The Hon’ble Union Finance Minister Smt. Nirmala Sitharaman chaired the 53rd GST Council Meeting held on 22 June 2024 in New Delhi. The recommendations of the GST Council Meeting was aimed at providing relaxation, bringing changes in the GST Tax rates, trade facilitation measures and for aiding to streamline compliances.

KEY POINTS OBSERVED FROM THE SAID GST COUNCIL MEETING ARE AS BELOW:

- Interest and penalty to be waived in case of demand notices issued under Section 73 of the CGST Act, for periods 2017-18, 2018-19, and 2019-20, subject to total tax demand being paid upto 31 March 2025

- Extension of timeline for availment of ITC under Section 16(4) of CGST Act for the period 2017-18, 2018-19, 2019-20 and 2020-21 till 30 November 2021

- Reduction in pre-deposit for filing appeal before GSTAT to 10%

- Interest u/s 50 of CGST Act in case of delayed filing of GSTR-3B would not be applicable on the amount deposited in electronic cash ledger on or before due-date of filing the GSTR-3B

- Interest u/s 50 of CGST Act in case of delayed filing of GSTR-3B would not be applicable on the amount deposited in electronic cash ledger on or before due-date of filing the GSTR-3B

- Reduction in TCS rate to 0.5% on the supplies made through Electronic Commerce Operators (ECO)

- Valuation prescribed under Rule 28(2) of CGST Rules i.e. in case of Corporate Guarantee, would not be applicable in case where the recipient is eligible for full ITC

- Waiver of Interest and Penalty:

It is proposed to waive off interest and penalty for demand notices raised under Section 73 of the CGST Act for the period 2017-18, 2018-19 and 2019-20, subject to payment of complete tax demand till 31 March 2025. The same is proposed to be implemented vide insertion of Section 128A in the CGST Act. Further, the same shall not cover demand of erroneous refunds wherein interest and penalty shall continue to apply.

- Relaxations pertaining to ITC:

- The last date to avail the credit for the period 2017-18 to 2020-21 has been proposed to be extended till 30 November 2021. The same would be given effect by retrospectively amending Section 16(4) of CGST Act.

- Conditional relaxation under Section 16(4) of the CGST Act would be provided for the period from the date of cancellation of registration/ effective date of cancellation of registration till the date of revocation of cancellation of the registration, wherein the returns are filed within 30 days of order of revocation.

- For supplies received from unregistered suppliers, where tax is payable by the recipient under RCM and invoice is to be issued by the recipient only; the relevant financial year for calculation of time limit for availment of ITC under Section 16(4) of CGST Act is proposed to be the financial year in which the invoice has been issued.

- Recommendations pertaining to adjudication and appeals:

- Below is the summary of monetary limits applicable to department for filing an appeal:

|

Particulars |

Monetary Limits |

|

Before GSTAT |

20 Lakhs |

|

Before High Court |

1 crore |

|

Before Supreme Court |

2 crore |

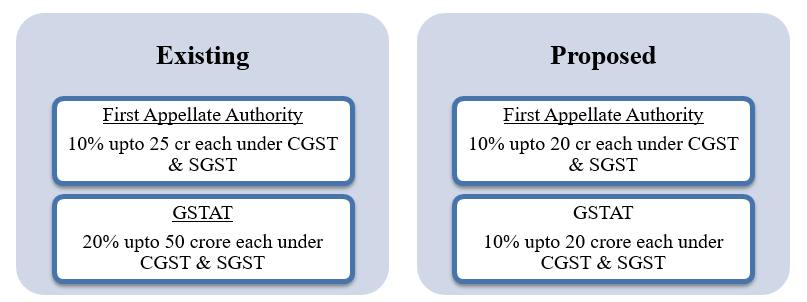

- The proposed reduction in amount of pre-deposit for filing appeal before the First Appellate Authority and the GSTAT is captured as below:-

- A specified date for three-month period for filing GST Appeals before GSTAT would be notified

- A common timeline for issuance of demand notices and orders for FY 2024-25 onwards would be made applicable by inserting Section 74A of CGST Act. Hence, irrespective of whether the case involves fraud, suppression or willful misstatement or not, the common timeline would be applicable for issuance of SCN and Order. Also, the time limit for taxpayers to avail the benefit of reduced penalty (through payment of tax demanded along with interest) is proposed to be increased from 30 days to 60 days.

- Interest in case of delayed filing of GSTR-3B:

Amendment in Rule 88B of CGST Rules to provide that interest would not be calculated on the amount lying in Electronic Cash Ledger (ECL) as on the due date of filing GSTR-3B, even in case wherein the said ledger gets debited post the due date of filing of GSTR-3B.

