. CBIC vide Circular 159/15/2021 dated 20 September 2021 has issued clarification in respect to the same.

- Refund of integrated tax paid on export of services:

- Refund of integrated tax paid on export of services, has been prescribed in Rule 96 of the CGST Rules, 2017.

- An application for refund of export of services needs to be filed in Form GST RFD-01.

- The details related to export transactions (with payment of tax) should be captured in Table 6A of GSTR-1. Subsequently, the same shall be reported in item 3.1 (b) of GSTR-3B and the tax amount shall be paid at the time of filing GSTR-3B of the particular month.

- The documents such as the Foreign Inward Remittance Certificate or Bank Realization Certificate would act as a proof of receipt of convertible foreign exchange, which needs to be maintained by the exporter.

Refund Amount = Amount in Table 6A & 6B of GSTR1 =/< Amount in Table 3.1 of GSTR-3B

{Export transactions carried out in a tax period, must be filed in the GSTR-1 and GSTR-3B of the same tax period}

- Refund of unutilized ITC on account of Export of goods and services without payment of IGST:

- In case of export of goods or services or both without payment of tax under bond or letter of undertaking in accordance with the provisions of sub-section (3) of section 16 of the IGST Act, 2017 (13 of 2017), refund of accumulated input tax credit shall be computed in view of Rule 89 (4) of the CGST Rules, 2017 as per the following formula –

Refund Amount = (Turnover of zero-rated supply of goods + Turnover of zero-rated supply of services) x Net ITC ÷ Adjusted Total Turnover

Where,-

(A) “Refund amount” means the maximum refund that is admissible;

(B) “Net ITC” means input tax credit availed on inputs and input services during the relevant period other than the input tax credit availed for which refund is claimed under sub-rules (4A)* or (4B)** or both

{*Sub-rule 4A pertains to – exports against Advance Authorization, EPCG Authorization, EOU etc., and **Sub-rule 4B pertains to – exemption w.r.t intra-state supply of taxable goods or Customs exemption notification for exports made to EOU}

(C) “Turnover of zero-rated supply of goods” means the value of zero-rated supply of goods made, during the relevant period without payment of tax under bond or letter of undertaking or the value which is 1.5 times the value of like goods domestically supplied by the same or, similarly placed, supplier, as declared by the supplier, whichever is less, other than the turnover of supplies in respect of which refund is claimed under sub-rules (4A) or (4B) or both

(D) “Turnover of zero-rated supply of services” means the value of zero-rated supply of services made without payment of tax under bond or letter of undertaking, calculated as follows-

Zero-rated supply of services = the aggregate of the payments received + payment received in advance – advances received for pending supplies; during the relevant period.

[It is worthwhile to note that there is restriction in case of turnover of zero-rated supply of goods i.e. the same cannot exceed 1.5 times the value of like goods supplied in the domestic market. However, in case of turnover of zero-rate supply of services there is no such restriction since the same is computed by considering the aggregate of actual payment received during a particular period]

(E) “Adjusted Total Turnover” means sum total of the value of turnover in a State or a Union territory, as defined under clause (112) of section 2, and the turnover of zero-rated supply of services determined in terms of clause (D) above and non-zero-rated supply of services, excluding –

- the value of exempt supplies other than zero-rated supplies, and

- the turnover of supplies in respect of which refund is claimed under sub-rule (4A) or sub-rule (4B) or both; during the relevant period.

(F) “Relevant period” means the period for which the claim has been filed.

Further, the Explanation to Rule 89(4) of CGST Rule provides that for computation of the refund, the value of goods exported out of India shall be taken as –

- the Free on Board (FOB) value declared in the Shipping Bill or Bill of Export form, as the case may be, as per the Shipping Bill and Bill of Export (Forms) Regulations, 2017; or

- the value declared in tax invoice or bill of supply,

Whichever is less.

