The Securities and Exchange Board of India has introduced a Settlement Scheme for Venture Capital Funds (“VCF Settlement Scheme, 2025”) vide Public Notice dated July 15, 2025. For the benefit of applicants to the said Scheme, FAQs have been drafted for easy understanding of the Scheme.

Q. 1. Where can one access the information regarding the VCF Settlement Scheme, 2025?

A. Information regarding the VCF Settlement Scheme, 2025 is available at the website of SEBI (www.sebi.gov.in) and may also be accessed using the following link: https://www.sebi.gov.in/media-and-notifications/public-notices/jul-2025/public-notice-in- respect-of-vcf-settlement-scheme-2025_95263.html

Q. 2. How to file a settlement application under the VCF Settlement Scheme, 2025?

A. An entity desirous of filing a settlement application under the VCF Settlement Scheme, 2025 is required to take the following sequential actions:

- Click on the following link: https://siportal.sebi.gov.in/intermediary/AOPaymentGateway.html

- Select “Settlement Scheme” option from the drop down menu of “Type of Category”, enter the PAN, Captcha and click on “Go”

- Online submission of scanned copies of the following documents:

- An application for settlement as per Annexure -1.

- A copy of undertakings and waivers on non-judicial stamp paper with stamp duty duly paid as per Annexure -2.

- A self-attested copy of the PAN Card of the applicant.

- Payment of the non-refundable settlement application fee of ₹29,500/- (i.e. ₹25,000/- + GST @ 18%).

- Payment of the settlement amount as displayed with reference to the applicant.

Q. 3. What is the eligibility criteria for availing the VCF Settlement Scheme, 2025?

A. The VCF Settlement Scheme, 2025 would be applicable to VCFs with at least one scheme whose tenure has expired but not wound up and which have completed the process of migration under the SEBI (Alternative Investment Funds) Regulations, 2012.

Q. 4. What is the settlement amount applicable to me?

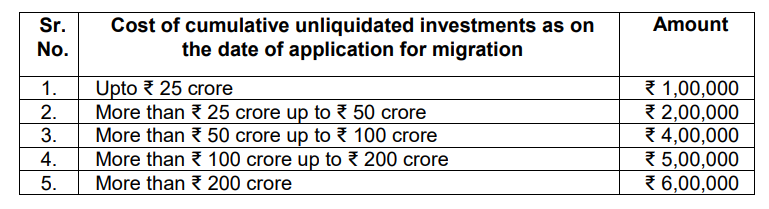

A. Under the VCF Settlement Scheme, 2025, the settlement amount applicable, is determined on the basis of the cost of cumulative unliquidated investments as on the date of application for migration and the number of years of delay. Accordingly, the applicable amounts for arriving at the final settlement amount using the above parameters would be as per the formulation given below:

- The Base Amount for settlement shall be ₹1,00,000 for delay up to 1 year in winding up the scheme. For every subsequent year of delay or part thereof, an additional amount of ₹50,000 shall be payable.

- Additionally, the following amount shall be levied for holding unliquidated investments of investors beyond the tenure of the fund/scheme:

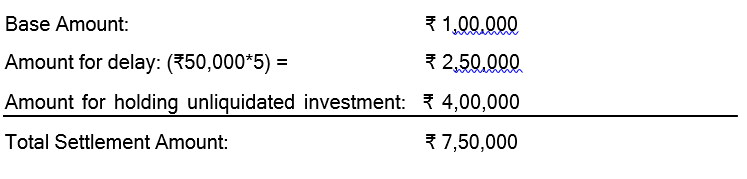

For example, if the liquidation period of a VCF, having unliquidated investment of ₹55,00,00,000, expired in September 2018, the amount of settlement amount shall be

Q.5 What is the mode of payment of the application fee/settlement amount mentioned above?

A. Applicant would be required to make the online payment of the application fee/settlement amount using the following link: https://siportal.sebi.gov.in/intermediary/AOPaymentGateway.html

Q. 6. When will the settlement order be passed under the Scheme?

A. Subsequent to the payment of the settlement amount, settlement order for each applicant shall be passed by the competent authority after reconciliation of records.

Q. 7. Should one wait till the last day for filing the settlement application under the Scheme?

A. The Scheme would be operational from July 21, 2025 till January 19, 2026, both days inclusive. It is advisable to file a settlement application under the Scheme at the earliest in order to avoid last minute delays.

Q. 8. What action would be taken, if the Scheme is not availed?

A. Upon conclusion of the VCF Settlement Scheme, 2025, action as per the relevant provisions of securities laws may be initiated against the entities, who have not availed the Scheme.

Q. 9. Would the VCFs be permitted to settle other non-compliances under this settlement scheme?

A. The settlement scheme has been devised only for settlement of any action for of non- compliance with Regulation 23(1) read with Regulation 17(1) of the repealed VCF Regulations. No other violation(s) shall be settled under this settlement scheme.

Any query/technical issues with respect to the VCF Settlement Scheme, 2025, may be sent to vcfsettlementscheme@sebi.gov.in, or assistance may be availed at helpline number 022-2644 9333 between 02:00 pm to 04:00 pm between Monday to Friday (excluding public holidays).

Disclaimer: This article provides general information existing at the time of preparation and we take no responsibility to update it with the subsequent changes in the law. The article is intended as a news update and Affluence Advisory neither assumes nor accepts any responsibility for any loss arising to any person acting or refraining from acting as a result of any material contained in this article. It is recommended that professional advice be taken based on specific facts and circumstances. This article does not substitute the need to refer to the original pronouncement.