Union Finance Minister Nirmala Sitharaman presented her sixth Budget on February 1, 2024. This article focuses on the GST part of the budget, breaking down what it means for different areas and how it might affect things.

Indirect Tax Updates:

- The long pending amendment in CGST Act, 2017, with respect to distribution of credit through ISD mechanism has been introduced vide Finance Bill 2024. While Circular No. 199/11/2023-GST dated 17 July 2023 clarified that credit pertaining to common input services procured from third-party can be distributed through ISD mechanism, however since it was not mandatory to opt for ISD mechanism, the taxpayers were opting for cross charging mechanism.

- 1 The amendments introduced vide Finance Bill 2024 pertaining to ISD is as below:

Substitution of definition of ‘Input Service Distributor’ i.e. Section 2(61) of CGST Act:

‘(61) “Input Service Distributor” means an office of the supplier of goods or services or both which receives tax invoices towards the receipt of input services, including invoices in respect of services liable to tax under sub-section (3) or sub-section (4) of section 9, for or on behalf of distinct persons referred to in section 25, and liable to distribute the input tax credit in respect of such invoices in the manner provided in section 20.

Substitution of Section 20 of CGST Act:

(1) Any office of the supplier of goods or services or both which receives tax invoices towards the receipt of input services, including invoices in respect of services liable to tax under sub-section (3) or sub-section (4) of section 9, for or on behalf of distinct persons referred to in section 25, shall be required to be registered as Input Service Distributor under clause (viii) of section 24 and shall distribute the input tax credit in respect of such invoices.

(2) The Input Service Distributor shall distribute the credit of central tax or integrated tax charged on invoices received by him, including the credit of central or integrated tax in respect of services subject to levy of tax under sub-section (3) or sub-section (4) of section 9 paid by a distinct person registered in the same State as the said Input Service Distributor, in such manner, within such time and subject to such restrictions and conditions as may be prescribed.

(3) The credit of central tax shall be distributed as central tax or integrated tax and integrated tax as integrated tax or central tax, by way of issue of a document containing the amount of input tax credit, in such manner as may be prescribed.

- 2 In light of the proposed amendment, it is now clear that the credit pertaining to common input services will have to be distributed through ISD mechanism. Also, the common expenses wherein tax is to be discharged under RCM shall also get covered. Further, we may have to watch for the amendments in the CGST Rules in light of the proposed amendment. Also, the procedure for implementation of ISD mechanism may also be prescribed. Hence, the businesses would be required to start the preparations for implementation of ISD mechanism namely identifying the common input services, changes in IT systems and procedure for obtaining ISD registration including other related compliances.

- Insertion of new provision for levy of penalty in case of failure to register certain machineries used in manufacture of goods as per special procedure:

A new section 122A is inserted after Section 122 of the CGST Act, 2017. The said section shall have an overriding effect over any other provisions in the law since its starts ‘Non- obstante clause’. It provides that any person engaged in manufacture of goods in respect of which any special procedure relating to registration of machines has been notified under Section 148 of CGST Act, acts in contravention of the said special procedure, he shall be liable to penalty of INR 1 Lakh for every machinery not so registered over and above the penalty payable under the Chapter XV or any other provisions of the Chapter XIX.

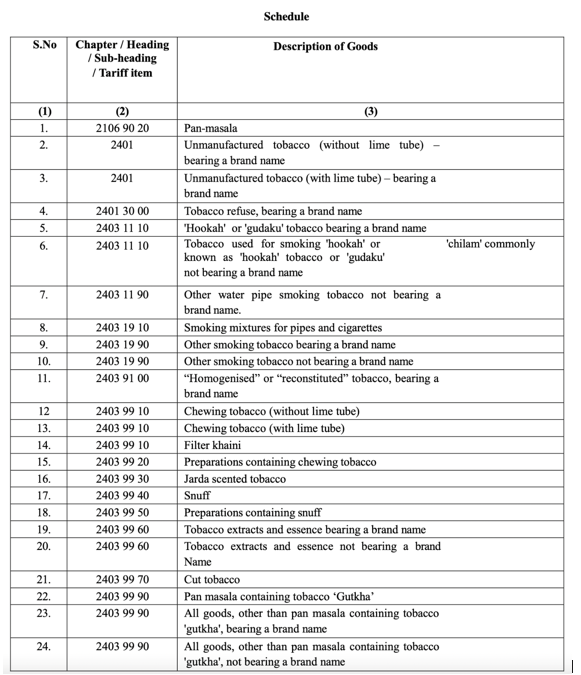

Further, in addition to the penalty as stated above, every machine not so registered shall be liable for seizure and confiscation. However, the same shall not be confiscated in case penalty so imposed is paid and the said machine is registered within 3 days of receipt of communication of the Order of penalty. The schedule containing list of goods for which special procedure as per Section 148 of CGST Act is notified vide Notification No. 04/2024–Central tax dated 5 January 2024 is captured as below:

Disclaimer: This article provides general information existing at the time of preparation and we take no responsibility to update it with the subsequent changes in the law. The article is intended as a news update and Affluence Advisory neither assumes nor accepts any responsibility for any loss arising to any person acting or refraining from acting as a result of any material contained in this article. It is recommended that professional advice be taken based on specific facts and circumstances. This article does not substitute the need to refer to the original pronouncement

CLICK HERE DOWNLOAD PDF