- Refund of accumulated Input Tax Credit on account of inverted duty structure:

- Inverted duty structure means cases where the rate of tax on inputs is higher than the rate of tax on output supplies (other than nil rated or fully exempt supplies).

- As per Sub-section 3 of Section 54 of CGST Act, 2017 refund of unutilized input tax credit on account of Inverted duty structure shall be allowed and the said refund of input tax credit shall be granted as per the following formula-

Maximum Refund Amount = {(Turnover of inverted rated supply of goods) x Net ITC ÷Adjusted Total Turnover} – tax payable on such inverted rated supply of goods.

[The expression “Net ITC” and “Adjusted total turnover” shall have the same meaning as assigned above in point B]

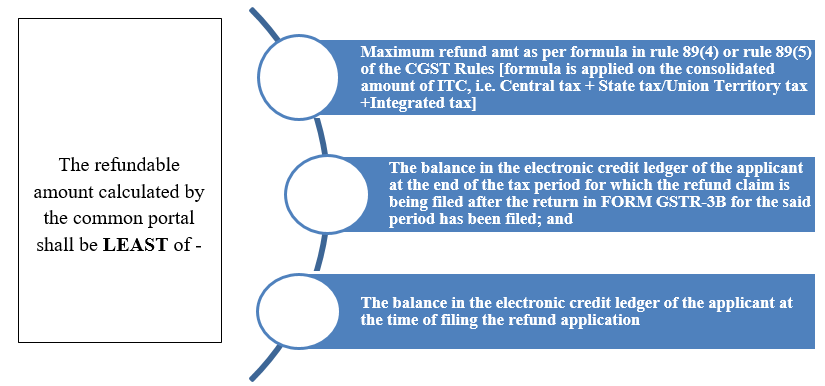

NOTE: In light of Circular No. 125/44/2019 – GST dated 18 November 2019, for refunds pertaining to unutilized ITC on account of exports without payment of tax (Point ‘C’), unutilized ITC on account of supplies made to SEZ Unit/SEZ Developer without payment of tax and unutilized ITC on account of accumulation due to inverted tax structure (Point ‘D’):

- REFUND IN CERTAIN SCENARIOS:-

- Refund in case of Tax Collected at Source (TCS) by e-commerce operator:

- In view of Section 52 of the CGST Act, 2017, TCS is a tax collected by the electronic commerce operator when a seller supplies goods or services through its website and the electronic commerce operator collects the payment for that supply.

- Such seller selling goods or services through e-commerce portal, would get the net payment after reducing 1% of taxable turnover (TCS @ 0.5% CGST+ 0.5% SGST or 1% IGST). The tax collected by the online aggregators is paid by the online aggregators in Form GSTR-8

- The supplier then accepts the TCS amount collected by the e– commerce operator in Form GSTR-8A and the said amount is credited to his electronic cash ledger, which can be further used by the supplier to discharge his tax liabilities.

- However, in case the supplier is unable to utilize the amounts in the electronic cash ledger, the supplier has the option to claim refund of the excess balance lying in his electronic cash ledger. This has been clarified by CBIC vide Circular No. 166/22/2021 dated 17 November 2021.

- The refund in this scenario shall be governed under the general refund provisions contained in Section 54 of the CGST Act, 2017.

- In this scenario, no certification/declaration under Rule 89(2)(1) or Rule 89(m) of the CGST Rules, 2017 is required to be furnished along with the application for refund of excess balance in electronic cash ledger. Although the proper officer may seek certain clarifications/details w.r.t. the refund claim viz-a-viz whether the taxpayer has complied with Rule 86B of the CGST Rules, whether there is mismatch in the turnover reported by the -ecommerce operator in its GSTR-8 and in the return filed by supplier etc.

- Refund in case of Payment of tax under the wrong head:

- Section 77 of the CGST Act, 2017 and Section 19 of the IGST Act, 2017 deals with provisions where tax is paid under wrong head i.e. CGST and SGST has been paid instead of IGST or vice-versa.