- Key updates related to Insurance Sector:

- In case of co-insurance arrangement, it is proposed that the transaction between lead insurer and co-insurer would get covered in Schedule III to CGST Act i.e. the same would fall outside the purview of ‘Supply’. Therefore, the current practise i.e. the payment of GST by the lead insurer on the total premium collected from insured would hold good. However, it would be imperative to take a note of the effect of this amendment for the past period, since the council has proposed that the past transactions would be regularized ‘as is where is’ basis

- Reinsurance commission would get covered under Schedule III to CGST Act and hence would not be considered as supply. Further, for the matters prior to this amendment proposed, the same is proposed to be dealt ‘as is where is’ basis

- With respect to the exemption for reinsurance service corresponding to provision of certain general (weather crop etc.) and life (Pradhan Mantri Jan Dhan Yojana etc.) insurance services, Council has proposed that the issue related to exemption for initial period i.e. 1 July 2017 to 24 January 2018 would be regularized ‘as is where is’ basis. Hence, it would be prudent to take a note of the clarification that would be issued in said regard

- With respect to taxability of retrocession i.e. ‘reinsurance of reinsurance’, it has been proposed that a clarification would be issued for covering the same under the exemption notification for reinsurance service related to certain general & life insurance services (Sl. No. 36A of Notification No. 12/2017- CTR dated 28 June 2017)

- Changes in Tax Rates:

- The Electronic Commerce Operators (ECO’s) would be required to collect TCS on net taxable supplies under Section 52 of the CGST Act at 0.5% instead of current TCS rate of 1%

- Rationalization of tax rates of certain goods such as carton, boxes, fire sprinklers etc. Also, with respect to services, certain services namely services provided by Indian Railway, services provided by SPV to Indian Railway is proposed to be exempted. Further, supply of accommodation service upto INR 20,000/- per month per person, provided for a minimum continuous period of 90 days, is proposed to be added in the list of exempted services.

- Other key updates:

- Rolling-out bio-metric based aadhar authentication on pan India basis

- The threshold limit for reporting B2C inter-State supplies in GSTR-1 is proposed to be reduced to INR 1 Lakh

- Threshold limit for filing GSTR-9/9A for FY 2023-24 is proposed to be INR 2 crore.

- A mechanism for claiming refund of additional IGST paid on account of upward revision in prices of goods subsequent to their exports is proposed to be provided.

- It is proposed to bring a clarification related to valuation in case of Corporate Guarantee provided between related parties. It is recommended that Rule 28(2) of the CGST Rules would not be applicable in case of export of such services and also where the recipient is eligible for full input tax credit.

- It is proposed to amend Rule 142 of CGST Rules and issuance of a circular for prescribing a mechanism for adjustment of an amount paid in respect of a demand through DRC-03 towards pre-deposit for filing the appeal.

- It is proposed to amend section 140(7) of CGST Act to provide retrospective relief for transitional credit with respect to invoices pertaining to services provided before appointed date and the same were received by Input Service Distributor (ISD) before the appointed date.

- An optional facility to amend details in GSTR-1 has been proposed, by introducing new Form GSTR-1A. The GSTR-1A would need to be filed before filing of GSTR-3B.

- Exemption w.r.t statutory collections made by Real Estate Regulatory Authority (RERA), by covering the same within the scope of entry No. 4 of NN 12/2017-CTR dated 28.06.2017.

- Clarification on following points among others would be provided:

- Availability of input tax credit on repair expenses incurred by the insurance companies in case of reimbursement mode of settlement of motor vehicle insurance claims.

- Taxability of wreck and salvage values in motor insurance claims

- Reversal of input tax credit in respect of amount of premium in case of Life Insurance policy, which is not included in the taxable value as per Rule 32(4) of CGST Rules

- Warranty/ Extended Warranty provided by Manufacturers to the end customers

- Taxability of re-imbursement of securities/shares as ESOP/ESPP/RSU provided by a company to its employees

- Taxability of loans granted between related person or between group companies

- Place of supply of goods supplied to unregistered persons, where delivery address is different from the billing address

- Mechanism for providing evidence by the suppliers for compliance of the conditions of Section 15(3)(b)(ii) of CGST Act, 2017 in respect of post-sale discounts, to the effect that input tax credit has been reversed by the recipient on the said amount

Note: We shall further update on the implementation of above recommendations of GST Council pursuant to issuance of Notification/Circular to give effect to the same.

Press release_ 53 GST Council Meeting 22 Jun 2024

Disclaimer: This article provides general information existing at the time of preparation and we take no responsibility to update it with the subsequent changes in the law. The article is intended as a news update and Affluence Advisory neither assumes nor accepts any responsibility for any loss arising to any person acting or refraining from acting as a result of any material contained in this article. It is recommended that professional advice be taken based on specific facts and circumstances. This article does not substitute the need to refer to the original pronouncement