- What is FLA and to whom it is applicable to file the said return?

A: FLA is an abbreviation of Foreign Assets and Liabilities. FLA return is required to be submitted by all the companies / LLPs / AIFs / Partnership Firms / Public Private Partnerships which have received FDI and/or made overseas investments in any of the previous year(s), including the current year.

- If the Company has filed (Annual Performance Report) APR for Overseas Direct Investment Whether FLA is to be filed or not?

A: Even if the Company has filed APR, it is mandatory that it files FLA as both are separate returns and are reported to different departments of the RBI.

- Where and how is the return filed?

A: Return is to be filed Online on RBI Portal. The portal on which you can file the return is https://flair.rbi.org.in/fla/ by logging in through the respective credentials of the Company.

- What is the due date of filing of the FLA return?

A: Entities should mandatorily file the FLA return within the due date i.e. 15th July of every year. In case the entities do not have their audited balance sheet finalized, they may fill the return with the provisional/unaudited numbers. Thereafter, once the audited numbers are ready, a request for revision of the previously filed return to RBI needs to be raised. Once approved by RBI, you can revise the previously filed return with audited numbers and re-submit the same to RBI.

- What is the financial year period for filing Annual Return?

A: Companies are required to furnish the information for the financial year ending by March of every financial year.

- What are the classes/types that a company may have?

A: No. of Classes and kinds are related to the range of face values for the Company.

(Illustration: if a Company has shares of face values say, INR 10 and INR 20, then “2” should be inserted). Similarly, the Company must indicate 2 against the Classes of Shares in the event of partially paid-up shares.

- What should we include in item 5 of sales made during the financial year of Section II?

A: In this field we are required to provide the information of sales made during the year financial year, sales include both sale of goods and services. In item, 5.1 we are required to provide information of Domestic Sales and in item 5.2 we are required to provide information of export sales.

- What should we include in item 5 of Purchase made during the financial year of Section II?

A: In this field, we are required to provide the information relating to all purchases of capital assets from the Balance Sheet and revenue expenses of goods and services. The formula to calculate purchase is as follows:

Sr. No. | Particulars | Amount |

1 | Total Expenses [including Capital (from the balance sheet) and revenue of goods and services] made domestically as well as foreign during the reference period April – March] | XXX |

2 | (-) Depreciation | (XX) |

3 | (+) Addition in Capital Assets | XXX |

Total Purchase | XXX | |

- What is Direct Investment and its types?

A: Direct investment is often referred to as foreign direct investment or FDI. Investors put money into a business operating in another country. It consists of two components, viz., Equity Capital and Other Capital.

Equity Capital

- All kinds of equities (except non-participating preference shares) in subsidiaries and associates;

- Acquisition of equities in Direct Investment Enterprise;

- Acquisition of shares by a DIE in its direct investor company, termed as a reverse investment (i.e. claims on DI).

Other Capital

- Receivables and Payables except for Equity and participating preference shares;

- Outstanding liabilities or claims out of borrowing;

- Trade credit;

- Financial leasing;

- Share Application Money;

- Investment in debt securities;

- Non-participating preference shares.

- What is the other investment in item 4 of Schedule III?

A: Trade Credit in item 4 includes trade Credit, loans, other payable accounts, and currency deposits other than foreign related Parties (any other foreign person not having invested in our Company and a foreign associate of the Company).

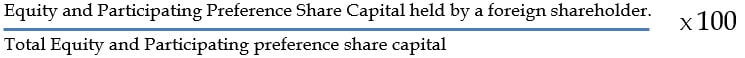

- How to calculate the percentage of foreign holding?

- What are participating Preference Shares?

A: Participating in Preference shares means the right to receive dividends out of surplus profit after paying the dividend. Right to have a share in case of winding up in surplus assets remaining after repayment of the entire capital.

- Where should we report the non-participating preference share issued to non-residents?

A: Nonparticipating preference shares are treated as debt securities. (a) If the Non-participating preference shares are held by a foreign investor who is also holding equity shares of the Indian reporting company, then the non-participating preference share should be reported at item 2.1 of 1.b FDI and 2.b Direct Investment in Section III.

- What if the Company had issued the shares to a non-resident on a non-repatriable basis, whether that company is required to submit the FLA Return?

A: Shares issued by reporting company to a non-resident on a non-repatriable basis are not considered a foreign investment; therefore, such companies are not required to submit the FLA Return.

- What if Company has received Share Application Money, whether it is required to file FLA return?

A: If the Company has received Share Application Money, then Company is not required to file FLA.

- How to calculate the market value of investment made by an Indian Company in an unlisted foreign Company?

A: = Net Worth of foreign Company * % of Equity held by you India Company

- How will we do the valuation of the equity capital for the listed DIE?

A: If the overseas company is listed then the closing share price as on the reference period, i.e. end-March of the previous and latest year should be used for the valuation of equity investment.

- Whether any domestic assets and liabilities are to be included in FLA Return?

A: Since FLA return is for reporting foreign assets and liabilities, any domestic assets and liabilities are not to be included.

- What is Direct Investment abroad by Indian companies?

A: If the reporting Indian company invests in equity and/or participating preference shares of overseas Companies, under the Overseas Direct Investment Scheme in India then it should be reported under the FLA return.

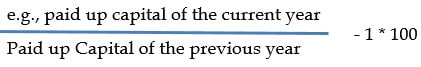

- How to calculate percentage variation as required in FLA return for paid Up Capital, Net Worth, Total Sales, etc.? (This is an auto Calculated field)

- How to file the previous year’s FLA return?

A: The company can file the previous year’s FLA return (through the online FLA portal only) by making a request for the same.

- How to delete the previous year’s FLA return and modify FLA return?

A: The company can delete/modify the FLA return after taking approval from RBI.

- What is the penalty which can be levied if the return filed does not capture all required information?

A: RBI can levy a Penalty of Rs. 7500 /- as per RBI notification dated 30th September 2022 if the return does not capture flows or any other periodical reporting.

- What is the penalty for non-filing FLA?

A: In case the company does not file the FLA return within the given time, the company will be liable to pay a penalty of thrice the sum involved in the contravention. In case it is not quantifiable, then a penalty of Rs.2,00,000 will have to be paid by the company. If the contravention continues, a penalty of Rs 5,000 per day will have to be paid by the Company

Disclaimer :This article provides general information existing at the time of preparation and we take no responsibility to update it with the subsequent changes in the law. The article is intended as a news update and Affluence Advisory neither assumes nor accepts any responsibility for any loss arising to any person acting or refraining from acting as a result of any material contained in this article. It is recommended that professional advice be taken based on specific facts and circumstances. This article does not substitute the need to refer to the original pronouncement