- In such cases, the refund of the tax paid under wrong head can be claimed. Additionally, interest will not be applicable while making the payment of tax under correct head. Further, Rule 89(1A) had been inserted in CGST Rules, 2017 vide Notification No. 35/2021-Central Tax dated 24.09.2021 to prescribe the manner and time period for filing such claim.

- In light of the said Notification, the refund claim can be filed within 2 years from the date of payment of tax paid under the correct head upon filing an application in Form GST RFD-01.

- Further, a Circular No. 162/18/2021-GST dated 25.09.2021 has been issued clarifying the issues relating to refund of tax paid under wrong head in terms of Section 77 of CGST Act, 2017 and Section 19 of IGST Act, 2017.

- Refund in case of Excess payment of cash:

- Rule 92 of the CGST Rules, 2017 was amended vide Notification No.16/2020-Central Tax dated 23.03.2020, and sub-Rule (1A) has been inserted prescribing the procedure related to refund in case of excess payment of cash.

- Refund application on account of excess payment of tax can be filed in case where the taxpayer has paid excess tax (in the form tax deducted/collected at source or self-assessment tax or payment of tax on regular assessment) against the tax required to be paid by him.

- The refund is granted after all the pending amounts towards the recovery of tax, interest, penalty, fees etc. has been adjusted. The refund can either be disbursed in cash or, at the option of the person, the said excess balance can be adjusted towards amount of tax and penalty or interest of subsequent period.

- LETTER OF UNDERTAKING (LUT) OR BOND IN CASE OF EXPORT OF GOODS OR SERVICES WITHOUT PAYMENT OF TAX:

- Rule 96A of CGST Rules deals with furnishing of LUT or Bonds for export of goods or services made without payment of tax and consequences wherein either goods are not exported or consideration against export of service has not been received within prescribed time.

- Any registered person who has opted for export goods or services without payment of tax will have to obtain LUT or Bond

- Notification No 37/2017- Central tax dated 4 October 2017 read with Circular No. 8/8/2017-GST dated 4 October 2017 deals with facility of furnishing LUT/Bond

- LUT can be obtained by filing Form RFD-11 in the prescribed format

- The validity of such LUT’s is for a period of one year (until the end of financial year)

- An exporter furnishing LUT’s is required to furnish fresh LUT for each financial year

- If the conditions mentioned in LUT are not satisfied within the time limit, the exporter will have to furnish bond [manually].

- Further, any person who has been prosecuted for tax evasion for an amount of INR 2.5 Crores or above under the act, is not eligible to furnish LUT

- Any registered person who has exported goods or services or has supplied goods or services to SEZ unit/developer without payment of Integrated tax after furnishing a LUT/Bond, would be liable to pay the tax along with the interest as applicable within a period of fifteen days after the expiry of the timeline given below in case of breach of the conditions identified in ‘Criterion Column’:

| Type of Transaction | Criterion | Time Period |

| Export of Goods | Goods are not exported out of India | 3 months from the date of issue of the invoice for export |

| Export of Services | If the payment is not received in Convertible Foreign Exchange | 1 year from the date of issue of the invoice for export |

- The jurisdictional Commissioner may consider granting extension of time limit for export as provided in the Rule 96A (1) of CGST Rules on post facto basis keeping in view the facts and circumstances of each case.

- The above provisions shall also apply in case of supply of goods or services to SEZ

Also Read: Cancellation, Suspension and revocation of GST registration

- BUNCHING OF REFUND CLAIMS

Earlier, while there was restriction on clubbing of refund claims, the applicant faced certain practical difficulties in cases where the ITC has been availed but there were no export of goods or services during the said month or where the ITC availed is not substantial in the month where there is export of goods or service. In such cases, the applicant would be eligible for a lesser refund.

