Introduction

- Alternative Investment Funds (AIFs of Funds) are an investment pooling vehicle that invests in various financial instruments. Such investments may be in primary market or secondary market depending on the objective of such Funds. AIFs are governed by regulations prescribed by Securities Exchange Board of India (SEBI).

- AIF can be established or incorporated in India in the form of a trust or a company or a limited liability partnership (LLP) or a body corporate. However, a substantial majority of the AIFs in India are established in the form of a trust. This is primarily due to the relative simplicity in formation, administration and governance of a trust and minimum statutory disclosure requirements, in comparison to a company or LLP or a body corporate.

- An AIF may launch schemes subject to filing of placement memorandum with SEBI.

- Further, it may be noted that prior to launch of scheme, an AIF is required to pay Rs. 1 lakh as scheme fees to SEBI while filing the placement memorandum. Such fee shall be paid atleast 30 days prior to launch of scheme. However, payment of scheme fees shall not apply in case of launch of first scheme by the AIF (other than angel fund) and to angel funds.

- AIFs have been very attractive mode of investment vehicle, particularly to HNIs due to its risk reward ratio. Even the foreign investors have preferred investments through AIF due to its ring fenced structure that it offers. As per the data by SEBI over 11lac crore of investment have been raised under the AIF route.

- An AIF can be registered under one of the following categories:

- Category I – funds (including angel funds) that invest in start-up or early-stage ventures [i.e. Venture Capital Undertakings (VCUs)] or social ventures or SMEs or infrastructure sector or special situation funds which are considered socially or economically desirable by government

- Category II – private equity or debt funds, which do not fall in Category I and III AIF

- Category III – funds that employ diverse or complex trading strategies and leverage including through investment in listed or unlisted derivatives

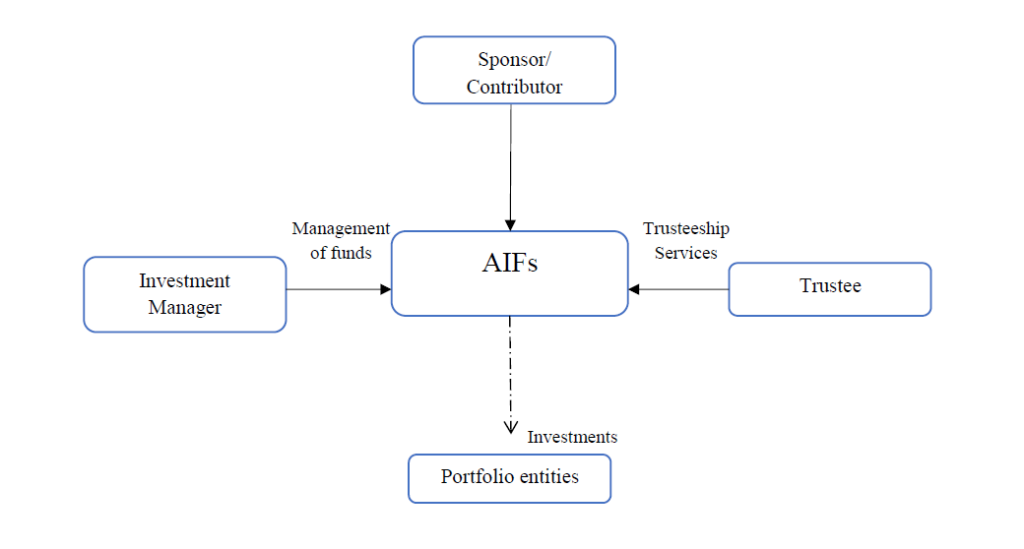

- Typically, the parties involved in the AIF are – the Sponsor, the Trustee, the AMC / Investment Manager.

A strawman structure of an AIF would look as below –

Also Read: Foreign investment in Alternative Investment Funds (AIFs)

Taxation of AIFs

- Section 115UB of the Income-tax Act, 1961 (IT Act) governs the taxation of AIFs for category – I and II and provides a pass through status to the funds.

- Further, by virtue of 10(23FBA) any income (other than business income) earned by the category – I and category -II AIFs is exempt from tax in hands of the AIF and is chargeable to tax in hands of the investors in the same manner as if it were income accruing or arising to, or received by, such investor had the investment been made by the investor directly.

|

Particulars |

Business income |

Other than business income |

|

Taxability |

Taxable at the AIF level at maximum marginal rate (MMR). |

Capital gains/ interest/ dividend – Exempt in the hands of AIF – tax payable at investor level |

|

Withholding tax |

No withholding tax in case of distribution of business income to the investors |

Withholding tax in case of distribution of income other than business income (except exempt income) at: 1. 10% to resident investors and 2. at rates in force in case of non-resident investors |

- If any income accruing or arising to, or received by, the AIF, during a particular financial year, is not paid or credited to the investors then it shall be deemed to be credited to the account of the investors on the last day of the financial year in the same proportion in which such investors would have been entitled to receive the income, had it been paid in the same financial year. In such a case, the AIF is required to withhold and pay tax.

- Any income (other than business income) received by the AIF is not subject to withholding tax requirements.

- Business loss shall be carried forward and set-off by the AIF at the AIF level (i.e. not to be passed on to unit holders). Loss other than business loss are allowed to be passed on to the unit holder only where such loss has arisen in respect of a unit which has been held for minimum 12 months. Loss cannot be carried forward even by the AIF where the condition in relation to 12 months is not complied with.

- In this regard, it would also be pertinent to refer to Circular No. 14/2019 [F.NO. 225/79/2019-ITA.II], DATED 3-7-2019 wherein the following clarification was provided:

5. The matter has been considered by the Board, As section 115UB(1) of the Act provides that the investments made by Category I or Category II AIFs are deemed to have been made by the investor directly, it is hereby clarified that any income in the hands of the non-resident investor from off-shore investments routed through the Category I or Category II AIF, being a deemed direct investment outside India by the non-resident investor, is not taxable in India under section 5(2) of the Act.

6. It is further clarified that loss arising from the off-shore investment relating to non-resident investor, being an exempt loss, shall not be allowed to be set-off or carried-forward and set off against the income of the Category I or Category II AIF.

- Further, depending on the period for which the securities are held, the gains could be taxable as short-term capital gains or long-term capital gains.

- The AIFs shall deduct tax from the payment of other income to the unit-holders under Section 194LBB.

- Further, compliance requirements such as issuance of Form 64-C and 64-D is to be complied with.

Conclusion

In the present article, we have covered on taxation for category-I and II AIFs. Apart from tax aspects, it would be pertinent to note that there are various regulatory aspects to be complied with by the AIFs such as requirement of minimum corpus limit, maximum number of investors in a fund, investment requirement by the fund manager etc.

Disclaimer: This article provides general information existing at the time of preparation and we take no responsibility to update it with the subsequent changes in the law. The article is intended as a news update and Affluence Advisory neither assumes nor accepts any responsibility for any loss arising to any person acting or refraining from acting as a result of any material contained in this article. It is recommended that professional advice be taken based on specific facts and circumstances. This article does not substitute the need to refer to the original pronouncement

CLICK HERE DOWNLOAD PDF