Later, CBIC vide Circular No. 135/05/2020-GST dated 31.03.2020 clarified that in view of Section 54(3) and Section 16(3) of the CGST Act, 2017 there appears to be no bar in claiming refund by clubbing different months across successive financial years. Thus, the “Circular No. 125/44/2019- GST dated 18 November 2019” was modified to the extent by removing the restriction on bunching of refund claims across financial years.

- PROCEDURE RELATED TO REFUND CLAIM

- A refund claim has to be filed online in FORM GST RFD-01.

- The concerned proper officer shall, within 15 days of filing of the said application, scrutinize the application for its completeness and if the same is found to be complete in all terms, issue an acknowledgement in FORM GST RFD-02 through the common portal electronically. In case, the said officer notices any discrepancies, the same shall be sent back to the applicant along with the notified deficiencies and on resolving the same, a fresh application for refund needs to be filed.

- In view of Section 54(1) of the CGST Act, 2017, the time period from the date of filing of refund claim to the date of issuance of deficiency memo in Form GST RFD-03 would be excluded for computation of time period of 2 years for filing of refund claim.

- Once the claim is sanctioned, an order in FORM GST RFD-06 shall be issued within a period of 60 days from the date of receipt of the refund application.

In case this mandatory period of 60 days is exceeded, interest at the rate of 6% (9% in case of refund made on order passed by an adjudicating authority or Appellate Tribunal or court which has attained finality) becomes payable along with refund amount from the expiry of 60 days till the date of payment of refund. However, if the refund claim is on account of pre-deposit made before any appellate authority, the interest becomes payable from the date of making such payment.

- RECOVERY OF REFUND IN CASE EXPORT PROCEEDS NOT REALIZED:

- Rule 96B of CGST Rules governs the cases where, refund of unutilized ITC or of IGST paid on export of goods has been granted to the applicant but the sale proceeds concerning such export goods have not been realized, in full or in part, in India within the period allowed under the Foreign Exchange and Management Act, 1999 (FEMA Act, 1999)

- The said provision was introduced vide Notification No. 16/2020- Central Tax dated 23 March 2020 to prevent fraudulent refund claims against export of goods

- In light of Rule 96B of CGST Rules, the applicant will have to deposit the amount so refunded within 30 days of expiry of period specified under the FEMA Act, 1999 (incl. extension, if any) to the extent of unrealized sale proceeds along with applicable interest.

- In case of non-adherence to above provisions, recovery of such erroneous refund shall be made invoking Section 73 or Section 74 of the CGST act 2017 as the case may be, along with the applicable interest under Section 50 of the CGST Act, 2017.

CONCLUSION:

While the refund filing process under GST is fairly automated, the processing of the same still involves manual interaction. Pursuant to filing of refund application, a taxpayer would be required to provide additional details/clarification which may be sought by the officer through issuance of SCN in Form RFD-08. Also, the taxpayer would be required to attend the personal hearing for explaining the submission. Consequently, the officer shall issue an Order in Form RFD-06 either accepting or rejecting the refund claim.

Further, it has been observed that the department has been very cautious with processing of GST refund claim due to certain incidents of fraudulent refund claims. As a measure, the officer also carries out the physical verification of premises of the taxpayer to validate whether the business has been actually carried out from said place.

Hence, the taxpayer filing the GST refund claim should take due caution in computing the correct amount of refund claim and also ensure that all relevant details/documents have been uploaded on the portal along with the refund application. Additionally, once the refund claim is filed, the taxpayer shall closely track the application status to ensure that response to any notice seeking further details/documents is not missed out.

Disclaimer: This article provides general information existing at the time of preparation and we take no responsibility to update it with the subsequent changes in the law. The article is intended as a news update and Affluence Advisory neither assumes nor accepts any responsibility for any loss arising to any person acting or refraining from acting as a result of any material contained in this article. It is recommended that professional advice be taken based on specific facts and circumstances. This article does not substitute the need to refer to the original pronouncement

CLICK HERE DOWNLOAD PDF